Paul, Weiss is an acknowledged leader among U.S. law firms representing Canadian public and private companies and their underwriters. With almost 50 years of history in Canada and an office in Toronto, our vibrant Canada practice is the largest among U.S. law firms and reflects our long-standing commitment to our clients in their Canadian–U.S. cross-border matters.

Client News

Algoma Steel Completes $350 Million Senior Secured Second Lien Notes Offering

Paul, Weiss advised Algoma Steel Inc., a leading Canadian steel producer, in its private offering of $350 million aggregate principal amount of 9.125% senior secured second lien notes due 2029.

» moreClient News

ATS Completes Secondary Offering

Paul, Weiss advised ATS Corporation in a secondary offering of 3.5 million common shares, representing gross proceeds to the selling shareholder of approximately C$163 million.

» moreClient News

Colliers International Closes $300 Million Public Offering

Paul, Weiss represented the underwriters in Colliers International Group Inc.’s public offering of 2,479,500 subordinate voting shares at a price of $121 per share for gross proceeds of approximately $300 million.

» moreClient News

Constellation Software Closes $1 Billion Inaugural U.S. Notes Offering

Paul, Weiss advised Constellation Software Inc., a Canadian technology company focused on acquiring, managing and building vertical market software businesses, on its inaugural U.S. offering of $500 million aggregate principal amount of 5.158% senior notes due 2029 and $500 million aggregate principal amount of 5.461% senior notes due 2034.

» moreClient News

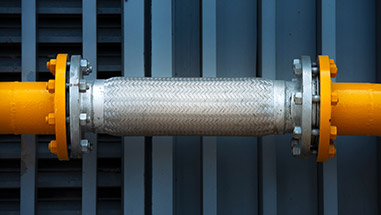

Columbia Pipelines Completes $500 Million Offering of Senior Notes

Paul, Weiss advised the underwriters in a Columbia Pipelines Holding Company LLC offering of $500 million aggregate principal amount of notes.

» moreClient News

Pembina Pipeline Completes Public Offering of Subscription Receipts

Paul, Weiss advised Pembina Pipeline Corporation in its public offering in the United States and Canada of 29,900,000 subscription receipts, representing gross proceeds of approximately C$1.28 billion.

» moreClient News

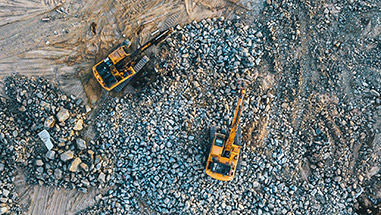

Ero Completes Public Offering of Shares

Paul, Weiss advised Vancouver-based Ero Copper Corp. in the offering of 9,010,000 of its common shares, representing gross proceeds to Ero of approximately $111 million.

» moreClient News

Teck Resources to Sell Steelmaking Coal Business to Glencore and Nippon Steel in $9 Billion Deal

Paul, Weiss is advising Teck Resources Limited in the sale of its steelmaking coal business, Elk Valley Resources (EVR), to Glencore plc and Nippon Steel Corporation.

» moreClient News

Crescent Point Energy Closes C$500 Million Public Offering

Paul, Weiss represented the underwriters in Crescent Point Energy Corp.’s public offering of 48,550,000 common shares at a price of C$10.30 per share for gross proceeds of approximately C$500 million.

» moreClient News

Hammerhead Energy to Be Acquired by Crescent Point Energy

Paul, Weiss is advising Hammerhead Energy Inc. in its C$2.55 billion ($1.9 billion) sale to Crescent Point Energy Corp., creating the seventh-largest exploration and production company in Canada.

» moreClient News

New Found Gold Corp. Completes C$56 Million U.S. Public Offering of Shares

Paul, Weiss advised Vancouver-based New Found Gold Corp. in the offering of 7,725,000 of its common shares, which constituted “flow-through” shares for Canadian tax purposes, representing gross proceeds to New Found Gold of C$56 million.

» moreClient News

Columbia Pipelines Completes $5.6 Billion Offering of Senior Notes

Paul, Weiss advised the initial purchasers in a Columbia Pipelines Operating Company LLC offering of $4.6 billion aggregate principal amount of notes and the initial purchasers in Columbia Pipelines Holding Company LLC’s offering of $1 billion aggregate principal amount of notes.

» moreClient News

Eldorado Completes C$135 Million Equity Offering

Paul, Weiss advised the underwriters in Vancouver-based Eldorado Gold Corporation’s registered offering of 10.4 million common shares in the United States and Canada, generating gross proceeds of C$135 million.

» moreClient News

ATS Completes $283 Million U.S. IPO

Paul, Weiss advised ATS Corporation in its U.S. initial public offering.

» moreAwards & Recognition

Adam Givertz Ranked as the 2022 “Top M&A Lawyer in Canada” by MergerLinks

Corporate partner Adam Givertz was ranked first on MergerLinks’s 2022 “Top M&A Lawyers in Canada” list, which annually recognizes Canada’s leading M&A lawyers by value of deals announced in the previous year.

» more