Employment Law, Workplace Investigations & Trade Secrets Litigation

Employment Law, Workplace Investigations & Trade Secrets Litigation

Employment-related disputes may have far-reaching implications for a company’s reputation, business and ability to attract and retain talent. Clients turn to Paul, Weiss for our deft handling of the most sensitive internal investigations, high-stakes employment and executive-related litigations, and business-critical trade secrets, non-competition and restrictive covenant disputes.

U.S. Department of Labor Promulgates Final Minimum Wage and Overtime Exemption Rule

May 3, 2024 Download PDF

On April 26, 2024, the U.S. Department of Labor (the “DOL”) published a final rule (the “Final Rule”)[1] under the Fair Labor Standards Act (the “FLSA”) that (i) increases the standard salary level applicable to “executive, administrative, or professional” (“EAP”) employees to $1,128 per week (or $58,656 annually for a full-year worker); (ii) increases the total annual compensation threshold for “highly compensated” employees to $151,164; and (iii) includes a mechanism that will allow for future updates on these two thresholds to reflect current earnings data.

The FLSA provides an exemption from minimum wage and overtime pay for employees employed in “a bona fide executive, administrative, or professional capacity.”[2] Since 1940, the regulations implementing the EAP exemption have generally required covered EAP employees to meet certain tests regarding their job duties and a minimum salary threshold.[3] While the “highly compensated” employee exemption also excludes covered employees from the minimum wage and overtime pay requirements, this exemption was added to the regulations in 2004 and applies a higher annual compensation requirement with a “minimal duties” test, which requires covered employees to customarily and regularly perform at least one of the exempt duties or responsibilities of an EAP employee.[4]

The effective date for the Final Rule is July 1, 2024.

Threshold Increase for “White-Collar” Exemption

The FLSA requires covered employers to pay employees a minimum wage and, for employees who work more than 40 hours in a week, overtime pay at a rate not less than one and half times the regular rate.[5] The statute also includes what is commonly referred to as a “white-collar” exemption, excluding covered EAP employees from both its minimum wage and overtime requirement.[6]

The current minimum salary threshold for EAP employees is $684 per week or $35,568 annually for a full-year worker under the previous final rule published on September 27, 2019 (the “2019 Rule”).[7]

The Final Rule increases the minimum salary threshold for EAP employees to $1,128 per week or $58,656 annually for a full-year worker.[8] The Final Rule explained that the new threshold accounts for earnings growth since the 2019 Rule and will “better define and delimit which employees are employed in a bona fide EAP capacity.”[9]

The new threshold becomes effective on January 1, 2025.

Threshold Increase for “Highly Compensated” Employees Exemption

Since 2004, the DOL has adopted a minimum wage and overtime pay exemption that applies to certain “highly compensated” employees based on the premise that “a very high level of compensation is a strong indicator of an employee’s exempt status.”[10]

The current minimum salary threshold for “highly compensated” employees is $107,432 per year.[11]

The Final Rule increases the total annual compensation threshold for these employees to $151,164, which represents the salary level at the 85th percentile of full-time salaried workers nationally.[12]

The new threshold becomes effective on January 1, 2025.

Scheduled Increases for Compensation Thresholds

Recognizing the need to regularly update the earnings threshold to help differentiate between the exempt and nonexempt employees,[13] the Final Rule includes a mechanism that will update the earnings threshold to reflect current wage data, initially on July 1, 2024 and every three years thereafter.[14]

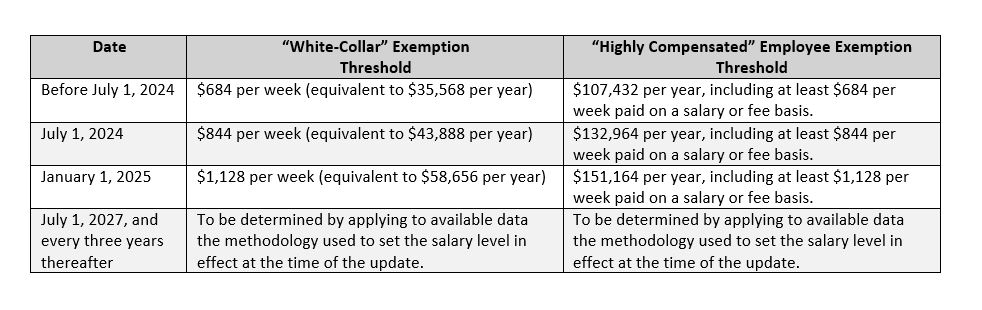

The following chart reflects the future updates contemplated by the Final Rule[15]:

|

The initial increase on July 1, 2024 will use the methodologies in place at that time (that is, the methodologies used by the 2019 Rule).[16] The new salary levels in the Final Rule take effect on January 1, 2025, as discussed above.

Under the Final Rule, the DOL may delay a future update to the earnings thresholds for a period of 120 days if the Secretary of the DOL has published a notice of proposed rulemaking in the Federal Register, not fewer than 150 days before the scheduled effective date of change, citing “unforeseen economic or other conditions.”[17]

Implications for Employers

- To prepare for and ensure compliance with the Final Rule, employers may want to consider taking the following actions:

(i) audit payrolls to determine which employees and positions that are currently classified as exempt are or may be affected;

(ii) update payroll and time-tracking systems to take into account impacted employees;

(iii) determine whether impacted employees should be reclassified as non-exempt or have their salaries raised above the new minimum salary levels;

(iv) implement a system that will alert them some time in advance of the anticipated threshold changes for 2025, 2027, and every three years thereafter which can serve as a reminder of the upcoming changes with enough time to address such changes in a timely manner;

(v) train any new non-exempt employees on tracking and recording their time to account for overtime hours;

(vi) create a plan to clearly communicate and discuss the changes in the Final Rule with employees; and

(vii) continue to monitor compliance with applicable state and local laws.

- Employers may consider monitoring the Final Rule for any further developments, including any potential legal challenges against the Final Rule. It has been reported that certain industry groups are contemplating legal challenges against the Final Rule.

The Final Rule can be found here.

* * *

[1] DOL, Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees, 89 Fed. Reg. 32,842 (to be codified at 29 C.F.R. Pt. 541).

[2] 29 U.S.C. § 213(a)(1).

[3] Final Rule at 32,842.

[4] Id. at 32,846.

[5] See 29 U.S.C. §§ 206, 207.

[6] Id. § 213(a)(1).

[7] Final Rule at 32,847. For a more detailed discussion of the 2019 Rule, see our October 1, 2019 Memorandum.

[8] Id. at 32,842.

[9] Id. at 32,843.

[10] Id.

[11] Id. at 38,847.

[12] Id. at 32,843.

[13] Id.

[14] See id. at 32,848.

[15] See also DOL, Final Rule: Restoring and Extending Overtime Protections, available at https://www.dol.gov/agencies/whd/overtime/rulemaking.

[16] Final Rule at 32,843.

[17] Id. at 32,973.