The Federal Trade Commission (FTC) has revised the jurisdictional and filing fee thresholds of the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act) and the Premerger Notification Rules, based on changes in the gross national product (GNP) as required by the 2000 amendments to the HSR Act. The filing thresholds and fees will increase as a result of the increase in the GNP and will apply to transactions that close on or after February 17, 2026. These threshold and filing fee adjustments occur annually and do not alter the HSR filing process.

The HSR Act requires parties intending to merge or to acquire assets, voting securities or certain non-corporate interests to notify the FTC and the Department of Justice, Antitrust Division, and to observe certain waiting periods before consummating the acquisition. Notification and Report Forms must be submitted by the parties to a transaction if both the (1) size of transaction and (2) size of parties thresholds are met, unless an exemption applies.

Size of Transaction

The minimum size of transaction threshold which will be effective as of February 17, 2026 is $133.9 million, increased from the 2025 threshold of $126.4 million.

Size of Parties

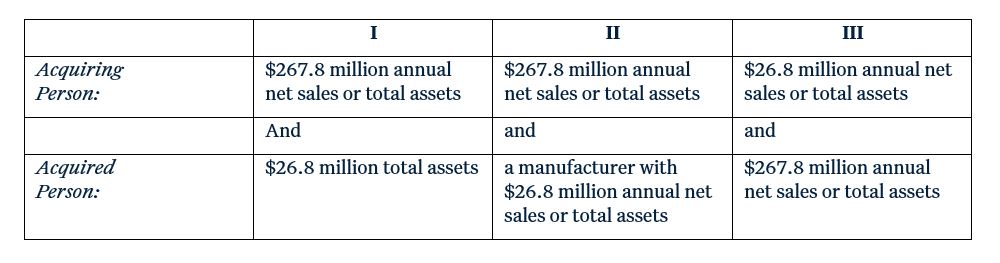

The size of parties threshold is inapplicable if the value of the transaction exceeds $535.5 million ($505.8 million in 2025). For transactions with a value between $133.9 million and $535.5 million, the size of parties threshold must be met and will be satisfied in one of the following three ways:

|

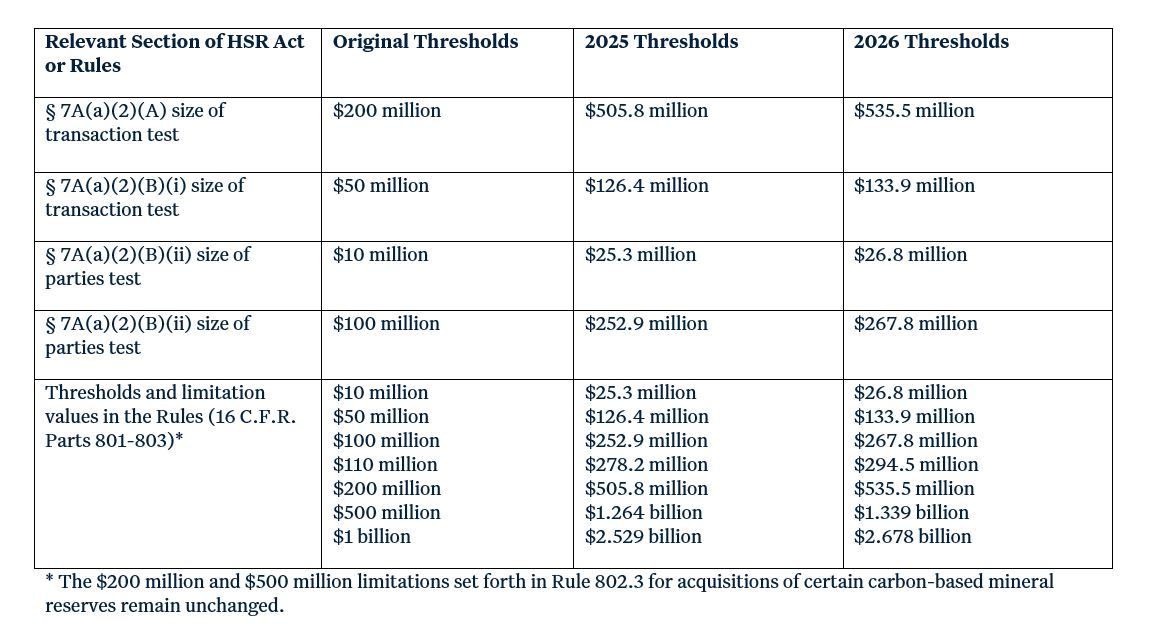

The various jurisdictional thresholds, notification thresholds, filing fee thresholds and thresholds applicable to certain exemptions will also increase, as summarized in Appendix A to this memorandum.

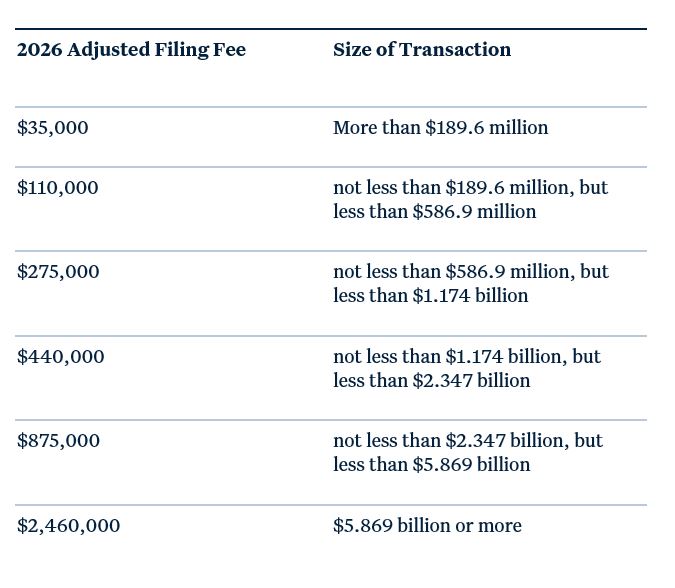

Filing Fees

For all filings made on or after February 17, 2026, the new HSR filing fees will be as follows:

|

The above thresholds and fees will continue to adjust annually.

The current maximum civil penalty for HSR Act violations is $53,088 per day, which is expected to increase soon.

Section 8 Interlocking Directorate Thresholds

Finally, the FTC has increased, effective January 16, 2026, the thresholds that prohibit, with certain exceptions, competitor companies from having interlocking relationships among their directors or officers under Section 8 of the Clayton Act. Section 8 provides that no person shall, at the same time, serve as a director or officer in any two corporations that are competitors, such that elimination of competition by agreement between them would constitute a violation of the antitrust laws. There are several “safe harbors” which render the prohibition inapplicable under certain circumstances, such as when the size of the corporations, or the size and degree of competitive sales between them, are below certain dollar thresholds. Competitor corporations are now subject to Section 8 if each one has capital, surplus and undivided profits aggregating more than $54,402,000, although no corporation is covered if the competitive sales of either corporation are less than $5,440,200. Even when the dollar thresholds are exceeded, other exceptions preventing the applicability of Section 8 may be available. In particular, if the competitive sales of either corporation are less than 2% of that corporation’s total sales, or less than 4% of each corporation’s total sales, the interlock is exempt. In addition, Section 8 provides a one-year grace period for an individual to resolve an interlock issue that arises as a result of an intervening event, such as a change in the capital, surplus and undivided profits or entry into new markets.

* * *

Appendix A

Summary of Revised Jurisdictional Thresholds of the HSR Act and Rules

|