California joins Washington and Colorado in adopting a state-level “mini-HSR” law, with bills pending in a half dozen other states.

Takeaways

-

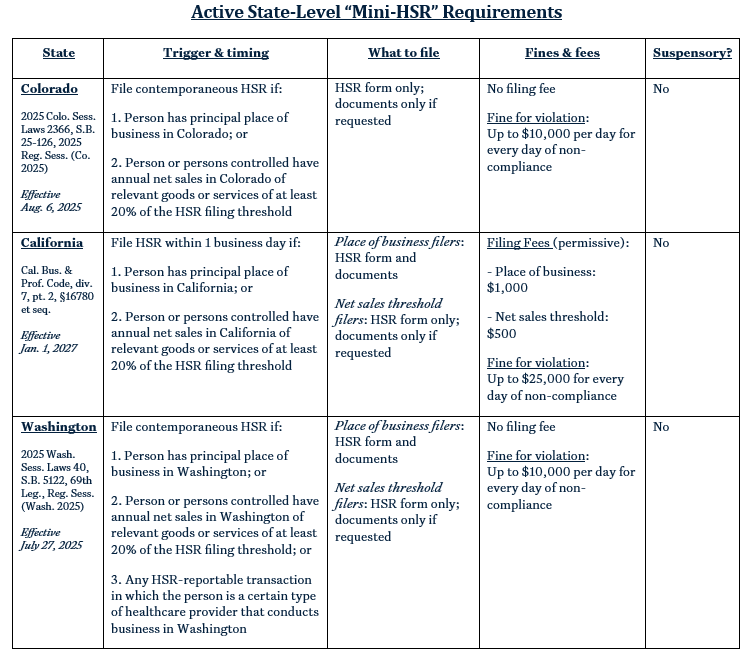

Driven by state-level antitrust enforcement efforts, states are increasingly requiring “mini-HSR” notices for certain transactions. In 2025, Washington and Colorado enacted such laws, and late yesterday, California followed with its own law. There are also similar bills pending in New York, the District of Columbia, Hawaii, Indiana, and West Virginia. These bills come at a time where we are seeing state attorneys general pursue antitrust enforcement even where they depart from federal enforcement decisions.

-

Critically, so far, these are notice-only filings and, unlike HSR, do not impose their own waiting periods. The bills do differ somewhat in that some, but not all, require production of deal-related documents. California also adds modest fees to its requirement.

-

We are tracking developments closely and have included here a chart for your reference. We stand ready to advise you on strategies for compliance going forward.

What deals are affected?

On February 10, 2026, California Governor Gavin Newsom signed into law SB 25, California's version of the Uniform Antitrust Premerger Notification Act (“UAPNA”), which requires certain merging parties to notify their transactions to state authorities. Beginning January 1, 2027, California will require the following categories of persons making a HSR filing also to file a copy with the California Attorney General (“AG”):

-

a person that has its principal place of business in California; or

-

a person, or a person it directly or indirectly controls, had annual net sales in California of at least $26.78 million of the goods or services involved in the transaction.

Principal place of business filers must submit to the AG any additional documentary materials filed under the HSR Act, while size of transaction threshold filers must only do so at the request of the AG. The AG may impose a filing fee of $1,000 for the former or $500 for the latter, with both filers subject to a potential civil penalty of $25,000 per day of noncompliance.

Submissions (including the fact of the submission and the proposed merger) must be kept confidential by the AG and are protected from disclosure, though the AG can share the submission with attorneys general of other states with a substantially similar law. Unlike the federal HSR law, the act does not impose a waiting period that parties must observe before closing.

Versions of the UAPNA have already been enacted in Washington and Colorado; and others have been introduced in the District of Columbia, Hawaii, Indiana[1], and West Virginia. A broader antitrust bill that includes premerger notification requirements is pending in the New York legislature. Still other states have premerger notification requirements limited to certain healthcare transactions, whereas the uniform act is broadly applicable.

What are the state by state requirements?

Please see the attached reference chart, reflecting the developments to date. We are continuing to monitor and are happy to discuss developments at any time.

|

* * *

[1] Indiana Senate Bill 219 has been passed by Senate Committee and sent to the House. If passed fully would go into effect July 1, 2026.