Executive Summary

On July 26, 2023, the SEC proposed a new rule and amendments to the books and records rule to address conflicts of interest associated with advisers’ interactions with investors through the use of certain technologies.[1] The proposal would impose burdensome, prescriptive requirements on advisers that use even simple technologies such as spreadsheets, commonly used software, mathematical formulas, and statistical tools in ordinary course activities such as communicating with existing and prospective investors, soliciting prospective investors, and managing clients’ assets.

The technology covered by the proposal is very broadly defined to include “analytical, technological, or computational functions, algorithms, models, correlation matrices, or similar methods or processes that optimize for, predict, guide, forecast, or direct investment-related behaviors or outcomes”.

The proposal generally would apply to an adviser’s use of such covered technology to engage in ordinary course activities such as:

- engaging or communicating with or providing information to a prospective or current client or a prospective or current investor in a pooled investment vehicle advised by the adviser;

- exercising discretion with respect to client assets;

- soliciting a prospective investor in a pooled investment vehicle advised by the adviser.

The proposal would require all investment advisers registered, or required to be registered, with the SEC to identify and eliminate (or neutralize the effect of) any conflict of interest associated with their use of covered technology in investor interactions that place the adviser’s or its associated person’s interest ahead of investors’ interests.[2] Notably, the proposed framework for advisers to address conflicts of interest in these circumstances is a significant departure from the longstanding legal framework of full and fair disclosure and informed consent.

In addition, the proposal would require all investment advisers registered, or required to be registered, with the SEC to adopt and implement written policies and procedures reasonably designed to prevent violations of the proposed rule; and to comply with extensive recordkeeping obligations.

Rationale

In light of the rapid adoption of predictive data analytics, artificial intelligence and similar technologies, the proposal is designed to address the additional challenges associated with identifying and addressing conflicts resulting from the use of these technologies and concerns about the potential for widespread investor harm.

Key Definitions

- Covered Technology means “an analytical, technological, or computational function, algorithm, model, correlation matrix, or similar method or process that optimizes for, predicts, guides, forecasts, or directs investment-related behaviors or outcomes.”[3]

Examples from the release:

— A spreadsheet that implements financial modeling tools or calculations, such as correlation matrices, algorithms, or other computational functions, to reflect historical correlations between economic business cycles and the market returns of certain asset classes in order to optimize asset allocation recommendations to investors.

— Algorithmic-based tools, such as investment analysis tools that provide tailored investment recommendations to investors.

— PDA-like technologies that analyze investors’ behaviors to proactively provide curated research reports on particular investment products.

— A conditional autoencoder model that predicts stock returns.

— A commercial off-the-shelf natural language processing technology that is licensed by an adviser to draft or revise advertisements guiding or directing investors or prospective investors to use its services.

- Conflict of interest “exists when an investment adviser uses a covered technology that takes into consideration an interest of the investment adviser, or a natural person who is a person associated with the investment adviser.”[4]

- Investor means “any prospective or current client of an investment adviser or any prospective or current investor in a pooled investment vehicle . . . advised by the investment adviser” (i.e., 3(c)(1) and 3(c)(7) funds).[5]

- Investor Interaction means “engaging or communicating with an investor, including by exercising discretion with respect to an investor’s account; providing information to an investor; or soliciting an investor; except that the term does not apply to interactions solely for purposes of meeting legal or regulatory obligations or providing clerical, ministerial, or general administrative support.”[6]

The proposal captures both direct and indirect use of covered technology in the investor interactions.

— “Direct” use is the use of the covered technology itself (e.g., a behavioral feature on an online or digital platform that is meant to prompt, or has the effect of prompting, investors’ investment-related behaviors).

— “Indirect” use involves adviser personnel using the covered technology and communicating the resulting information gleaned to an investor.

Examples:

— “Using covered technology to provide customized insights into an investor’s needs and interests that the adviser uses to supplement their existing knowledge and expertise when making a suggestion to the investor during an in-person meeting.

— “Using covered technology that scrapes public data, which the adviser uses to solicit clients through broadcast emails.

Evaluation and Identification, Determination, and Elimination (or Neutralization) of Conflicts

The proposed rule would require advisers to:

- evaluate any use, or reasonably foreseeable potential use, of a covered technology in any investor interaction to identify any conflict of interest associated with such use or potential use, including through testing the technology prior to use or modification and periodically thereafter;

- determine if any such conflict of interest places the interest of the adviser (or an associated person of the adviser) ahead of investors’ interests; and

- eliminate or neutralize the effect of any such conflict of interest “promptly after” the time when the adviser determined (or reasonably should have determined) that the conflict of interest placed the interests of the adviser (or an associated person of the adviser) ahead of the interests of the investors.

Evaluation and Identification

The proposed rule defines a “conflict of interest” as “when an investment adviser uses a covered technology that takes into consideration an interest of the investment adviser, or a natural person who is a person associated with the investment adviser.”[7] Notably, if a covered technology considers any information favorable to the adviser (or its associated persons) in an investor interaction, there would be a conflict of interest under the proposed rule.

The proposal does not mandate a particular means by which an adviser is required to evaluate its particular use (or potential use) of a covered technology to identify a conflict of interest associated with that use (or potential use). Instead, advisers have flexibility to adopt any approach that is appropriate for the particular use of the covered technology, provided that the evaluation approach is sufficient for the adviser to identify the conflicts of interest that are associated with how the technology has operated in the past (e.g., based on the adviser’s experience in testing, or based on research the adviser conducts into other firms’ experience with the covered technology) and how it could operate once employed by the adviser.

As part of the evaluation and identification of potential conflicts of interest, the proposal would require investment advisers to test each covered technology (1) prior to its implementation or material modification, and (2) periodically thereafter, to determine whether the use of such covered technology is associated with a conflict of interest.[8] The proposal does not set specific requirements for testing and retesting. Rather, the proposal notes that advisers would be expected to consider the nature and complexity of the covered technology in determining what timing and manner of testing would be appropriate.

Determination

The Proposal acknowledges that the determination as to whether a conflict of interest in an adviser’s use of a particular covered technology places the adviser’s interest ahead of investors’ interests is a facts and circumstances analysis and would depend on a variety of factors such as (1) the covered technology, (2) its anticipated use, (3) the conflict of interest involved, (4) the methodologies used and outcomes generated, and (5) the interests of the investor.

To this end, the proposal states that advisers must “reasonably believe that the covered technology either does not place the interests of the [adviser] or its associated persons ahead of investors’ interests, or the [adviser] would need to take additional steps to eliminate, or neutralize the effect of, the conflict.”[9]

Elimination or Neutralization of the Conflict

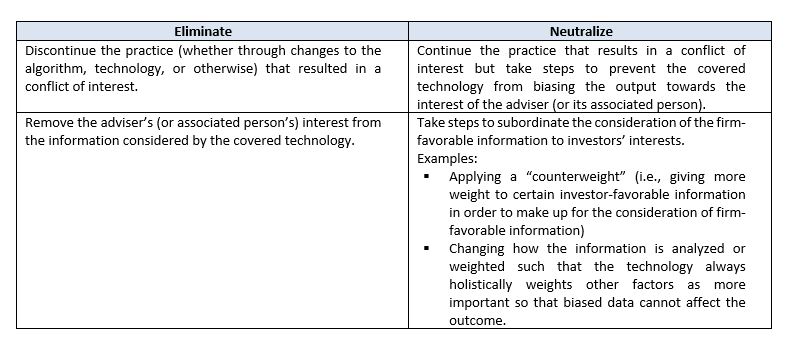

The test for whether an adviser has successfully eliminated or neutralized the effect of a conflict of interest is whether the interaction no longer places the interest of the adviser (or persons associated with the adviser) ahead of the interests of investors. The proposed rule does not specify a method to eliminate or neutralize the effect of an adviser’s conflict of interest. However, the release provides examples of what would be perceived to be an elimination or neutralization.[10]

|

Policies and Procedures

The proposed rule would require an adviser that has any investor interaction using covered technology to adopt and implement written policies and procedures reasonably designed to achieve compliance with the proposed rule, including:

- A written description of the process for evaluating any use (or reasonably foreseeable potential use) of a covered technology in any investor interaction;

- A written description of any material features of any covered technology used in any investor interaction and of any conflicts of interest associated with that use;

- A written description of the process for determining whether any conflict of interest identified results in an investor interaction that places the interest of the adviser (or person associated with the adviser) ahead of the interests of the investor;

- A written description of the process for determining how to eliminate, or neutralize the effect of, any conflicts of interest determined to result in an investor interaction that places the interest of the adviser (or associated person) ahead of the interests of investors; and

- A review and written documentation of the adviser’s review, no less frequently than annually, of the adequacy of the policies and procedures and the effectiveness of their implementation as well as a review of the written descriptions established.

The requirement to adopt, implement, and maintain policies and procedures to comply with the proposed rule applies irrespective of whether advisers that use covered technology in investor interactions actually identify any conflicts of interest associated with the use of the covered technology.

Recordkeeping

Proposed amendments to the Advisers Act books and records rule[11] would require advisers to make and maintain the following specific records pursuant to the proposed conflict rule:

- Written documentation of the evaluation of any conflict of interest associated with the use or potential use by the adviser (or associated person of the adviser) of a covered technology in any investor interaction, including

— a list or other record of all covered technologies used in investor interactions by the investment adviser, including (i) the date on which each covered technology is first implemented, and each date on which any covered technology is materially modified; and (ii) the investment adviser’s evaluation of the intended as compared to the actual use and outcome of each covered technology in investor interactions;

— documentation describing any testing of a covered technology, including (i) the date on which testing was completed, (ii) the methods used to conduct the testing, (iii) any actual or reasonably foreseeable potential conflicts of interest identified as a result of the testing, (iv) a description of any changes or modifications made to the covered technology that resulted from the testing and the reason for those changes, and (v) any restrictions placed on the use of the covered technology as a result of the testing.

- Written documentation of the determination whether any identified conflict of interest places the interest of the firm, or associated persons of the firm, ahead of the interests of investors, including the adviser’s rationale for such determination;

- Written documentation of each elimination or neutralization;

- Written policies and procedures, including any written descriptions and the date on which the policies and procedures were last reviewed;

- A record of any disclosures provided to investors regarding the adviser’s use of covered technologies, including, if applicable, the date such disclosure was first provided or the date such disclosure was updated; and

- A record of each instance in which a covered technology was altered, overridden, or disabled, the reason for such action and the date thereof, including a record of all instances where an investor requested that a covered technology be altered or restricted in any manner.

Conclusion

As noted at the beginning of this memorandum, the expansiveness of the proposal is considerable. The scope of the proposed rules would encompass even ordinary course presentations to existing and prospective investors, investment reviews, and market analyses that utilize any sort of analytical model or tool designed to achieve an “investment-related behavior[] or outcome[].” Further, investment advisers would be required to undertake an extensive review of all such models or tools in order to meet the rule’s requirements to “evaluate” and “identify” potential conflicts of interest – with a view toward ultimately “eliminating” or “neutralizing” them – even where the technology ultimately does not give rise to a significant or substantive conflict. Where conflicts arise, merely disclosing them would not be sufficient to comply with the rules. As a result, if adopted as proposed, the rules would vastly expand the role of compliance departments in overseeing the substance of internal and external communications that include any sort of quantitative analysis (particularly those that are tailored or customized). Ultimately, the burdensome impacts of these requirements could have a chilling effect on the ability of advisers to use both current and future technologies to make or communicate recommendations to their clients.

* * *

[1] Conflicts of Interest Associated with the Use of Predictive Data Analytics by Broker-Dealers and Investment Advisers, SEC Release No. IA-6353, https://www.sec.gov/files/rules/proposed/2023/34-97990.pdf (the “Proposal”). The Proposal would establish the conflict of interest requirements for both broker-dealers and investment advisers. This memorandum focuses on the Advisers Act portions of the proposal only.

[2] The term “associated person” means, for investment advisers, a natural person who is a “person associated with an investment adviser” as defined in section 202(a)(17) of the Advisers Act (i.e., any partner, officer, or director of an investment adviser—or a person performing similar functions—or any person directly or indirectly controlling or controlled by an investment adviser, including any employee of such investment adviser, except for employees who perform clerical or ministerial functions for the adviser). See Proposal at 40 n.119.

[3] Proposed § 275.211(h)(2)-4 (a).

[4] Id.

[5] Id.

[6] Id.

[7] Id.

[8] An example of a “material modification” is a modification to add new functionality. The SEC “would not generally view minor modifications, such as standard software updates, security or other patches, bug fixes, or minor performance improvements to be a ‘material modification.’” See Proposal at 75.

[9] See Proposal at 89.

[10] See Proposal at 98-101.

[11] Proposed § 275.204-2(a)(24).