Our team advises U.S. and non-U.S. clients across industries on their most sensitive U.S. economic sanctions and Bank Secrecy Act/anti-money laundering (BSA/AML) issues. With our preeminent regulatory defense and white collar experience, we are uniquely positioned to assist clients in responding to regulator inquiries, examinations and subpoenas; conducting internal investigations; and handling matters that develop into multi-agency civil and criminal investigations. Our practice also encompasses regulatory advice, compliance counseling and transactional due diligence.

Economic Sanctions and Anti-Money Laundering Developments: 2023 Year in Review

People

- Anderson, Jarryd E.

- Boehning, H. Christopher

- Brown, Walter

- Carey, Jessica S.

- Carlin, John P.

- Fein, David

- Gertzman, Michael E.

- Gonzalez, Roberto J.

- Karp, Brad S.

- Lynch, Loretta E.

- Mendelsohn, Mark F.

- Elliott, Richard S.

- Kessler, David K.

- Mitchell, Nathan

- Schutte, Jacobus J.

- Gilbert, Jennifer

- Kleiner, Samuel

- Lipin, Anna P.

- Madden, Kevin P.

- Malone, Sean S.

- Orosz, Jordan E.

- Smith-Sandy, Shekida A.

- Thompson, Joshua R.

- Varner, Griffin

- Wellner, Jacob

- Calderone, Sarah

- Cunningham, Ridan R.

January 22, 2024 Download PDF

Table of Contents

- Executive Summary

- Treasury’s Office of Foreign Assets Control

- Treasury’s Financial Crimes Enforcement Network

- Department of Justice

- Federal Banking Agencies

- Securities and Exchange Commission and Financial Industry Regulatory Authority

- New York State Department of Financial Services

- Considerations for Strengthening Sanctions/AML Compliance

Executive Summary

In this memorandum, we survey 2023 U.S. economic sanctions and anti-money laundering (“AML”) developments and trends and provide an outlook for 2024. We also provide thoughts on compliance and risk mitigation measures in this dynamic environment.

During the second year of Russia’s invasion of Ukraine, the U.S. continued tightening sanctions on Russia and, in particular, focused on combatting efforts to evade or circumvent the extensive sanctions in place. Among other things, the Treasury Department’s Office of Foreign Assets Control (“OFAC”) designated a number of parties in third countries, including Türkiye and the United Arab Emirates (“UAE”), for facilitating the transfer of high-value goods to Russia’s military-industrial complex. In December 2023, President Biden issued an Executive Order authorizing the imposition of secondary sanctions on foreign financial institutions that facilitate the transfer of critical goods to Russia or otherwise support Russia’s military-industrial complex. Additionally, OFAC took action in other sanctions programs to advance U.S. foreign policy objectives, such as by further targeting terrorist financing following Hamas’s October 7 attack on Israel.

In 2023, OFAC issued 17 enforcement actions, totaling over $1.5 billion in civil penalties, nearly four times the level of OFAC’s civil penalties in 2022. OFAC’s $970 million settlement with Binance marked the largest penalty in OFAC’s history.[1] Brian Nelson, the Treasury Department’s Under Secretary for Terrorism and Financial Intelligence, said that this penalty, in addition to the penalty imposed by Treasury’s Financial Crimes Enforcement Network (“FinCEN”), marked a “new era of enforcement for the Treasury.”[2] Additionally, OFAC entered into a $508 million settlement with British American Tobacco, which marked the largest-ever OFAC resolution with a non-financial institution.[3]

At the Department of Justice (“DOJ”), there is an increased focus on corporate national security-related criminal enforcement, encompassing sanctions, export controls, and related violations. In addition to the continuing operation of Task Force KleptoCapture and the Disruptive Technology Strike Force, in 2023 DOJ hired 25 new prosecutors to its National Security Division (“NSD”) and created new corporate enforcement roles filled by longtime prosecutors with experience bringing national security-related cases against corporations. DOJ initiated at least 15 prosecutions or enforcement actions involving Russia sanctions or export control evasion, and achieved significant multi-agency resolutions with Binance and British American Tobacco.

DOJ, OFAC, and the U.S. Department of Commerce’s Bureau of Industry and Security (“BIS”) have also made a new push to encourage voluntary self-disclosures (“VSDs”), although the policies vary by agency. One of the most notable announcements on VSDs this year involved DOJ’s Safe Harbor Policy for mergers and acquisitions, which provides incentives for acquiring companies to voluntarily disclose misconduct uncovered during the M&A process.[4]

On the AML side, FinCEN has remained busy implementing the various provisions of the AML Act of 2020. Notably, January 1, 2024 marked the effective date of FinCEN’s Beneficial Ownership Information reporting rule; the implementation of the rule will be a core area of focus for the agency in 2024. Additionally, in 2024 FinCEN intends to undertake additional significant rulemakings, including to revise its Customer Due Diligence (“CDD”) Rule in light of the Beneficial Ownership Information reporting rule and to impose AML requirements on investment advisers and the residential real estate sector.[5] FinCEN has also announced that it expects to issue a proposed rule to facilitate the implementation of its whistleblower program, which applies to both AML and sanctions violations. In the interim, FinCEN is already receiving tips and making referrals to OFAC and DOJ.[6] In 2023, FinCEN also joined with BIS to issue guidance to financial institutions for filing Suspicious Activity Reports (“SARs”) related to export control violations.

Additionally, FinCEN has continued to utilize its enforcement tools. In 2023, FinCEN released an order under Section 9714(a) of the Combating Russian Money Laundering Act, placing restrictions on Bitzlato Limited (“Bitzlato”), a virtual currency exchange, for facilitating illicit transactions linked to Russian money laundering. And in the wake of the Hamas attack, FinCEN proposed a regulation under Section 311 of the USA PATRIOT Act that would require domestic financial institutions to report information about a transaction that they “know, suspect, or have reason to suspect . . . involves CVC mixing within or involving jurisdictions outside the United States.”[7] FinCEN also imposed a $3.4 billion penalty on Binance, which represented FinCEN’s largest penalty to date, and issued over $30 million in additional penalties, including FinCEN’s first enforcement actions against a Puerto Rican International Banking Entity and against a trust company.[8]

New York’s Department of Financial Services (“DFS”) remains an active regulator in the sanctions/AML space. DFS pursued enforcement actions focused on deficiencies in AML compliance programs, both against entities in the virtual currency industry, including a $100 million settlement with Coinbase, and against banks, including Metropolitan Commercial Bank and Shinhan Bank America (“SHBA”).

In total, through the end of 2023, federal and state authorities imposed approximately $3.96 billion in penalties and asset seizures for AML/sanctions violations.[9] While this total is on par with the total penalties and seizures imposed in 2022 ($3.88 billion), it is significantly higher than the totals from prior years (approximately $630 million in 2021 and approximately $960 million in 2020) and reflects a more aggressive enforcement environment driven by multiple agencies.

Treasury’s Office of Foreign Assets Control

Changes to Sanctions Programs

Russia. OFAC took a number of actions in 2023 to ratchet up sanctions pressure on Russia. The key actions are summarized below.

- Designations of Russian Individuals and Entities. As we discussed in our prior Year in Review,[10] following Russia’s February 2022 invasion of Ukraine, OFAC imposed blocking sanctions on major Russian financial institutions and state-owned entities (including Sberbank, Alfa Bank VTB Bank, Alrosa, and the Russian Direct Investment Fund), as well as additional prominent Russian companies and individuals. OFAC designated these individuals and entities on the Specially Designated Nationals List (“SDN List”), which broadly prohibits U.S.-nexus dealings with the designated parties, and which requires U.S. persons in possession of designated parties’ property or interests in property to “block” or “freeze” their property, and report the block to OFAC. Throughout 2023, OFAC continued to designate hundreds of Russian individuals and entities on the SDN List, broadly cutting them off from the U.S. economy.[11] Many of the Russian entities added to the SDN List in 2023 are active in the country’s financial, defense, and energy sectors, or are owned or controlled by the Russian government or prominent Russian oligarchs. OFAC also sanctioned a number of Russian individuals involved in malicious cyber activities like election interference and disinformation activities.[12]

- Restrictions on New Investments and Certain Services. On April 6, 2022 President Biden issued Executive Order 14071, which prohibits U.S. persons from (i) making any new investment in the Russian Federation and (ii) providing any category of services to any person in the Russian Federation, as determined by the Secretary of the Treasury (in consultation with the Secretary of State).[13] Since then, the Secretary of the Treasury has issued a number of determinations on “categories of services” that U.S. persons are prohibited from providing to persons in the Russian Federation without a license, including, for example, accounting, management consulting, architecture, and engineering services.[14]

- Prohibitions on Facilitation. OFAC sanctions programs generally contain a prohibition on “facilitation” that prohibits a U.S. person from “facilitating” a transaction that they would be prohibited from taking themselves. For example, Executive Order 14071 (which, as explained above, prohibits the provision of new investments and certain services to persons in the Russian Federation) includes a prohibition on “facilitation”—meaning that a U.S. person is prohibited from facilitating the provision of these services or new investments in the Russian Federation by a non-U.S. person.[15] Furthermore, the March 11, 2022 Executive Order 14068 prohibits U.S. persons from approving, financing, facilitating, or guaranteeing the export, reexport, sale, or supply to Russia of any item that could not be exported to Russia from the U.S. based on Commerce Department regulations. OFAC has in multiple enforcement matters treated a U.S. parent company’s approval of its foreign subsidiary’s transaction with a prohibited party or jurisdiction as prohibited “facilitation.”[16]

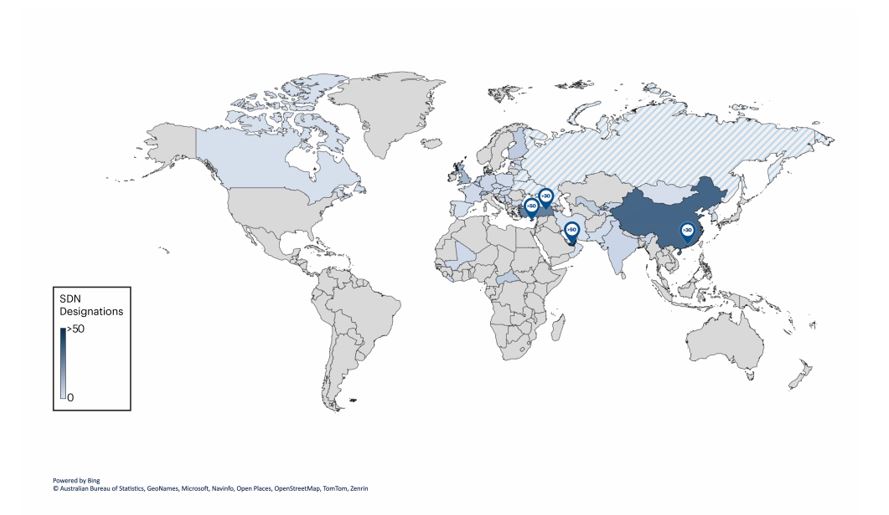

- Preventing Evasion/Circumvention. In 2023, OFAC focused on limiting attempts to evade or circumvent Russia sanctions. Indeed, in May 2023, Secretary of the Treasury Janet Yellen stated that “a central piece” of Treasury’s strategy on Russia sanctions “is to take further actions to disrupt Russia’s attempts to evade our sanctions.”[17] Consistent with that strategy, in 2023, OFAC designated under its Russia sanctions program over 375 individuals and entities domiciled outside of Russia, generally for facilitating circumvention or sanctions evasion. As reflected in the heat map below, the largest number of designations were in Cyprus, the UAE, Türkiye, and the PRC.[18] According to OFAC, the UAE, Türkiye, and the PRC are “hubs for exporting, re-exporting and transshipping to Russia foreign-made technology and equipment” and entities in those countries “continue to send high-priority dual-use goods to Russia, including critical components that Russia relies on for its weapons systems.”[19] OFAC also designated networks linked to the transfer of unmanned aerial vehicles from Iran to Russia and the transfer of arms from North Korea to Russia.[20]

OFAC also has reiterated that it can bring enforcement actions against non-U.S. persons that cause a U.S. person to violate sanctions, especially in the context of transactions that transit the U.S. financial system or that depend on U.S.-based servers or other infrastructure. [21] In December 2023, OFAC stated that “non-U.S. persons are prohibited from causing or conspiring to cause U.S. persons to wittingly or unwittingly violate U.S. sanctions, as well as engaging in conduct that evades U.S. sanctions. OFAC uses its enforcement discretion robustly to identify and address U.S. sanctions violations by non-U.S. persons.”[22]

- Executive Order Authorizing Secondary Sanctions on Foreign Financial Institutions. Beginning in early 2023, administration officials traveled to countries of concern to highlight the risks of Russia-related sanctions evasion.[23] In furtherance of these efforts, on December 22, 2023, President Biden issued Executive Order 14114, which pointedly adds the threat of secondary sanctions. Specifically, the Executive Order provides that Treasury may impose on foreign financial institutions either (i) correspondent banking restrictions or (ii) full blocking sanctions (i.e., an SDN designation) upon determining that the financial institution has:

(i) conducted or facilitated any significant transaction or transactions for or on behalf of any person designated pursuant to Section 1(a)(i) of E.O. 14024 for operating or having operated in the technology, defense and related materiel, construction, aerospace, or manufacturing sectors of the Russian economy, or other such sectors as may be determined to support Russia’s military-industrial base by the Secretary of the Treasury, in consultation with the Secretary of State; or

(ii) conducted or facilitated any significant transaction or transactions, or provided any service, involving Russia’s military-industrial base, including the sale, supply or transfer, directly or indirectly, to the Russian Federation of any item or class of items as may be determined by the Secretary of the Treasury, in consultation with the Secretary of State and the Secretary of Commerce.[24]

On December 22, 2023, OFAC issued a Determination identifying certain “critical items” (including certain machine tools and manufacturing equipment, manufacturing materials for semiconductors and related electronics, electronic test equipment, propellants and chemical precursors for propellants and explosives, lubricants and lubricant additives, bearings, advanced optical systems, and navigation instruments)[25] that support Russia’s military-industrial base. OFAC stated that foreign financial institutions should “use the list of specified items for the purpose of mitigating sanctions risk under” the Executive Order.[26]

As a senior administration official stated, the Executive Order marks the “first time that we’re introducing a tool that allows us to use secondary sanctions to go after financial institutions during this conflict” and would “provide us with a strong tool to disincentivize the type of behavior that is furthering Russia’s ability to build weapons of choice that they are using in Ukraine.”[27] Deputy Treasury Secretary Wally Adeyemo stated: “Financial institutions that continue to process transactions to Russia have a clear choice to make—stop all transactions from customers selling critical goods, or ensure these goods are not benefiting Russia’s war machine. Otherwise, you risk losing access to the US financial system.”[28]

Notably, the Executive Order does not require that foreign financial institutions “knowingly” engage in the conduct specified in the Executive Order, allowing OFAC, in theory, to impose secondary sanctions for unwitting conduct.

OFAC also issued a sanctions advisory on December 22, 2023, providing examples of conduct that could constitute a sanctions risk, including maintaining accounts, transferring funds, or providing other financial services (including trade finance) that would support Russia’s military-industrial base, facilitating the sale, supply, or transfer of the critical items to Russian importers or companies shipping the items to Russia, or helping companies or individuals evade U.S. sanctions on Russia’s military industrial base (including taking steps to hide the ultimate purpose of transactions to evade sanctions).[29] The advisory states that “each institution should implement controls commensurate with its risk and current exposure to Russia’s military-industrial base and its supporters.” It also builds on other recent guidance from OFAC, FinCEN, and BIS relating to sanctions and export controls evasion and notes that foreign financial institutions should (1) communicate compliance expectations relating to the usage of accounts to customers (including the prohibitions related to Russia’s military-industrial base); (2) seek additional information from certain customers through questionnaires and attestations; and (3) place appropriate mitigation measures on accounts related to high-risk activity or where the customer failed to respond to a request regarding activity of concern. In effect, the advisory provides an overview of OFAC’s compliance expectations for foreign financial institutions to avoid the imposition of sanctions.

Additionally, in December 2023, OFAC issued 12 new Russia-related FAQs regarding the Executive Order.[30] Those FAQs include FAQ 1151, which states that “OFAC may consider the totality of the facts and circumstances” to determine whether a given transaction is “significant” for purposes of the Executive Order. According to FAQ 1151, “some or all of the following factors may be considered: (a) the size, number, and frequency of the transaction(s); (b) the nature of the transaction(s); (c) the level of awareness of management and whether the transactions are part of a pattern of conduct; (d) the nexus of the transaction(s) to persons sanctioned pursuant to E.O. 14024, or to persons operating in Russia’s military-industrial base; (e) whether the transaction(s) involve deceptive practices; (f) the impact of the transaction(s) on U.S. national security objectives; and (g) such other relevant factors that OFAC deems relevant.”

- Price Cap on Russian Oil. OFAC has also heightened its enforcement activities surrounding the multilateral “price cap” on Russian oil and issued significant guidance related to compliance with the price cap.[31] In October 2023, OFAC imposed the first sanctions for violations of the price cap, designating vessels and entities from Türkiye, the Marshall Islands, the UAE, and Liberia tied to shipments of Russian oil.[32] In November and December 2023, OFAC issued additional price-cap-related sanctions, including designating vessels and entities from the UAE, Liberia, and Hong Kong that carried Russian oil priced above the price cap, as well as designating several oil traders.[33] In October 2023, the international Price Cap Coalition published an advisory with “best practices” for industry stakeholders to ensure they do not purchase Russian-origin oil priced above the price cap.[34] In December, OFAC and the Price Cap Coalition updated OFAC’s “Guidance on Implementation of the Price Cap Policy and Petroleum Products of Russian Federation Origin” to strengthen the requirements relating to attestation and recordkeeping for certain covered service providers.[35]

- Russian Sovereign Assets. Throughout 2023, the U.S. and other members of the G-7 considered options regarding the approximately $300 billion of immobilized Russian sovereign assets. Secretary Yellen stated that the U.S. is “examining a number of options, including some that we may be able to take under existing authorities.”[36] According to press reports, the G-7 may make an announcement on this issue before the second anniversary of Russia’s invasion of Ukraine on February 24, 2024.[37] Notably, there are potential limitations under U.S. law on what the Biden Administration can do regarding Russian sovereign assets in the U.S., as the International Emergency Economic Powers Act (“IEEPA”) only permits seizures of foreign property during a time of war. However, there are press reports suggesting that the Biden Administration supports legislation expanding IEEPA authority to allow action in this specific circumstance.[38]

Virtual Currency. In 2023, OFAC continued taking actions related to virtual currency. This included a number of significant enforcement actions (described below) and the designations of entities and individuals associated with the illicit use of virtual currency, such as: (i) a “virtual currency mixer,” Sinbad.io, utilized by the Lazarus Group[39]; (ii) a Gaza-based virtual currency exchange utilized by terrorist groups; and (iii) a “virtual currency money launderer” who illicitly transferred funds for Russian elites.[40]

As we discussed in our last Year in Review, in 2022, OFAC designated Tornado Cash, a cryptocurrency privacy protocol and a number of smart contracts associated with it.[41] That designation was challenged by plaintiffs in lawsuits filed in the Western District of Texas and the Northern District of Florida. On August 17, 2023, the district court in the Western District of Texas granted summary judgment for OFAC. The court held that OFAC did not exceed its authority in this designation because, under the IEEPA and OFAC’s regulations, Tornado Cash is a “person” and it has an “interest” in the designated smart contracts, which are “property.”[42] On October 20, 2023, the district court in the Northern District of Florida granted summary judgment for OFAC, finding that, “because foreigners (e.g., Tornado Cash’s founders, developers, and DAO) have a financial ‘interest’ in the increased use and popularity of the Tornado Cash service as a whole, OFAC did not exceed its statutory authority by designating all of the addresses affiliated with the service, including the core software tool, under the IEEPA.”[43] Those cases are now pending appeal.

China-related Designations. In 2023, the Biden Administration did not issue any designations under China-specific sanctions authorities, such as the Chinese Military Industrial Complex Company program or the Hong Kong Autonomy Act. However, there have been significant designations of Chinese entities and individuals under other sanctions programs, including designations of Chinese companies and individuals for: (i) providing high-value goods to Russia’s defense-industrial complex;[44] (ii) involvement with the international proliferation of illicit drugs, including the manufacturing and distribution of fentanyl and methamphetamine precursors;[45] and (iii) involvement in the procurement of sensitive parts for Iran’s unmanned aerial vehicle program.[46]

Counter-terrorism. Since the October 7, 2023 terrorist attack on Israel, OFAC has sanctioned additional Hamas members, financial facilitators in Gaza and abroad, and Hamas-linked operatives in other parts of the region, including Sudan, Türkiye, Algeria, and Qatar.[47] Notably, OFAC designated a Gaza-based crypto exchange.[48] These sanctions build on OFAC’s May 2022 designations of persons and entities involved in Hamas’s secret investment portfolio and previous designations of Hamas-linked entities and individuals.[49] In December, OFAC also targeted an Iranian-affiliated network that supported the Houthis in Yemen, which resulted in sanctions on entities in Iran, Lebanon, Türkiye, St. Kitts and Nevis, Yemen, and the United Kingdom (“U.K.”).[50] Most recently, in January 2024, OFAC re-added the Houthis to the SDN List as a “Specially Designated Global Terrorist group,”[51] three years after it had delisted the group in “recognition of the dire humanitarian situation in Yemen.”[52] Treasury has signaled that its “efforts to identify and freeze the finances of Hamas and other Iran-backed terrorist groups” are a high priority and that such “targeted measures will continue.”[53]

OFAC has also continued to make designations targeting Hezbollah. In April 2023, Treasury designated a global network that facilitated the shipment of “diamonds, precious gems, art, and luxury goods” for a Hezbollah financier. Under Secretary Nelson noted that the individuals in the network “used shell companies and fraudulent schemes” to disguise the Hezbollah financier’s involvement and that “luxury good market participants should be attentive to these potential tactics and schemes[.]”[54]

Venezuela. In October 2023, OFAC issued General Licenses and related guidance providing sanctions relief to the Government of Venezuela and certain sectors of the Venezuelan economy. The relief follows the “electoral roadmap agreement” between the Maduro regime and Venezuelan opposition parties. Notably, General License 44 (“GL 44”) authorized certain transactions with Petróleos de Venezuela, S.A and related entities (subject to certain limitations, including that the authorization does not apply to entities that are Specially Designated Nationals (“SDNs”)).[55] GL 44 extends until April 18, 2024, and OFAC noted in its October 18, 2023 guidance that the U.S government “intends to renew GL 44 only if the representatives of Maduro follow through with their commitments and take continued concrete steps toward a democratic election by the end of 2024.”[56] In November 2023, Assistant Secretary of State Brian Nichols said that he was “confident” that the Maduro regime would live up to the electoral roadmap agreement, but emphasized that “everything is on the table” if they do not, including removing the newly issued licenses.[57]

Inflation Adjustment to OFAC Penalties. Consistent with the Federal Civil Penalties Inflation Adjustment Act of 1990, as amended by the Federal Civil Penalties Adjustment Act Improvements Act of 2015, OFAC announced on January 12, 2024 amendments to its regulations to adjust for inflation the maximum amount of civil monetary penalties that OFAC may assess pursuant to OFAC regulations.[58] The amendments raised the applicable statutory maximum civil penalty amounts to $368,136 per violation of the IEEPA and $108,489 per violation of the Trading With the Enemy Act. The penalties for violations of sanctions administered pursuant to the Antiterrorism and Effective Death Penalty Act of 1996 were increased to $97,178, and penalties for violations of the sanctions administered pursuant to the Foreign Narcotics Kingpin Designation Act were increased to $1,829,177. The applicable penalties for various OFAC-administered recordkeeping violations were increased to between $1,422 and $71,162, depending on the type of recordkeeping violation.

Guidance

Compliance-related Guidance. As discussed in greater detail in the DOJ section, OFAC joined with other government agencies in issuing compliance-related guidance, including guidance on “Know Your Cargo” in December 2023,[59] on “Voluntary Self-Disclosure of Potential Violations” in July 2023,[60] on “Russia Sanctions and Export Control Evasion” in March 2023,[61] and on “Iran Ballistic Missile Procurement” in October 2023.[62]

Humanitarian-related Guidance. In December 2022, OFAC amended its regulations across a number of sanctions programs to “ease the delivery of humanitarian aid.”[63] Secretary of State Anthony Blinken noted that the updates to U.S. sanctions were intended to “make our sanctions clearer, stronger, and more effective and streamlined.”[64] In 2023, OFAC built on that effort by releasing Supplemental Guidance for the Provision of Humanitarian Assistance,[65] which clarified the scope of the December 2022 updates, and further guidance specific to providing humanitarian assistance to the Palestinian people (November 2023)[66] and to Syria (August 2023).[67] In June 2023, OFAC and the U.K.’s Office of Financial Sanctions Implementation issued guidance related to humanitarian assistance and food security under the Russian sanctions program.[68]

Other Developments

In 2023, OFAC’s Director, Andrea Gacki, was named as the Director of FinCEN[69]; OFAC’s Deputy Director, Brad Smith, was named as the new Director of OFAC; and Lisa Palluconi, who had served as an associate director, was elevated to Deputy Director.[70]

OFAC has indicated that it is considering updating its enforcement guidelines. The existing guidelines are essentially the same as the guidelines issued in 2009.[71]

Enforcement Actions

OFAC’s 2023 enforcement actions targeted a mix of U.S. and non-U.S. parties across a range of industries including financial institutions, technology companies, manufacturing companies and, continuing a trend that began in 2021, a number of companies active in the virtual currency space. OFAC penalties for 2023 totaled more than $1.54 billion, before crediting, which vastly exceeded the approximately $43 million penalties imposed in 2022. Although OFAC issued 17 public enforcement actions in 2023, the vast majority of its 2023 penalty total (almost $1.5 billion) is from two major actions—against Binance ($968 million) and British American Tobacco (“BAT”) ($508 million), two of the largest OFAC settlements ever. Consistent with OFAC’s new focus in recent years on individual liability, OFAC reached a settlement involving a penalty with an unnamed U.S. executive at a company that was also the target of an enforcement action (Murad LLC). Below we summarize OFAC’s enforcement actions from 2023, grouped by category.

Use of the U.S. Financial System

British American Tobacco p.l.c. As discussed in our prior memorandum and in the DOJ section below,[72] on April 25, 2023, OFAC announced a $508,612,492 settlement with U.K.-based tobacco and cigarette manufacturer BAT for 16 apparent violations of North Korea sanctions between 2009 and 2017 that involved a BAT subsidiary in Singapore, British-American Tobacco Marketing (Singapore) PTE Ltd. (“BATMS”).[73] According to the government, in 2001, BATMS established a joint venture (the “Joint Venture”) with a company located in North Korea for the purpose of manufacturing and distributing BAT cigarettes. According to OFAC, in 2007, BAT’s Standing Committee, which includes BAT senior executives in London, approved a plan whereby BATMS would sell its 60% stake in the Joint Venture to a company in Singapore because of concerns over public associations with North Korea and the difficulty in extracting profits from that country. OFAC stated that BAT publicly represented this sale in a press release as a divestment of the portion of its business involved in North Korea tobacco sales, but that, in reality, BATMS still held a controlling interest in the Joint Venture and used that control to continue tobacco sales in North Korea. According to OFAC, through this concealment scheme, BATMS caused U.S. financial institutions to process transactions that would have been frozen, blocked, investigated, or declined had the banks known of the connection to North Korea. OFAC determined that the apparent violations were egregious and not voluntarily self-disclosed. OFAC’s resolution with BAT was reached concurrently with BATMS’s DOJ guilty plea agreement and BAT’s execution of a deferred prosecution agreement.

In announcing the settlement, Under Secretary Nelson stated that “[c]ompanies that seek to profit from circumventing sanctions by obscuring their involvement will be discovered and will pay a price . . . Firms that deal with blocked persons, even indirectly, will be penalized when their schemes implicate the U.S. financial system.” Under Secretary Nelson also noted that this action constituted the largest resolution against a non-financial institution in OFAC’s history. As with the Binance settlement, OFAC credited fines paid to DOJ against a vast majority of the settlement, and BAT was ultimately obligated to pay $5,348,685 to Treasury.

Godfrey Phillips India Limited. On March 1, 2023, OFAC announced a $332,500 settlement with India-based Godfrey Phillips India Limited (“GPI”) for five apparent violations of North Korea sanctions between 2016 and 2017.[74] According to OFAC, the apparent violations resulted from GPI’s use of the U.S. financial system to receive payments for tobacco it indirectly exported to North Korea through third-country intermediaries. OFAC stated that GPI had exported tobacco to North Korea through an intermediary in Thailand and had received payments through intermediaries in Hong Kong. OFAC stated that “by directing the Hong Kong intermediaries to remit payments in USD, GPI caused U.S. correspondent banks that processed payments, as well as the foreign branch of a U.S. bank, to export financial services to or otherwise facilitate the exportation of tobacco” to North Korea. OFAC found the case to be non-egregious. OFAC noted that this action “highlights how non-U.S. persons engaged in business with sanctioned actors and jurisdictions can violate U.S. sanctions regulations by causing U.S. persons to engage in prohibited transactions.”

Swedbank Latvia AS. On June 20, 2023, OFAC announced a $3,430,900 settlement with Swedbank Latvia AS (“Swedbank Latvia”) for 386 apparent violations of OFAC sanctions on Crimea.[75] Swedbank Latvia is headquartered in Riga, Latvia, and is a subsidiary of Swedbank AB, an international financial institution headquartered in Stockholm, Sweden. According to OFAC, throughout 2015 and 2016, a customer with an IP address in Crimea used Swedbank Latvia’s e-banking platform to send payments through U.S. correspondent banks to persons in Crimea. According to OFAC, a U.S. correspondent bank rejected certain payments initiated by the client due to a potential connection with Crimea and alerted Swedbank Latvia. OFAC determined that a relationship manager at Swedbank Latvia then re-routed the rejected payments to a different U.S. correspondent bank, which ultimately processed the transactions. OFAC determined that the apparent violations were non-egregious and not voluntarily self-disclosed. OFAC treated as an aggravating factor Swedbank Latvia’s failure to integrate into its sanctions screening process Know Your Customer (“KYC”) and IP data regarding its client’s presence in Crimea. OFAC also noted that Swedbank Latvia is a sophisticated financial institution and had knowledge that it had customers in Crimea. Mitigating factors noted by OFAC included Swedbank AB and Swedbank Latvia’s “extensive lookback” review.

OFAC emphasized that the case illustrates, among other things, the importance of “ensuring that KYC information (such as passports, phone numbers, nationalities, and addresses) and IP data are appropriately integrated into sanctions screening protocols.” OFAC remarked that “the bank’s own KYC information supported the concerns of its correspondent bank, yet it went ignored.”

Wells Fargo Bank, N.A. On March 30, 2023, OFAC announced a $30,000,000 settlement with Wells Fargo Bank, N.A. (“Wells Fargo”) related to 124 apparent violations of the U.S.’s Iran-, Sudan- and Syria-focused sanctions programs.[76] According to OFAC, from approximately 2008 to 2015, Wells Fargo and Wachovia Bank (“Wachovia”), which Wells Fargo acquired in 2008, provided a custom trade software platform for use by a European bank. OFAC determined that the European bank then used the platform to process trade finance transactions with U.S.-sanctioned jurisdictions and persons. According to OFAC, this system relied on servers and technology based in the U.S. and was created at the direction of a U.S.-based mid-level manager within Wachovia’s Global Trade Services (“GTS”) business unit. OFAC stated that Wells Fargo “knew or should have known” the European bank would use the software to transact with comprehensively sanctioned jurisdictions or SDNs—especially as concerns were raised internally regarding the system on multiple occasions following Wells Fargo’s acquisition of Wachovia and because OFAC also determined that employees in GTS had unsuccessfully attempted to design the system in a manner that would avoid the involvement of Wells Fargo or other U.S. persons due to sanctions compliance concerns.

OFAC determined that the apparent sanctions violations were voluntarily self-disclosed and egregious. Aggravating factors included the fact that sanctions concerns were repeatedly raised to senior management, and that Wachovia and Wells Fargo are global commercially sophisticated financial institutions. Mitigating factors included GTS’s small role within Wells Fargo and the bank’s otherwise “strong” sanctions program; the relatively modest financial magnitude of the apparent violations; and the fact that the majority of the apparent violations related to agriculture, medicine, and telecommunications, and thus may have been eligible for a license.

In announcing the settlement, OFAC highlighted the sanctions compliance risks that companies can face from “smaller, non-core business lines” and emphasized the importance of addressing internal compliance concerns even when they relate to those more marginal lines of business.

Emigrant Bank. On September 21, 2023, OFAC announced a $31,867.90 settlement with U.S.-based Emigrant Bank (“Emigrant”) for 30 apparent violations of the Iranian Transactions and Sanctions Regulations between 2017 and 2021.[77] For approximately 26 years, Emigrant maintained a Certificate of Deposit account for two Iranian residents, for which it processed 30 transactions totaling $91,051.13. According to OFAC, Emigrant had actual knowledge of the Iranian address and apparent location of the accountholders during this period, but failed to implement adequate controls to identify and prevent prohibited account services. OFAC treated as an aggravating factor that “Emigrant is a longstanding privately-owned bank in the United States and is a sophisticated financial institution.” OFAC ultimately found the case to be non-egregious and voluntarily self-disclosed. It highlighted as a mitigating factor the “negligible harm to U.S. sanctions policy objectives.”

Sanctions Screening Issues; Deficiencies in IP Address Blocking; Deficiencies in Other Automated Systems

Uphold HQ Inc. On March 31, 2023, OFAC announced a $72,230.32 settlement with U.S.-based digital trading platform Uphold HQ Inc. (“Uphold”) for 152 transactions worth $180,575.80 in apparent violation of OFAC’s sanctions against Iran, Cuba, and Venezuela.[78] According to OFAC, Uphold or certain of its non-U.S. affiliates processed transactions for customers who self-identified as being located in Iran or Cuba and for employees of the Government of Venezuela. OFAC determined that the apparent violations were voluntarily self-disclosed and were non-egregious. OFAC treated as an aggravating factor that Uphold had information in its possession giving it reason to know that it was processing payments in apparent violation of U.S. sanctions. OFAC stated that the case illustrates the importance of integrating “information provided by customers during the account opening and diligence processes, such as identification and location information” into financial institutions’ sanctions screening programs. Regarding the Venezuela-related transactions, OFAC reminded financial institutions that it expects them to “conduct due diligence on their own direct customers to confirm that those customers are not persons whose property and interests in property are blocked.”

Microsoft Corporation. On April 6, 2023, OFAC announced a $2,980,265.86 settlement with Microsoft related to the indirect export of services and software from the U.S. to sanctioned jurisdictions and SDNs in apparent violation of OFAC’s Cuba, Iran, Syria, and Ukraine-/Russia-Related sanctions programs.[79] The settlement was part of a joint administrative enforcement effort with BIS, resulting in a total penalty of over $3.3 million.[80] According to OFAC, Microsoft Ireland Operations Limited and Microsoft Rus LLC (collectively, the “Microsoft Entities”), were involved in 1,339 apparent violations of OFAC sanctions programs when they engaged third-party licensing solution partners (“LSPs”) to sell the Microsoft Entities’ products to customers globally. OFAC determined that the Microsoft Entities’ LSPs sold software licenses to end users located in several comprehensively sanctioned jurisdictions and also SDN end users, to which the Microsoft Entities then provided U.S.-origin software and/or U.S.-based services.

OFAC also faulted the Microsoft Entities’ sanctions screening procedures, which OFAC determined “did not identify blocked parties not specifically listed on the SDN List, but owned 50 percent or more by SDNs, or SDNs’ Cyrillic or Chinese names.” OFAC also faulted the Microsoft Entities’ screening procedures for not screening certain address information collected by the Microsoft Entities during the normal course of business. OFAC determined that the apparent violations were non-egregious and self-disclosed. OFAC treated as aggravating factors the sheer number of apparent violations, which OFAC described as “not isolated or atypical in nature”; the fact that “major Russian enterprises” benefitted from the apparent violations; and that Microsoft is a leading global technology company. OFAC focused in particular on Microsoft’s failure to screen certain end users whose names were provided to the Microsoft Entities during the normal course of business—including names that appeared in Cyrillic.

OFAC stated that global technology companies should ensure that their sanctions controls are “commensurate” with the risks posed by “the increased use of internet-based computing and global demand for software applications.” Finally, OFAC emphasized that these apparent violations illustrate the “persistent efforts” of Russian actors to evade sanctions, and cautioned firms to be aware of the “evasion techniques” that resulted in the apparent violations.

Poloniex, LLC. On May 1, 2023, OFAC announced a $7,591,630 settlement with U.S.-based virtual currency exchange Poloniex, LLC (“Poloniex”) for 65,942 apparent violations of multiple OFAC sanctions programs between 2014 and 2019.[81] According to OFAC, the Poloniex trading platform allowed customers apparently located in sanctioned jurisdictions, such as Crimea, Cuba, Iran, Sudan, and Syria, to engage in online digital asset-related transactions, such as trades, deposits, and withdrawals, with a combined value of $15,335,349, despite having reason to know their location from both KYC information and IP address data. OFAC treated as an aggravating factor that Poloniex operated with no sanctions compliance program for more than a year after first beginning operations. OFAC noted that even after Poloniex implemented its sanctions compliance program in May 2015, the company did not apply the program consistently across comprehensively sanctioned jurisdictions nor to customers who had self-identified before May 2015 as residing in a comprehensively sanctioned jurisdiction. OFAC ultimately found the case to be non-egregious, citing, among other things, that Poloniex was a small start-up at the time of most of the apparent violations. OFAC highlighted “the importance of using all available location-related information for sanctions compliance purposes” and that compliance controls apply “not only to new customers, but to existing ones as well.”

daVinci Payments. On November 6, 2023, OFAC announced a $206,213 settlement with U.S.-based financial services firm Swift Prepaid Solutions, Inc. d/b/a daVinci Payments (“daVinci”) for 12,391 apparent violations of OFAC’s Crimea, Iran, Syria, and Cuba sanctions programs.[82] According to OFAC, daVinci provides payment reward card programs that allow their clients to issue prepaid cards to select recipients, typically as part of a loyalty, award, or promotional incentive for employees, customers, and others. OFAC determined that clients funded cards themselves through an issuing bank, and that daVinci provided digital or physical prepaid cards to authorized users after receiving a list of recipients from its client and prompting the recipient to redeem the token for the prepaid card. OFAC noted that to receive the token, users entered their names, addresses, and email addresses on daVinci’s website and that users could not enter an address in a comprehensively sanctioned jurisdiction and were screened against sanctions lists. According to OFAC, in the course of a compliance review and subsequent investigation, daVinci discovered that on 12,378 occasions it had redeemed cards for users with IP addresses associated with comprehensively sanctioned jurisdictions. OFAC determined that the conduct was non-egregious and was voluntarily self-disclosed.

OFAC emphasized that the action “underscores the importance of obtaining and using all available information to verify a customer’s identity or residency, including by using location-related data, such as IP address and top-level domains, for sanctions compliance purposes.” It also stressed that the case “demonstrates the potential shortcomings of controls that rely on customer-provided information.”

Binance Holdings, Ltd. As discussed further in the DOJ section, on November 21, 2023, OFAC announced a $968,618, 825 settlement with Cayman Islands-incorporated Binance Holdings, Ltd. (“Binance”) for 1,667,153 apparent violations of multiple OFAC sanctions programs.[83] These apparent violations related to crypto transactions involving both comprehensively sanctioned jurisdictions as well as persons on the SDN List. This action represents the largest settlement in OFAC history and was part of a global settlement including DOJ, FinCEN, and the Commodity Futures Trading Commission (“CFTC”). OFAC determined that “senior Binance management knew of and permitted the presence of both U.S. and [comprehensively] sanctioned jurisdiction users on its platform and did so despite understanding that [this] could cause violations of OFAC-administered sanctions programs.” OFAC ultimately determined that Binance’s apparent violations were not voluntarily self-disclosed and that Binance’s conduct was egregious. OFAC credited fines paid to DOJ against a vast majority of the settlement. OFAC also credited Binance for its “significant remedial measures,” including revamping and expanding its sanctions and KYC compliance frameworks and retaining a compliance monitor for a five-year period.

CoinList Markets LLC. On December 13, 2023, OFAC announced a $1,207,830 settlement with U.S.-based virtual currency exchange CoinList Markets LLC (“CLM”) relating to 989 apparent violations of OFAC’s Russia/Ukraine sanctions.[84] According to OFAC, although CLM screened new and existing customers against OFAC and other sanctions lists, CLM’s screening procedures “failed to capture users who represented themselves as resident of a non-embargoed country but who nevertheless provided an address within Crimea.” OFAC ultimately found CLM’s apparent violations were not voluntarily self-disclosed and were non-egregious. OFAC treated as an aggravating factor that CLM knew or had reason to know it was conducting transactions on behalf of individuals likely to be ordinarily resident in Crimea. Specifically, OFAC noted that the users in question self-reported addresses during the opening of a CLM account specifying a city in Crimea, the word “Crimea,” or both.

Privilege Underwriters Reciprocal Exchange. On December 21, 2023, OFAC announced a $466,200 settlement with U.S.-based insurance company Privilege Underwriters Reciprocal Exchange (“PURE”) for 39 apparent violations of OFAC’s Ukraine/Russia-Related sanctions between May 2018 and July 2020.[85] According to OFAC, during the relevant period, PURE engaged in transactions related to four insurance policies involving a Panama-based company that, while not itself listed on the SDN List, was wholly owned by Russian SDN Viktor Vekselberg. According to OFAC, email correspondence from as early as January 2010 demonstrated that PURE’s underwriting manager was aware that the insurance policies provided coverage for property wholly owned by Vekselberg. OFAC ultimately found PURE’s apparent violations were not voluntarily self-disclosed and were non-egregious. OFAC treated as aggravating factors that PURE had reason to know it was receiving premium payments from and providing coverage to a company wholly owned by a blocked person, and that PURE did not ensure ownership information about a customer was incorporated into its sanctions screening program.

OFAC noted that the case demonstrates the importance of including in sanctions compliance programs mechanisms to comply with OFAC’s 50 Percent Rule and to ensure that information collected during the ordinary course of business, such as customers’ ownership information, is regularly re-screened to account for changes or updates to the SDN List.

U.S. Parent Liability for Non-U.S. Subsidiary Business with Iran or Cuba

Construction Specialties Inc. On August 16, 2023, OFAC announced a $660,594 settlement with U.S.-based Construction Specialties Inc. (“CS”) related to three apparent violations of OFAC sanctions targeting Iran.[86] According to OFAC, between December 4, 2016 and August 3, 2017, CS’s UAE subsidiary, Construction Specialties Middle East L.L.C. (“CSME”) “imported building materials from the United States to the UAE and then knowingly reexported them to Iran.” OFAC noted that CSME’s general manager directed this activity in contravention of CS’s sanctions policy. OFAC determined that a whistleblower at CSME alerted CS headquarters, and that CS then initiated an internal review and voluntarily reported the matter to OFAC. According to OFAC, the apparent violations were voluntarily self-disclosed and egregious. OFAC treated as aggravating factors the willful involvement of senior CSME management in the apparent violations and the general commercial sophistication of CS and CSME.

In announcing the settlement, OFAC emphasized the “challenges that multinational companies face when they pursue business opportunities in high-risk jurisdictions,” where employees might be particularly inclined to “act on their own initiative to disregard policies and controls and seek to circumvent applicable sanctions.” OFAC also stated that the action highlights the importance of a whistleblower program through which employees can report potential sanctions violations. In this context, OFAC highlighted the FinCEN whistleblower program, noting that it applies to OFAC-administered sanctions. As discussed in our prior memorandum,[87] OFAC also highlighted “the importance for parent companies to . . . exercise appropriate oversight over activities of . . . subsidiaries that may pose sanctions risks.”

3M Company. As discussed in our prior memorandum, on September 21, 2023, OFAC announced a $9,618,477 settlement with U.S.-based 3M Company (“3M”), a global manufacturing company, for 54 apparent violations of OFAC sanctions targeting Iran between 2016 and 2018.[88] According to OFAC, two non-U.S. 3M subsidiaries engaged in sales of reflective license plate sheeting to a German reseller which “3M knew or should have known would be resold to an arm of the [Law Enforcement Forces] of Iran.” Although during the period in question OFAC’s General License H (“GL H”) authorized foreign subsidiaries of U.S. companies to engage in certain transactions with Iran, GL H explicitly prohibited transactions with Iranian law enforcement. OFAC treated as an aggravating factor that numerous 3M employees, including trade compliance personnel, failed to “properly evaluate the proposed sales” and “ignore[d] ample evidence” of the apparent violations; however, OFAC noted as mitigating factors 3M’s remedial efforts, such as the addition of more trade compliance counsel.

In announcing the settlement, OFAC emphasized that “parent companies are expected to oversee compliance with applicable U.S. sanctions laws within their subsidiaries, and to empower employees to alert headquarters trade compliance when business dealings need further review.”

Nasdaq, Inc. On December 8, 2023, OFAC announced a $4,040,923 settlement with U.S.-based stock exchange NASDAQ, Inc. (“Nasdaq”) for 151 apparent violations between 2012 and 2014 arising from the conduct of its former wholly owned subsidiary, Nasdaq OMX Armenia OJSC (“Nasdaq OMX Armenia”).[89] According to OFAC, in February 2008, Nasdaq acquired OMX AB, a Swedish financial company that owned and operated the Armenian Stock Exchange, which, after the acquisition, became Nasdaq OMX Armenia. According to OFAC, Nasdaq OMX Armenia knowingly processed trades and settled payments involving the OFAC-designated Armenian subsidiary of Iran’s state-owned Bank Mellat, Mellat Bank SB CJSC (“Mellat Armenia”). OFAC determined that Nasdaq OMX Armenia knew throughout the relevant period that Mellat Armenia regularly participated in Nasdaq OMX Armenia’s credit resource and foreign exchange markets. OFAC ultimately determined that the apparent violations were non-egregious and voluntarily self-disclosed. OFAC treated as aggravating factors that Nasdaq OMX Armenia was owned and operated by Nasdaq, a large, commercially sophisticated, international financial services corporation, and that Nasdaq and Nasdaq OMX Armenia had actual knowledge that Mellat Armenia was trading on the Nasdaq OMX Armenia exchange throughout the relevant period. OFAC also highlighted several mitigating factors, including that Nasdaq was subsequently eligible for a license to permit Nasdaq OMX Armenia’s continued engagement in certain activities with Mellat Armenia.

OFAC noted that this case highlights the “acute potential sanctions risks” associated with cross-border mergers and acquisitions. OFAC stated that, as a result, companies engaging in such activity would be well-advised to perform commensurate diligence and to implement sanctions compliance policies and procedures at their newly acquired subsidiaries. Here, OFAC noted that “basic screening of the 35 [Nasdaq OMX Armenia] members as a part of the due diligence of the newly acquired business would have revealed Mellat Armenia’s participation.”

Sales to Comprehensively Sanctioned Jurisdictions Through Non-U.S. Third Parties; Individual Liability

Murad LLC and U.S. Person-1. On May 17, 2023, OFAC announced a $3,334,286 settlement with U.S.-headquartered cosmetics company Murad, LLC (“Murad”) and a separate $175,000 settlement with a U.S. person (“U.S. Person-1”), who was a former senior manager of Murad.[90] According to OFAC, U.S. Person-1 conspired with an Iranian distributor and UAE distributor to sell Murad’s products in Iran. OFAC determined that the scheme, which ended in 2018, resulted in the export to Iran of more than $11 million of goods and services over an approximately eight-year period. OFAC noted that Murad sold its products to the UAE distributor and provided support for it to open a Murad-branded store in Tehran even after OFAC rejected Murad’s request for a license to export its products to Iran. OFAC noted that Murad was ultimately acquired by Unilever, which, when it discovered this arrangement, instructed U.S. Person-1 to direct the UAE distributor to cease all sales to Iran; however, OFAC determined that U.S. Person-1 continued to support the UAE distributor’s sales of Murad products into Iran for several more years. In announcing the settlement with Murad, OFAC treated as an aggravating factor the fact that U.S. Person-1 was a Murad senior executive. OFAC noted as a mitigating factor for both Murad and U.S. Person-1 the “benign consumer nature of [Murad’s] products.” For Murad, OFAC also highlighted as a mitigating factor “the small overall share of Company sales represented by its sales to Iran.” Nevertheless, OFAC determined that the apparent violations constituted an egregious case. OFAC also determined that Murad’s apparent violations were voluntarily self-disclosed, but that Person-1’s were not.

In announcing the settlement, OFAC highlighted the “importance of conducting sufficient pre- and post-acquisition due diligence in order to identify and promptly remediate compliance deficiencies.” According to OFAC, the action also “underscores the importance of companies ensuring that conduct implicating OFAC sanctions is authorized, including by general or specific license, before engaging in what could be prohibited activity.”

Treasury’s Financial Crimes Enforcement Network

Rulemaking

Beneficial Ownership. In January 2021, as part of the AML Act of 2020, Congress enacted the Corporate Transparency Act (“CTA”), which required Treasury (through FinCEN) to undertake three rulemakings related to beneficial ownership: (i) establish a beneficial ownership reporting requirement; (ii) establish rules for who may access beneficial ownership information and in what circumstances; and (iii) revise FinCEN’s customer due diligence (“CDD”) rule.

As discussed below, FinCEN has now completed the beneficial ownership rulemakings relating to reporting and access. The reporting requirement became effective on January 1, 2024 and applies broadly to millions of companies incorporated or doing business in the United States.

- Beneficial Ownership Reporting Rule. On January 1, 2024, FinCEN’s beneficial ownership reporting rule (the “Beneficial Ownership Reporting Rule”) took effect and FinCEN began accepting Beneficial Ownership Information (“BOI”) reports. According to Secretary Yellen, “[t]he launch of the United States’ beneficial ownership registry marks a historic step forward to protect our economic and national security.”[91]

As discussed in greater detail in our previous memorandum, [92] the Beneficial Ownership Reporting Rule, which was issued in September 2022, requires “Reporting Companies”—generally legal entities formed or registered to do business in the U.S.[93]—to file BOI reports with FinCEN. Under the rule, there are 23 categories of entities that are exempt, including certain entities that are already required to report BOI, or similar information, to other regulators (e.g., publicly traded companies, registered investment funds and registered investment advisers, banks, credit unions, broker-dealers, insurance companies). Notably, the rule exempts large operating companies—companies with a physical U.S. office, 20 or more full-time employees in the U.S., and $5 million in gross receipts or sales in the past year. Subsidiaries of certain exempt entities are also exempt.[94]

Reporting Companies that cannot rely on an exemption are now required to report certain identifying information regarding the companies, as well as their beneficial owners and company applicants (as applicable),[95] including date of birth, residential or business address (as applicable), and an identifying document.

An individual can apply for a “FinCEN identifier” that can be obtained directly from FinCEN, and then can provide that unique identifier to the Reporting Company, which in turn can provide that “identifier” to FinCEN.[96] While the use of these identifiers is not required, it is an option that may streamline the reporting process.

Under the Beneficial Ownership Reporting Rule, beneficial owners are defined as individuals who directly or indirectly (i) exercise substantial control[97] or (ii) own or control at least 25% of the ownership interests of a Reporting Company. This is a meaningfully broader definition of beneficial owners than that adopted by FinCEN in its CDD Rule.

Reporting Companies must file their beneficial ownership report under the following timeline:

— Reporting Companies in existence before January 1, 2024 must file a report by January 1, 2025;

— Reporting Companies formed or registered from January 1, 2024 through December 31, 2024 must file a report within 90 days of being formed or registered to do business in the United States;[98] and

— Reporting Companies formed or registered from January 1, 2025 onwards must file a report within 30 days of being formed or registered to do business in the U.S.

The Beneficial Ownership Reporting Rule also imposes ongoing obligations on Reporting Companies, including that they must file updated BOI reports in the event that any previously provided information regarding their beneficial owners changes.

Although FinCEN has issued FAQs clarifying reporting requirements and details about the reporting process,[99] there is still ambiguity on how the Beneficial Ownership Reporting Rule may apply to certain complex business structures.

Willful reporting violations of the Beneficial Ownership Reporting Rule can result in civil and criminal penalties, including fines of $500 per day (up to a maximum of $10,000) and imprisonment for not more than two years.[100] The rule notes that “as a general matter, FinCEN does not expect that an inadvertent mistake by a reporting entity acting in good faith after diligent inquiry would constitute a willfully false or fraudulent violation.” FinCEN has emphasized that during 2024 it will prioritize educating reporting entities on their reporting obligations. FinCEN has stated that it “understands this is a new requirement” and that entities that make a mistake or omission in their report may correct it within 90 days without penalty.

- Beneficial Ownership Access Rule. In December 2023, FinCEN issued a final regulation governing the availability of BOI (the “Beneficial Ownership Access Rule”).[101] Under the Beneficial Ownership Access Rule, FinCEN may disclose BOI under specific circumstances to “(1) U.S. Federal agencies engaged in national security, intelligence, or law enforcement activity; (2) U.S. State, local, and Tribal law enforcement agencies; (3) foreign law enforcement agencies, judges, prosecutors, central authorities, and competent authorities (foreign requesters); (4) financial institutions using BOI to facilitate compliance with customer due diligence (CDD) requirements under applicable law; (5) Federal functional regulators and other appropriate regulatory agencies acting in a supervisory capacity assessing financial institutions for compliance with CDD requirements under applicable law; and (6) Treasury officers and employees.”[102]

There are certain limitations on how these users will be able to access BOI. For example, State, local, and Tribal law enforcement agencies will be required to certify that “a court of competent jurisdiction” has authorized the agency to seek the information in a criminal or civil investigation and that the information being requested is relevant to that investigation. Financial institutions will only be able to access BOI where it has the relevant Reporting Company’s consent for such disclosure. Access by any recipient will be “subject to security and confidentiality protocols aligned with applicable access and use provisions.”

The Beneficial Ownership Access Rule becomes effective on February 1, 2024, but FinCEN is taking a “phased approach” to providing access, beginning with a pilot program for “a handful of key Federal agency users starting in 2024” and then providing access to other users, with “financial institutions and their supervisors” being the last to receive access.

The Beneficial Ownership Access Rule included some notable differences from the NPRM pertaining to financial institutions’ access to BOI. First, the final rule broadened the types of financial institutions that could access the information. While the NPRM limited access to financial institutions that are required to comply with FinCEN’s CDD rule, the final rule broadened this to all financial institutions, which means that financial institutions including money service businesses could obtain access. Second, the final rule broadened how financial institutions could utilize the information they obtain. While the NPRM limited use to compliance with the CDD rule, the final rule would allow financial institutions to utilize the information to comply with legal requirements where financial institutions would normally verify customer information—which would include AML and sanctions compliance functions. Third, FinCEN removed the restriction proposed in the NPRM that the information must be kept “in the United States” and revised this section to allow financial institutions to send and store the BOI in most foreign jurisdictions (with the exception of China, Russia, and jurisdictions designated as state sponsors of terrorism or subject to comprehensive sanctions). Taken together, these changes appear to be designed to make the BOI more useful for financial institutions.

While the beneficial ownership rulemakings do not alter a financial institution’s obligation to comply with FinCEN’s CDD rule, FinCEN has stated that, consistent with the CTA, in 2024 it intends to issue an NPRM on revision to the CDD rule to “account for the changes created by the BOI reporting and access requirements set out in the CTA.”[103]

Bitzlato Section 9714 Order. As discussed in our previous memorandum, on January 18, 2023, FinCEN issued an order pursuant to Section 9714(a) of the Combating Russian Money Laundering Act identifying Bitzlato—a virtual currency exchange offering exchange and peer-to-peer services—as a “primary money laundering concern” and prohibiting covered financial institutions from transacting with Bitzlato, effective on February 1, 2023.[104] FinCEN stated that Bitzlato enables the laundering of Convertible Virtual Currency (“CVC”) by facilitating illicit transactions for ransomware actors in Russia, including those connected to the Russian government, and transactions involving Russia-linked darknet markets. The Bitzlato order is FinCEN’s first order issued under Section 9714(a), which, through authority delegated by the Treasury Secretary, authorizes FinCEN to prohibit or impose conditions on the transmittal of funds that involve foreign financial institutions found to be of “primary money laundering concern in connection with Russian illicit finance.” Under Section 9714(b), FinCEN can impose several “special measures” on such institutions, including requiring recordkeeping and reporting. That provision also permits FinCEN, in consultation with the Secretary of State, the Attorney General, and the Chairman of the Board of Governors of the Federal Reserve, to prohibit the creation of correspondent or payable-through accounts for such foreign financial institutions.[105] Because technological limitations may prevent a financial institution from declining transfers originating from Bitzlato, the order permits financial institutions to “reject” a transfer after funds are received, such as by preventing the recipient from accessing the transferred assets.

Virtual Currency Mixing 311 Special Measure. As discussed in our previous memorandum, on October 19, 2023, FinCEN proposed a new regulation under its Section 311 of the USA PATRIOT Act that would identify “non-U.S. convertible virtual currency mixing” (“CVC mixing”) as a class of transactions of primary money laundering concern.[106] This proposed regulation was issued pursuant to Section 311’s Special Measure One and would “requir[e] covered financial institutions,” including crypto exchanges that qualify as money services businesses, “to implement certain recordkeeping and reporting requirements on transactions that covered financial institutions know, suspect, or have reason to suspect involve CVC mixing within or involving jurisdictions outside the United States.”[107] Deputy Secretary of the Treasury Wally Adeyemo stated that FinCEN was proposing this regulation because of the “exploitation” of CVC mixing by “a broad range of illicit actors, including state-affiliated cyber actors, cyber criminals, and terrorist groups.”[108] FinCEN’s new director, Andrea Gacki, highlighted the novel nature of the proposed regulation, noting that it is “FinCEN’s first ever use of the Section 311 authority to target a class of transactions of primary money laundering concern” and that “Treasury will work to identify and root out the illegal use and abuse of the CVC ecosystem.”[109] While this proposed regulation was issued in the weeks after Hamas’s attacks on Israel, it covers non-U.S. crypto mixing more broadly.

2024 Regulatory Priorities. Treasury’s fall 2023 statement of regulatory priorities highlights a number of critical rulemakings that FinCEN considers “regulatory priorities” for fiscal year 2024.[110] Those include:

- Revisions to Customer Due Diligence Requirements for Financial Institutions. As discussed in the Beneficial Ownership section, FinCEN intends to update the CDD rule to accord with the Beneficial Ownership rules.

- Residential Real Estate Transaction Reports and Records. In recent years, Treasury has emphasized the AML risks from “anonymous, non-financed (i.e., all-cash) purchases of residential real estate to launder or hide the proceeds of crime” and has stated that it will “issue a notice of proposed rulemaking (NPRM) in early 2024 that will be an important step toward bringing greater transparency to this sector.”[111]

- Commercial Real Estate Transaction Reports and Records. Treasury has noted that it is “also considering next steps with regard to addressing the illicit finance risks associated with the U.S. commercial real estate sector” and indicated that it intends to undertake a separate rulemaking to address this issue.

- Anti-Money Laundering Program and Suspicious Activity Report Filing Requirement for Investment Advisers. In recent years, Treasury has emphasized the AML risks associated with investment advisers. Treasury recently noted that “[i]nvestment advisers are not subject to consistent or comprehensive AML/CFT obligations in the United States, creating the risk that corrupt officials and other illicit actors may invest ill-gotten gains in the U.S. financial system through hedge funds, private equity firms, and other investment services.” Building on a 2015 NPRM, Treasury “aims to issue in the first quarter of 2024 an updated NPRM that would propose applying AML/CFT requirements pursuant to the Bank Secrecy Act [“BSA”], including suspicious activity reporting obligations, to certain investment advisers.”

- Establishment of National Exam and Supervision Priorities. Consistent with the requirements of the CTA, FinCEN intends to issue an NPRM related to the establishment of national exam and supervision priorities. This proposed rule will build on the AML/CFT national priorities that FinCEN published in 2021, which include: (1) corruption; (2) cybercrime, including relevant cybersecurity and virtual currency considerations; (3) foreign and domestic terrorist financing; (4) fraud; (5) transnational criminal organization activity; (6) drug trafficking organization activity; (7) human trafficking and human smuggling; and (8) proliferation financing.[112] The proposed rulemaking will include a risk assessment requirement, a requirement to incorporate AML/CFT priorities into risk-based programs, and certain technology-related requirements.[113] While financial institutions are not required to incorporate the national priorities into their AML compliance program until a final rule is effective, FinCEN and the banking regulators noted in 2021 that financial institutions may “wish to start considering how they will incorporate the AML/CFT Priorities into their risk based BSA compliance programs, such as by assessing the potential related risks associated with the products and services they offer, the customers they serve, and the geographic areas in which they operate.”[114]

- Updating Whistleblower Incentives and Protection. As discussed in our prior memorandum, the whistleblower framework established by the AML Act of 2020 and expanded upon in the Anti-Money Laundering Whistleblower Improvement Act provides financial incentives for U.S. or non-U.S. individuals to report certain AML and sanctions violations to FinCEN, which is responsible for administering the program.[115] Under the AML Act, successful whistleblowers would receive at least 10 percent of a collected penalty that exceeds $1 million, up to a 30 percent cap.[116] FinCEN has stated that it plans to issue an NPRM aimed at governing the awards distributed in connection with the program. While FinCEN has not yet issued whistleblower regulations, it has established an Office of the Whistleblower and has been “accepting whistleblower tips while we work towards the development of a more formal tip intake system.”[117] FinCEN routinely shares these tips with OFAC and DOJ.

While this list is only a statement of “regulatory priorities” and it is possible that FinCEN could issue rulemakings not on the list in 2024, it is notable that a number of significant recent FinCEN rulemakings do not appear in the statement of priorities—including the SARs sharing pilot program (NPRM issued in 2022), the application of BSA requirements to the trade in antiquities (ANPRM issued in 2021), updates to the travel rule (NPRM issued in 2020), and the so-called unhosted wallets rule (NPRM issued in 2020).

Guidance

Countering Terrorist Financing to Hamas. As discussed in our previous memorandum, on October 20, 2023 FinCEN issued an alert to financial institutions identifying several red flags of potential terrorist financing related to Hamas, following the terrorist organization’s October 7 attack on Israel.[118] The alert encouraged financial institutions to report promptly suspicious transactions with indicia of terrorist financing and provided guidance for the type of information to include in SARs for cyber-related transactions. The guidance instructs financial institutions to include any relevant technical cyber indicators in their SARs, including, for example, chat logs, suspicious IP addresses, suspicious email addresses, and suspicious digital asset addresses. FinCEN also encouraged reporting financial institutions to include any external information available to them suggesting that activity may be linked to Hamas or other terrorist groups. Specific red flags provided by FinCEN in the alert include: (i) a customer conducting transactions that involve shell entities, “trading companies,” or other holding companies with a nexus to Iran or countries of higher risk for terrorist financing; (ii) a customer that is a charitable organization that receives large donations from an unknown source in a short period of time and then wires the funds to other charitable organizations or non-governmental organizations; and (iii) a customer that is a charitable organization but which does not appear to provide any charitable services or openly supports Hamas and its operations.

Potential U.S. Commercial Real Estate Investments by Sanctioned Russian Elites, Oligarchs, and Their Proxies. On January 25, 2023, FinCEN issued an alert to financial institutions regarding “potential investments in the U.S. commercial real estate (“CRE”) sector by sanctioned Russian elites, oligarchs, their family members, and the entities through which they act.”[119] The alert provides potential “red flags and typologies” that may indicate an attempt to circumvent sanctions. The typologies include, but are not limited to, using pooled investment vehicles, using shell companies and trusts, the involvement of third parties, and investing in CRE projects that are “inconspicuous” and provide “stable returns.” The “red flags” include, but are not limited to, the use of an offshore-based private investment vehicle to buy CRE, with investors that are politically exposed persons or other foreign nationals, customers refusing to provide information regarding ultimate beneficial owners or controllers, and ownership of CRE through legal entities in more than one jurisdiction without a clear business purpose.

This guidance builds on extensive guidance issued by FinCEN in 2022 relating to Russian sanctions evasion, including through high-value assets and real estate investments, as discussed further in our 2022 Year in Review.[120]

New Reporting Key Term and Red Flags Relating to Global Evasion of U.S. Export Controls; Potential Russian Export Control Evasion Attempts (FinCEN and BIS). As discussed in our previous memorandum, on November 6, 2023 FinCEN and BIS jointly issued a notice announcing a new SAR key term, “FIN-2023-GLOBALEXPORT,” that financial institutions should reference when reporting potential efforts by individuals or entities seeking to evade U.S. export controls.[121] The Notice emphasizes that BIS and FinCEN expect financial institutions to “be vigilant against efforts by individuals or entities to evade U.S. sanctions and export controls.” The Notice states that financial institutions “with customers in export/import industries, including the maritime industry, should rely on the financial institutions’ internal risk assessments to employ appropriate risk-mitigation measures consistent with their underlying BSA obligations.” Further, the Notice states that financial institutions that are “directly involved in providing trade financing for exporters also may have access to information relevant to identifying potentially suspicious activity” that should be accounted for in their risk-mitigation measures. The Notice underscores that financial institutions should be “applying a risk-based approach to trade transactions.” The Notice builds on two earlier joint alerts from FinCEN and BIS in June 2022 and May 2023 that urged financial institutions to monitor potential Russian export controls evasion and provided a SAR term, “FIN-2022-RUSSIABIS,” for filing SARs related to suspected Russian export control evasion.[122] A September 2023 FinCEN Financial Trend Analysis noted that there had been nearly $1 billion in relevant SARs filed following those alerts and that this reporting was used to provide leads to BIS enforcement agents and to support new designations on the Entity List.[123]

Enforcement Actions

Shinhan Bank America. On September 29, 2023, FinCEN entered into a consent order and assessed a $15 million civil money penalty against SHBA, finding that SHBA failed to fully remediate BSA/AML deficiencies for which it had received repeated notice. [124] FinCEN found, among other things, that SHBA failed to develop and implement an effective process for identifying and reporting suspicious activity in a timely manner, resulting in the untimely filing of several hundred SARs. DFS and the FDIC entered into consent orders with SHBA for the same conduct, with penalties of $10 million and $5 million, respectively. FinCEN credited the civil money penalty imposed by the FDIC.