- U.S. antitrust merger filing fees will be changing in 2023. The filing fees for transactions valued at $500 million or more will increase meaningfully.

- Filing fees will increase annually in line with any increase in the Consumer Price Index (the filing threshold values already adjust annually).

- Additionally, following the Federal Trade Commission’s issuance of a new rule, parties will be required to report in their U.S. premerger filings information regarding subsidies received from a “foreign entity of concern.”

On Thursday, December 29, 2022, the President signed into law H.R. 2617, the Consolidated Appropriations Act, 2023, which includes the Merger Filing Fee Modernization Act. This law has several provisions affecting merger enforcement: it changes the fees required when filing a Premerger Notification and Report Form under the Hart-Scott-Rodino (HSR) Act; it requires reporting of subsidies from a “foreign entity of concern” in HSR filings; and it may impact the defense of merger challenges in certain circumstances.

Current HSR filing fees are $45,000 for transactions valued in excess of $101 million but less than $202 million; $125,000 for transactions valued at $202 million or more but less than $1.0098 billion; and $280,000 for transactions valued at $1.0098 billion or more. These fees remain in effect until further notice from the FTC.

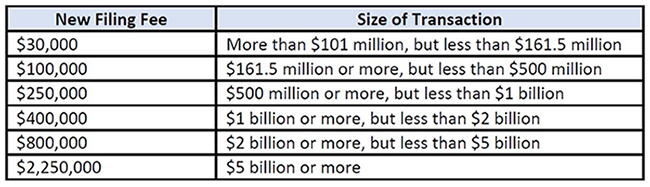

Once implemented, the new HSR filing fees will be as follows:

|

The above fees will increase annually in line with any increase in the Consumer Price Index. The size of transaction thresholds to which the fees apply will continue to adjust annually.

While larger-value transactions will be subject to higher HSR filing fees, smaller transactions will have the benefit of a lower filing fee: a $30,000 (rather than $45,000) HSR filing fee would apply to reportable transactions valued at less than $161.5 million, and a $100,000 (rather than $125,000) HSR filing fee would apply to reportable transactions valued at $202 million or more but less than $500 million. Legislation to increase merger filing fees has been proposed in several recent Congresses. For example, Sen. Amy Klobuchar introduced a bill in 2017.

In addition, pursuant to the Foreign Merger Subsidy Disclosure Act (which is also part of the omnibus law) a person required to make an HSR filing that received any subsidy (including grants, loans, or other categories of benefits) from a “foreign entity of concern” will be required to include in the filing “content regarding such subsidy.” Foreign entities of concern include certain entities related to China, Russia, Iran or North Korea; foreign terrorist organizations; and those designated on Office of Foreign Assets Control lists of the Department of Treasury, among others. The specifics of this new requirement will be included in a rule to be promulgated by the Federal Trade Commission, and the new reporting requirement will be effective when that rule takes effect.

The omnibus package also includes the State Antitrust Enforcement Venue Act, which makes procedural changes to suits brought by state attorneys general under federal antitrust laws and could potentially complicate the defense of merger challenges in certain situations. Previously, when similar lawsuits were filed in different federal districts, the parties could petition the Judicial Panel on Multidistrict Litigation for an order transferring the cases to one court for coordinated or consolidated pretrial proceedings. While suits arising under the antitrust laws filed by the United States were exempt from this transfer procedure, suits filed by states were not. Therefore, state enforcers faced the possibility that they would have to prosecute their lawsuits in federal courts outside of their states. This recently occurred when an action brought by Texas against Google was transferred from a federal court in Texas to the Southern District of New York over the objection of Texas.

Going forward, antitrust suits filed by state enforcers are also exempt from this transfer procedure. This increases the possibility that companies may have to defend the same or similar antitrust claims in multiple jurisdictions. However, parties to the litigation may still have the ability to seek transfer under other provisions of federal law. (It remains to be seen what practical effect this new provision will have in the merger context. When federal and state enforcers challenge a merger, the historical practice has been for them to share resources and join as plaintiffs in one lawsuit. That said, in recent years states have shown increased willingness to bring antitrust cases alone, without the aid of the federal agencies, and the new law may prompt additional antitrust litigation.)

* * *