The following is our summary of significant U.S. legal and regulatory developments during the first quarter of 2023 of interest to Canadian companies and their advisors.

- Stock Exchanges Publish Clawback Proposals

As required by Rule 10D-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the New York Stock Exchange (the “NYSE”) and Nasdaq have issued their respective proposed clawback listing standards. The proposed standards were published in the Federal Register on March 13, 2023, and were open for comment until April 3, 2023. Under Rule 10D-1, the proposed standards must be finalized and be effective by November 28, 2023. Listed companies will have up to 60 days thereafter to adopt clawback policies as required by the listing standards (which will be no later than January 27, 2024, but may be earlier if the listing standards become effective prior to November 28, 2023).

The proposals are substantially identical to the requirements of Rule 10D-1. If a listed issuer is required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws, the issuer will be required to recover, pursuant to its policy, incentive-based compensation received by current and former executive officers during the three completed fiscal years immediately preceding the date on which the issuer is required to prepare the accounting restatement. Recovery will be required on a “no fault” basis, without regard to whether any issuer or executive misconduct occurred or to an executive officer’s responsibility for the erroneous financial statements. Issuers will be required to recover the amount of incentive-based compensation paid that exceeds the amount the executive officer would have received during the applicable period had the incentive-based compensation been determined based on the restated financial statements. The recoverable amount is to be calculated on a pre-tax basis.

Failure to comply with the listing requirements will subject listed companies on either exchange to suspension of trading and delisting. In the case of non-compliance, as proposed, Nasdaq-listed issuers will be eligible to submit a plan of compliance within 45 days and will have access to cure rights, in accordance with existing Nasdaq procedures. By contrast, the NYSE has proposed specific remediation provisions regarding its clawback rules. NYSE-listed issuers who have failed to adopt a policy within 60 days of the effectiveness of the listing standards would be required to issue a press release identifying their delinquency, the reasons for it, and, if known, the date by which they expect to be in compliance. NYSE-listed issuers who fail to recover erroneously awarded compensation reasonably promptly as required by their clawback policies (and fail to qualify for an exception from the clawback requirements) would be subject to an immediate suspension of trading and commencement of delisting procedures.

For the full text of our memorandum, please see:

For the full text of our memorandum regarding the initial adoption of the clawback requirements by the United States Securities and Exchange Commission (the “SEC”), please see:

For the NYSE’s proposed clawback listing standards, please see:

For Nasdaq’s proposed clawback listing standards, please see:

- SEC Adopts Rules to Shorten the Securities Settlement Cycle

The SEC has adopted amendments to Rule 15c6-1 under the Exchange Act to shorten the securities settlement cycle for most transactions to T+1 (from T+2), and for firm commitment offerings priced after 4:30 p.m. (New York City time) to T+2 (from T+4). The SEC has also amended Rule 15c6-1(b) to exempt security-based swaps from the Rule 15c6-1 settlement deadlines (contracts involving the purchase or sale of unlisted/unquoted limited partnership interests will continue to be exempt from these settlement deadlines as well).

In order to facilitate the shortened settlement cycle, the SEC has adopted additional new rules that will require brokers and dealers to enter into agreements, or to establish, maintain and enforce policies and procedures, providing for the completion of allocations, confirmations, affirmations or any combination thereof, on a same day basis, and for investment advisers to make and keep records of confirmations received and allocations and affirmations sent. The SEC has also adopted new rules which will require central matching service providers to adopt policies and procedures to facilitate straight-through processing (and to file annual reports regarding their progress with respect to straight-through processing).

These amendments and new rules, including the amendments exempting security-based swaps from Rule 15c6-1, will become effective on May 5, 2023. Otherwise, compliance will be required as of May 28, 2024.

For the full text of our memorandum, please see:

For the SEC’s amendments, please see:

- Claims That SPAC Directors, Sponsor Breached Fiduciary Duties Survive Motion to Dismiss

In Delman v. GigAcquisitions3, LLC, et al. (“Delman”), the Delaware Court of Chancery, in an opinion by Vice Chancellor Will, recently held on a motion to dismiss that it was reasonably conceivable that the directors of a special purpose acquisition company (“SPAC”) and its sponsor breached their fiduciary duties by disloyally depriving the SPAC public stockholders of information material to their decision on whether to redeem their shares in connection with the deSPAC transaction. Evaluating the claims under the stringent entire fairness standard, the court concluded that the SPAC’s sponsor qualified as a controlling stockholder due to its control and influence over the SPAC, even though it held a minority interest, and that the SPAC directors lacked independence from the sponsor. In addition, entire fairness review was warranted based on the divergent interests between the sponsor and public stockholders that are inherent in the SPAC structure, including the sponsor’s unique incentive to take a “bad deal” over a liquidation of the SPAC and returning the public stockholders’ investment. The opinion provides important key takeaways for sponsors, directors and investors in Delaware SPACs.

Background

GigCapital3, Inc. (“Gig3”) was a Delaware corporation formed with a standard SPAC structure by its sponsor, GigAcquisitions3, LLC (“Sponsor”), in 2020. Among Gig3’s features the court found to be “within the[] structural norms” for a SPAC were the facts that its Sponsor received a “promote” in the form of 20% of the post-initial public offering (“IPO”) equity; that the Sponsor appointed all of the members of the SPAC board, who were partially compensated with promote shares; that public stockholders had redemption rights in connection with a deSPAC transaction allowing them to recoup their investment of $10 per share while retaining their warrants (sold as a unit in the IPO) regardless of how they voted on the deSPAC transaction; and that the SPAC had a limited window (in Gig3’s case, 18 months from its IPO) to complete a deSPAC transaction or liquidate.

Gig3 ultimately engaged in a deSPAC merger with Lightning eMotors Inc. (“Lightning”). Over 98% of the votes cast were in favor of the transaction, with 29% of the public stockholders electing to redeem. The proxy statement in connection with the stockholder vote included financial projections for the post-deSPAC public company that forecast dramatic growth. Less than two weeks after the merger closed, the company publicly announced revenue guidance that was more than 12% below the proxy’s projections for the same time period, and over the following months its stock price fell to a fraction of the redemption price.

Plaintiff, a Gig3 stockholder, claimed the Gig3 board and Sponsor breached their fiduciary duties in connection with the public stockholders’ redemptions rights.

Court’s Ruling & Takeaways

The court denied the defendants’ motion to dismiss the plaintiff’s claims, concluding that entire fairness was the applicable standard of review and, under that standard, it was reasonably conceivable that the Sponsor and Gig3 board did not follow a fair process in connection with the redemption rights. Key takeaways from the court’s analysis include the following:

Bases for Applying Entire Fairness Review. The court applied the entire fairness standard “due to inherent conflicts between the SPAC’s fiduciaries and public stockholders in the context of a value-decreasing transaction,” meaning a deSPAC transaction that would value the post-closing shares less than their $10 redemption price.

- Despite holding a minority of the voting power, the Sponsor was a controlling stockholder. The court found that the Sponsor controlled Gig3, despite holding only approximately 22% of Gig3’s pre-merger voting power, because:

- the Sponsor appointed the initial board, which remained in place through the merger;

- the Sponsor-affiliated directors (including the Sponsor’s controller and his spouse) “dominated” the process to find a target, which was Gig3’s “sole objective,” and thereby exercised power over “the most crucial decision facing [Gig3]: merge or liquidate”; and

- the IPO prospectus disclosed that the sponsor “may exert a substantial influence on actions requiring a stockholder vote” because most stockholder votes (including to approve the deSPAC transaction) required approval by a majority of votes cast, effectively increasing the Sponsor’s voting bloc as public stockholders abstained or did not vote.

- The SPAC directors lacked independence from the Sponsor. The court found numerous board level affiliations with the Sponsor, including that the Gig3 directors each had a number of ties to the Sponsor and its controller, such as employment with a Sponsor-related entity and past or current directorships on other Sponsor-related entities. The court wrote that it was “reasonably inferable that these directors would expect to be considered for directorships in companies—such as other SPACs—that [the Sponsor’s controller] launches in the future.”

- The Sponsor was conflicted regarding stockholders’ redemption rights. The court held that “the Sponsor’s interests diverged from public stockholders in the choice between a bad deal and a liquidation.” In the case of a “bad deal,” the Sponsor could still realize “enormous returns” but receive nothing in the case of a liquidation, whereas the public stockholders would suffer a loss if the post-deSPAC company stock price fell below $10 but recoup their investment plus interest in a liquidation. Additionally, the Sponsor had an incentive to minimize redemptions to “ensure greater certainty” that the SPAC could satisfy a closing condition to the merger agreement that at least $50 million be released to the combined company from the trust account at closing.

- The conflict was not ameliorated by other protections to align the Sponsor’s interests. The defendants argued that these “inherent” SPAC conflicts were ameliorated by, among other things, the facts that the Sponsor’s shares were the same class as the public’s with the same voting power, that the Sponsor’s shares were subject to a one-year lockup post closing, that the directors were partially compensated in cash and that the SPAC had 11 months left to consummate a transaction out of its 18-month completion window. The court reasoned that none of these facts ameliorated the disparate incentives. The class structure did not redress the conflict because “[t]he nature of the Sponsor’s promote incentivized it to complete a merger with Lightning, even if the deal proved disastrous for non-redeeming public stockholders.” As to the lockup, “unless Gig3 went bankrupt within a year,” the Sponsor’s promote “would well exceed” its investment after the lockup expired. Regarding the directors’ cash compensation, the court reasoned it did not resolve their lack of independence from the Sponsor. Finally, the time left in the completion window did not reduce the incentives to approve a “bad deal” because “the Sponsor might have desired to take the money in hand and focus on the next ‘Gig’ SPAC rather than continuing to seek a target for Gig3.”

Stockholder Votes Do Not Cleanse SPAC Conflicts. The court also rejected the defendants’ argument that the stockholder vote in favor of the deSPAC transaction could cleanse the board-level conflicts.

- Corwin cleansing not available for board level conflicts. The court held that the framework established in Corwin KKR Financial Holdings LLC (“Corwin”) is not available to restore business judgment review in the case of SPACs’ board level conflicts due to the structure of the stockholder vote in deSPAC transactions. According to the court, fully informed and uncoerced stockholder votes are afforded deference under Corwin because stockholders are presumed impartial decision-makers with an actual economic stake in the outcome of the merger. The court observed that the Gig3 stockholder vote (like the typical vote in a deSPAC transaction) “could not reflect the investors’ collective economic preferences [because] [s]tockholders’ voting interests were decoupled from their economic interests” by virtue of their ability to both vote yes on the deSPAC transaction and redeem. “Moreover, redeeming stockholders remained incentivized to vote in favor of a deal—regardless of its merits—to preserve the value of the warrants included in SPAC IPO units. Because this vote was of no real consequence, its effect on the standard of review is equivalently meaningless.”

- Similarly, MFW is likely unavailable to cleanse SPAC sponsor conflicts. In dicta, the court observed that the protections set forth in Kahn M&F Worldwide Corp. (“MFW”) should also not apply to cleanse controlling sponsor conflicts in deSPAC transactions. The court observed that MFW was designed to protect minority stockholders from the retribution of a controlling stockholder in a self-dealing transaction, specifically a squeeze-out merger. This threat of retribution does not exist in the SPAC structure, as public stockholders can simply choose to redeem their shares.

Unfair Interference with Redemption Rights. The court ruled that “[t]he plaintiff provided ‘some facts’ that public stockholders’ redemption decisions were compromised by the defendants’ unfair dealing,” primarily relating to allegations that the stockholders were deprived of material information relevant to their redemption decision.

- SPAC boards are expected to perform real due diligence and disclose conclusions in the proxy. The court concluded the proxy issued in connection with the deSPAC transaction was misleading, in part, because the target’s “lofty projections were not counterbalanced by impartial information.” For example, the complaint alleged that the Gig3 board should have been able to tell that the business model on which the projections were based would be difficult to achieve. According to the court, “[t]he nature of Lightning’s business model was ‘knowable’ through the sort of diligence and analysis expected of the board of a Delaware corporation undertaking a major transaction.” Here, the court inferred that the defendants “knew (and should have disclosed) or should have known (but failed to investigate) that Lightning’s production would be difficult to scale in the manner predicted.”

- Other indications of unfair process. Having found the misleading disclosures sufficient to deny a motion to dismiss under the entire fairness standard, the court noted briefly several additional indicators of unfair dealing, including that:

- the merger negotiations were directed by the Sponsor’s controller and his spouse (also a SPAC director), who were “the two individuals who arguably stood to gain the most in a value-destructive deal”;

- the board’s financial advisors were also its underwriters and thereby conflicted by their deferred underwriting fees as well as by holding private placement shares, both of which would be lost if the SPAC did not find a deal; and

- the board did not obtain a fairness opinion or even an information presentation on the fairness of the transaction from its financial advisors.

For the full text of our memorandum, please see:

For the Delaware Court of Chancery’s opinion in Delman, please see:

- DOJ and SEC Allege Insider Trading Based Exclusively on Use of Rule 10b5-1 Trading Plans

On March 1, 2023, the U.S. Department of Justice (the “DOJ”) unsealed criminal insider trading charges, and the SEC filed a parallel civil complaint, against the Executive Chairman of a publicly-traded healthcare company based on stock sales made pursuant to Rule 10b5-1 trading plans. As highlighted by the DOJ in its press release, the case represents the first-ever insider trading prosecution based exclusively on the use of Rule 10b5-1 trading plans. These actions are consistent with an increased government focus on, and scrutiny of, Rule 10b5-1 plans and come on the heels of recent SEC amendments to Rule 10b5-1.

Background on Rule 10b5-1

Rule 10b5-1 establishes an affirmative defense to insider trading for purchases or sales of stock made pursuant to a written plan adopted before the person became aware of material, nonpublic information (“MNPI”). A Rule 10b5-1 plan thus allows a public company insider who may come into possession of MNPI to buy or sell shares at a predetermined time on a scheduled basis, provided that the plan satisfies certain conditions and is adopted at a time when the insider has no MNPI.

In December 2022, the SEC adopted certain amendments to Rule 10b5-1, which became effective on February 27, 2023. The rule changes include the imposition of cooling-off periods before trading by individuals can commence under a Rule 10b5-1 plan, a requirement that all persons entering into a Rule 10b5-1 plan must act in good faith with respect to the plan, and a condition that directors and officers include representations in their plans certifying at the time of the adoption of a new or modified Rule 10b5-1 plan that: (1) they are not aware of any MNPI about the issuer or its securities; and (2) they are adopting the plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1. The amendments also require more comprehensive disclosure about issuers’ policies and procedures related to insider trading, including quarterly disclosure by issuers regarding the use of Rule 10b5-1 plans and certain other trading arrangements by their directors and officers for the trading of their securities.

The Government’s Allegations

Terren S. Peizer was the Executive Chairman of Ontrak, Inc. (“Ontrak”), a company that provided behavioral health services to patients insured by Cigna Corporation (“Cigna”). The government alleges that through his position on the board of Ontrak, Peizer learned that Cigna had raised several concerns about its relationship with Ontrak and that, as a result, Ontrak was in “serious danger of Cigna terminating its agreement . . . .” Peizer allegedly contacted a broker to set up a Rule 10b5-1 plan to sell shares of Ontrak after learning this information, but the broker required that the Rule 10b5-1 plan have a cooling off period. Peizer allegedly then contacted a second broker that did not require a cooling-off period and requested that his shares be sold as soon as possible. According to the government, Peizer certified to Ontrak’s CFO, in seeking approval for the plan, that “this proposed dealing was not a result of access to, or receipt of Material Nonpublic Information as described in the Company’s Insider Trading Policy.” Peizer entered into a Rule 10b5-1 plan with the second broker and sold shares that generated approximately $19 million in proceeds.

Thereafter, Peizer allegedly entered into a second Rule 10b5-1 plan and again certified to Ontrak’s CFO that he did not possess MNPI. Peizer sold approximately $900,000 of Ontrak shares pursuant to that plan. When Ontrak later disclosed the termination of its relationship with Cigna, Ontrak’s stock price allegedly fell by approximately 44%.

Takeaways

This first-ever insider trading prosecution based exclusively on the use of Rule 10b5-1 plans came just a week after recent SEC amendments to Rule 10b5-1 became effective, and is consistent with an increased government and regulatory focus on and scrutiny of Rule 10b5-1 trading plans. The DOJ announced that the prosecution was part of its “data-driven initiative led by the Fraud Section to identify executive abuses of 10b5-1 trading plans,” and SEC Chair Gary Gensler specifically referenced the recent amendments to Rule 10b5-1 in the SEC’s press release, stating that the amendments “will further help prevent unlawful trading by executives on the basis of non-public information and help build greater confidence in the market.”

In light of the amendments to Rule 10b5-1 and the continued government and regulatory emphasis on Rule 10b5-1 plans, it is important not only that insiders with potential access to MNPI remain vigilant when adopting a Rule 10b5-1 plan, but that issuers carefully evaluate existing policies and controls and address any potential gaps.

For the full text of our memorandum, please see:

For the full text of our memorandum discussing the amendments to Rule 10b5-1, please see:

- SEC Announces Novel Human Capital Internal Controls Settlement with Activision Blizzard, Inc.

On February 3, 2023, the SEC reached a novel $35 million settlement with Activision Blizzard, Inc. (“Activision Blizzard”), one of the world’s largest video game developers and publishing companies, to resolve allegations that the company failed to maintain controls and procedures to ensure the adequacy of disclosures it made related to human capital in SEC filings. Activision Blizzard agreed to settle the allegations without admitting or denying the SEC’s findings, concluding an almost 17-month investigation stemming from workplace misconduct complaints at Activision Blizzard and its subsidiaries.

The SEC alleges that although Activision Blizzard disclosed—in Form 10-K and 10-Q filings made between 2017 and 2021—that a failure to attract, retain and motivate key personnel could materially affect the company’s performance, the company lacked internal controls and procedures “designed to ensure that information related to employee complaints of workplace misconduct would be communicated to Activision Blizzard’s disclosure personnel to allow for timely assessment on its disclosures.” As a result, the SEC alleges, Activision Blizzard’s management “lack[ed] sufficient information to understand the volume and substance of employee complaints of workplace misconduct” and was unable “to assess related risks to the company’s business, whether material issues existed that warranted disclosure to investors, or whether the disclosures it made to investors in connection with these risks were fulsome and accurate.” The SEC concluded that through this failure, the company violated Exchange Act Rule 13a-15(a), which requires issuers to implement and maintain controls and procedures “designed to ensure that information required to be disclosed” in SEC filings is (1) timely “recorded, processed, summarized and reported” to the SEC and (2) “accumulated and communicated to the issuer’s management . . . as appropriate to allow timely decisions regarding required disclosure.”

The Activision Blizzard order reflects an expansive view as to what Rule 13a-15(a) requires with respect to internal controls and procedures concerning human capital. The rule requires that issuers implement controls and procedures to ensure timely communication of information “required to be disclosed” to the SEC. In the Order, the SEC does not allege that the company’s disclosures themselves were incomplete or inaccurate. Instead, the SEC contends that Activision Blizzard’s disclosure controls and procedures were inadequate because they “should capture not only the required disclosures but also information that is relevant to an assessment of the need to disclose developments and risks that pertain to the issuer’s businesses.”

This conclusion not only finds a violation of the rule based on language that the rule does not in fact contain, but interestingly the Order does not allege that workplace misconduct—or reports of workplace misconduct at Activision Blizzard—was in fact relevant to retention and recruitment efforts, i.e., was relevant to the underlying disclosure, let alone that such information was material such that it needed to be disclosed.

This Order raises important questions as to how broadly the SEC believes companies must implement controls and policies concerning information that may be connected to employee retention and recruitment. Workplace complaints are one of any number of sources of information potentially relevant to employee retention and recruitment. As such, they are also one of any number of topics as to which the SEC may in hindsight allege that a company’s management “lack[ed] sufficient information to understand” when making human capital disclosures, resulting in alleged Rule 13a-15(a) violations. In this sense, the Order may be an ominous sign of forthcoming SEC regulation by enforcement, where the SEC is limited—for now—by hindsight and not much else.

Going forward, human capital will continue to be a critical area of enforcement activity to monitor as the Enforcement Division continues to refine what controls, policies and disclosures are required in this space. There may also be rulemaking on the horizon that further clarifies disclosure and internal control requirements in the human capital space.

In 2020, the SEC amended Item 101 of Regulation S-K to require disclosure of “the number of persons employed by the registrant, and any human capital measures or objectives that the registrant focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the development, attraction and retention of personnel).” Since that time, there has been ongoing discussion about enhancing those disclosure requirements, particularly with respect to how public companies value their investments and expenses in human capital. This disclosure item is called for in certain periodic reports and registration statement by U.S. domestic issuers.

In June of 2022, a Working Group on Human Capital Accounting Disclosure, composed of academics, market participants and former SEC officials, submitted a petition for rulemaking asking the SEC to develop rules requiring human capital accounting disclosure requirements. The petition requested that the SEC “develop rules to require public companies to disclose sufficient information to allow investors to assess the extent to which firms invest in their workforce,” and recommended enhanced accounting-related disclosure to reflect that human capital-related costs are deemed expenses as opposed to investments. Chair Gary Gensler indicated on several occasions in 2022 that he is seriously considering acting on this petition and/or otherwise revisiting the human capital disclosure requirements.

In 2023 and beyond, human capital is likely to remain a hot button area for SEC enforcement activity and rulemaking. We will continue to monitor this critical and emerging area for significant developments.

For the full text of our memorandum, please see:

- On One-Year Anniversary of Russia’s Invasion of Ukraine, OFAC and BIS Announce Expansive New Sanctions and Export Controls Targeting Russia and Belarus, While DOJ Increases Resources Targeting Sanctions Evasion

On February 24, 2023, exactly one year after Russia began its invasion of Ukraine, the U.S. government announced a new wave of sweeping sanctions and export controls targeting Russia as well as Belarus for its role in continuing to support Russia’s invasion of Ukraine. The U.S. Department of Treasury’s Office of Foreign Assets Control (“OFAC”) (i) issued a new determination that authorizes the imposition of blocking sanctions on individuals and entities determined to operate or have operated in the metals and mining sector of the Russian economy; (ii) designated 14 additional Russian financial institutions (including Credit Bank of Moscow PSJ, one of the 10 largest Russian banks by asset value) on its Specially Designated Nationals and Blocked Persons List (the “SDN List”); and (iii) designated dozens of Russian, Belarussian, and third country individuals and entities on the SDN List for engaging in sanctions evasion activities as well as a number of companies determined to be in Russia’s military supply chain.

On the same day, in a separate action, the U.S. Department of Commerce’s Bureau of Industry and Security (“BIS”) issued a number of expanded export controls targeting Russia in an effort to further align the U.S. Export Administration Regulations (“EAR”) with export controls that have been implemented by allied nations. These BIS actions included: (i) expanding restrictions in the EAR with regard to the scope of the EAR’s Russian and Belarusian industry sector prohibition (including with regard to oil and gas production, certain commercial and industrial items, and chemical and biological precursors); (ii) significantly expanding restrictions in the EAR prohibiting the export or re-export of “luxury goods” to Russia to cover a wider range of items (including, e.g., engines, vehicles parts, household and restaurant appliances, and electronics (including smart phones)); (iii) adding 86 entities located in a variety of countries to the Entity List for their support of the Russian military; and (iv) targeting the apparent incorporation of U.S.-origin parts and components in unmanned aerial vehicles (“UAVs”) that Iran has supplied to Russia.

On March 2, 2023, the DOJ along with OFAC and BIS issued a joint compliance note on Russia-related sanctions and export control evasion attempts. The compliance note focuses in particular on the use of third-party intermediaries by Russian and Belarusian SDNs or Entity List persons to obscure the true identities of Russian or Belarusian end users and thereby evade U.S. sanctions and export controls. The compliance note includes a list of red flags that may indicate that an intermediary may be engaged in efforts to evade sanctions or export controls and identifies certain techniques used by such third-party intermediaries to evade sanctions and export controls.

In a speech the same day, Deputy Attorney General Lisa Monaco reiterated that “in today’s world, sanctions are the new [Foreign Corrupt Practices Act]” and specifically noted that DOJ was adding over 25 prosecutors to a unit focused on the investigation and prosecution of sanctions evasion, export control violations, and similar economic crimes. Deputy Attorney General Monaco also noted the following regarding DOJ’s increased focus on sanctions and export control evasion:

- “What was once a technical area of concern for select businesses should now be at the top of every company’s risk compliance chart;”

- “[W]e are handling corporate investigations that involve sanctions evasion – in industries a varied as transportation, fin tech, banking, defense, and agriculture;”

- “[S]tarting today, the [National Security Division (“NSD”)] will issue joint advisories with the Commerce and Treasury Departments [regarding sanctions evasion];”

- “[W]e will also be making a substantial investment in the Bank Integrity Unit in the Criminal Division’s Money Laundering and Asset Recovery Section” which “has a significant track record of prosecuting global financial institutions for sanctions violations, and these additional resources will allow it to build upon that record and be a strong partner to NSD.”

Implications

These additional sanctions and export controls reflect the U.S. government’s continuing whole-of-government focus on punishing the Russian economy and, in particular, the sectors of the Russian economy that support the Russian military, as a result of Russia’s ongoing invasion of Ukraine. This new tranche of sanctions and export controls further expands U.S. restrictions targeting Russia and Belarus (an OFAC fact sheet issued the same day as these sanctions noted that in waves of sanctions over the last year OFAC has designated over 2,500 Russian individuals, entities, vessels, and aircraft as SDNs, and this figure does not include the hundreds of Russian individuals and entities on the BIS Entity List). As a result, Russia and (to a lesser extent) Belarus continue to be effectively quasi-comprehensively sanctioned jurisdictions for U.S. persons.

Although we expect the U.S. government to make additional sanctions designations and export controls restrictions targeting Russia and Belarus for as long as the war in Ukraine continues, the recent combined compliance note and remarks from the Deputy Attorney General regarding the creation of a new unit at DOJ dedicated to investigating sanctions and export control evasion may also signal a redoubling of efforts throughout the U.S. government to aggressively enforce the existing broad sanctions and export controls targeting Russia and Belarus (as well as investigating sanctions or export control evasions in other contexts).

As a result and as the joint compliance note suggests, U.S. and non-U.S. companies alike would be well-advised to review and, as necessary, enhance their sanctions and export control compliance policies and procedures regarding, among other things: (i) the screening of customers and counterparties (and their owners and directors); (ii) the monitoring for, and appropriate escalation and investigation of negative news and red flags (including the red flags included in the compliance note around sanctions evasion and diversion risks); and (iii) the performing of periodic export control classification assessments (and reviews or audits of end user statements). Companies would be well advised to engage in such a review not only if they still engage in business in or with Russia or Belarus, but also if they engage in business with the countries that border Russia and Belarus or other known diversion points that were described in the compliance note. Additionally, all companies engaging in international business would be well advised to review the sanctions and export control evasion red flags in the compliance note and to consider how their compliance framework could be enhanced to better identify and escalate such red flags if presented.

We will continue to monitor sanctions and export controls targeting Russia and Belarus and will provide further updates as appropriate.

For the full text of our memorandum, please see:

- Delaware Court of Chancery Dismisses Caremark Claims Against Directors for Failure to Allege Bad Faith Conduct

On March 1, 2023, the Delaware Court of Chancery dismissed Caremark oversight claims brought against the directors of McDonald’s Corporation for their alleged failure to address “red flags” suggesting widespread sexual harassment and workplace misconduct at the company. In In re McDonald’s Corp. Stockholder Derivative Litigation (“McDonald’s”), the court found that the plaintiffs’ allegations criticizing the directors’ efforts to address such red flags failed to plead that the directors acted in bad faith. McDonald’s reaffirms the vitality of Delaware’s strict Caremark pleading standard and should help allay recent concerns that it had been diluted.

Background on Caremark Claims

Delaware law has long recognized that directors’ fiduciary duty of loyalty requires that they supervise a corporation’s affairs by both establishing a system of internal controls and responding to “red flags” suggesting corporate misconduct. Claims that directors breached their oversight responsibilities are described as “among the hardest to plead and prove” because such claims require a showing of bad faith conduct. Lawsuits asserting such claims had historically and routinely been dismissed at the pleadings stage under this strict standard.

The Delaware Supreme Court’s 2019 decision in Marchand v. Barnhill (“Marchand”) was perceived as a turning point and potential dilution of the historically strict standard. In Marchand, the Supreme Court reversed the Court of Chancery’s dismissal of Caremark claims against the directors of an ice cream company, Blue Bell Creameries USA, Inc., stemming from a widespread listeria outbreak. The Supreme Court reasoned that the allegations that the directors failed to implement any “board-level compliance monitoring and reporting” concerning the “intrinsically critical” issue of food safety were sufficient to plead that the directors acted in bad faith. Marchand and a series of subsequent decisions declining to dismiss Caremark claims at the pleadings stage have led to a perception that Caremark claims have become easier to plead.

The Court of Chancery’s Opinion

Certain McDonald’s Corporation stockholders filed a consolidated complaint alleging that, under the watch of the CEO and CPO, the company cultivated and promoted a culture of sexual harassment and workplace misconduct. The stockholders alleged that McDonald’s Corporation directors were put on notice of this misconduct by employee complaints, strikes and even an inquiry from a U.S. senator. The plaintiffs’ complaint also detailed the actions the directors had taken in response, including “(i) hiring outside consultants, (ii) revising the [c]ompany’s policies, (iii) implementing new training programs, (iv) providing new levels of support to franchisees, and (v) taking other steps to establish a renewed commitment to a safe and respectful workplace.” The stockholders criticized the directors’ response as ineffective and alleged that the directors violated their fiduciary duties under Caremark because they “did not fix the problem.”

In addition, the stockholders alleged that the directors breached their fiduciary duties by entering into a without-cause separation agreement with McDonald’s Corporation’s CEO. The stockholders alleged the directors acted out of self-interest, purportedly fearing that a for-cause termination would invite a litigation challenge by the CEO and publicize the company’s pervasive culture problems that the directors had allegedly failed to remedy in bad faith.

The Court of Chancery dismissed the stockholders’ claims against the directors as insufficient to plead a claim. The court reasoned that the stockholders’ own allegations and documents incorporated into the complaint demonstrated that the directors acted in good faith to remedy the alleged misconduct brought to their attention. The court further reasoned that the allegations the directors’ responses were ineffective did not demonstrate bad faith, explaining that fiduciaries “cannot guarantee success . . . [w]hat they have to do is make a good faith effort.”

The court also dismissed the stockholders’ claims that the directors breached their fiduciary duties by agreeing to a without-cause separation agreement. In addition to finding no allegations suggesting bad faith conduct by the directors, the court reasoned the stockholders failed to allege that the directors were interested or lacked independence in reaching that decision. The court thus explained that the directors’ decision “was a classic business judgment” entitled to deference.

Implications

Dispelling the perception that Delaware courts have lowered the Caremark pleading bar, McDonald’s highlights that directors fulfill their duty of loyalty by making a good faith effort to respond to reports of misconduct. In addition, the good-faith decisions of disinterested and independent directors to part ways with members of management alleged to have been involved in reported misconduct will continue to be protected by business judgment deference. Accordingly, complaints charging only that the directors’ actions were ineffective or even grossly negligent should still be expected to fail at the pleadings stage. And, the same is true with good-faith business judgments made by a majority of unconflicted directors.

McDonald’s also highlights the importance of sound formal corporate recordkeeping. The directors’ good-faith efforts to address the alleged red flags were documented in board meeting minutes and materials that were provided to the court in support of their motion to dismiss. Although noting that director defendants’ overreliance on such documents in their motions to dismiss can sometimes lead to the court converting a pleadings-stage motion to one for summary judgment, the court found that conversion in this instance was not warranted.

For the full text of our memorandum, please see:

- FTC Announces Hart-Scott-Rodino and Clayton Act Section 8 Thresholds for 2023

The Federal Trade Commission (the “FTC”) has revised the jurisdictional and filing fee thresholds of the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the “HSR Act”) and the Premerger Notification Rules (the “Rules”), based on changes in the gross national product (“GNP”) as required by the 2000 amendments to the HSR Act. The filing thresholds increased as a result of the increase in the GNP and apply to transactions that closed on or after February 27, 2023 and the new filing fees apply to HSR filings submitted on or after February 27, 2023.

The HSR Act requires parties intending to merge or to acquire assets, voting securities or certain non-corporate interests to notify the FTC and the Department of Justice, Antitrust Division, and to observe certain waiting periods before consummating the acquisition if certain filing thresholds are met. Notification and Report Forms must be submitted by the parties to a transaction if both the (1) size of transaction and (2) size of parties thresholds are met, unless an exemption applies.

i. Size of Transaction

The minimum size of transaction threshold which are effective as of February 27, 2023, is $111.4 million, increased from the 2022 threshold of $101 million.

ii. Size of Parties

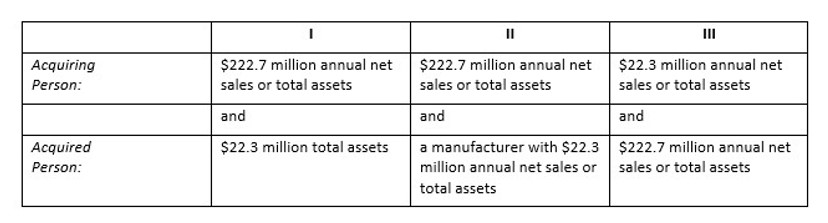

The size of parties threshold is inapplicable if the value of the transaction exceeds $445.5 million ($403.9 million in 2021). For transactions with a value between $111.4 million and $445.5 million, the size of parties threshold must be met and will be satisfied in one of the following three ways:

|

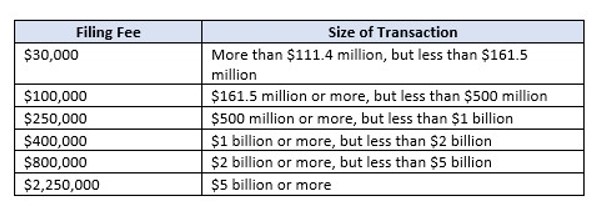

iii. Filing Fees

On December 29, 2022, the President signed into law H.R. 2617, the Consolidated Appropriations Act, 2023, which included the Merger Filing Fee Modernization Act. This Act required the FTC to revise the filing fee thresholds annually. In 2022, HSR filing fees were $45,000 for transactions valued in excess of $101 million but less than $202 million; $125,000 for transactions valued at $202 million or more but less than $1.0098 billion; and $280,000 for transactions valued at $1.0098 billion or more. For all filings made on or after February 27, 2023, the new HSR filing fees are as follows:

|

The FTC also announced the maximum civil penalty for HSR Act violations, raising the amount from $46,517 per day to $50,120 per day, effective as of January 11, 2023.

Finally, the FTC has increased, effective on January 20, 2023, the thresholds that prohibit, with certain exceptions, competitor companies from having interlocking relationships among their directors or officers under Section 8 of the Clayton Act. Section 8 provides that no person shall, at the same time, serve as a director or officer in any two corporations (not other business structures (e.g., partnerships or LLCs)) that are competitors, such that elimination of competition by agreement between them would constitute a violation of the antitrust laws. There are several “safe harbors” which render the prohibition inapplicable under certain circumstances, such as when the size of the corporations, or the size and degree of competitive sales between them, are below certain dollar thresholds. Competitor corporations are now subject to Section 8 if each one has capital, surplus and undivided profits aggregating more than $45,257,000, although no corporation is covered if the competitive sales of either corporation are less than $4,525,700. Even when the dollar thresholds are exceeded, other exceptions preventing the applicability of Section 8 may be available. In particular, if the competitive sales of either corporation are less than 2% of that corporation’s total sales, or less than 4% of each corporation’s total sales, the interlock is exempt. In addition, Section 8 provides a one-year grace period for an individual to resolve an interlock issue that arises as a result of an intervening event, such as a change in the capital, surplus and undivided profits or entry into new markets.

For the full text of our memorandum, please see:

* * *