The SEC has finalized its pay-for-performance disclosure rules, largely as proposed (available here). These rules implement Section 14(i) of the Securities Exchange Act of 1934 (the “Exchange Act”), as added by Section 953(a) of the Dodd-Frank Act. Section 14(i) directs the Commission to adopt rules requiring reporting companies to disclose in a clear manner the relationship between executive compensation actually paid and the financial performance of the company.

Although the Summary Compensation Table and accompanying tables already required under Item 402 of Regulation S-K are subject to detailed rules with respect to various elements of executive compensation, and many CD&As describe pay-for-performance using metrics chosen by the company, there has not been any requirement for tabular disclosure showing executive compensation relative to a uniform measure of the company’s financial performance. These new pay-for-performance rules will require reporting companies to disclose in their proxy and information statements a new standardized figure for compensation “actually paid” (that is, total compensation otherwise reported in the proxy with the adjustments to pension and equity award methodologies) to the principal executive officer and to the remaining named executive officers; tabular disclosure of certain performance measures, including absolute and relative total shareholder return and net income; and a description of the relationship between the performance measures and compensation. Disclosure will be required for the last five fiscal years, subject to a transition period.

These requirements will apply to all reporting companies, except foreign private issuers, registered investment companies and emerging growth companies. Smaller reporting companies will be subject to scaled reporting requirements.

Timing of Disclosure

The rules will become effective 30 days following publication of the release in the Federal Register, and the new disclosure will be required in proxy and information statements disclosing compensation for fiscal years ending on or after December 16, 2022. For companies with calendar year fiscal years, this means that they will need to promptly start collecting the information to prepare this disclosure, which for many companies will be part of filings in the next six to eight months, which gives a short lead‑time for compliance.

Tabular Disclosure

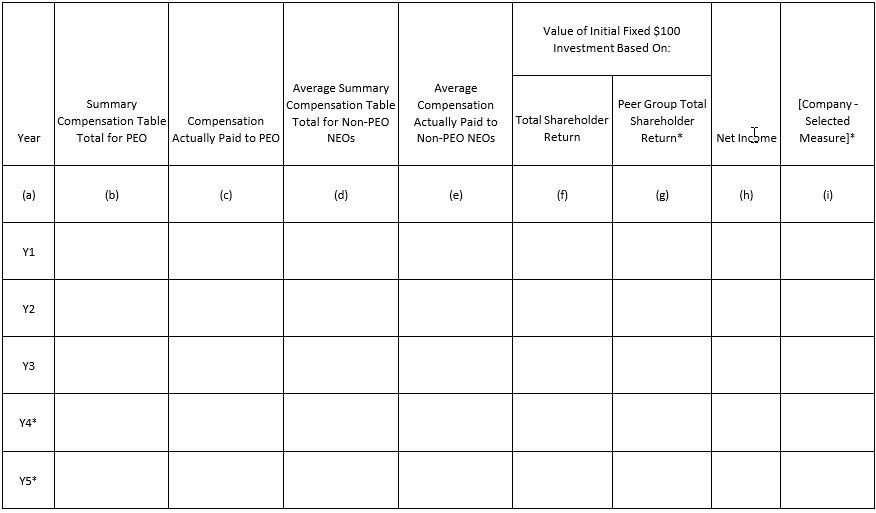

New Item 402(v) of Regulation S-K requires companies to disclose, in any proxy or consent solicitation material for an annual meeting of shareholders, in tabular format for each of the last five fiscal years:

- total compensation earned (the amount reported in the Summary Compensation Table), and a new figure of compensation “actually paid” (as further explained below), to the principal executive officer (“PEO”) (as defined in Item 402(a)(3) of Regulation S-K);

- average total compensation earned (the average of the amount reported in the Summary Compensation Table), and a new figure of average compensation “actually paid”, to the other named executive officers (“NEOs”) (as defined in Item 402(a)(3) of Regulation S-K);

- total shareholder return (“TSR”) of the company, as measured by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the company’s share price at the end and the beginning of the measurement period, by the share price at the beginning of the measurement period (as set forth in Item 201(e) of Regulation S-K);

- TSR of a peer group (as further described below);

- net income (loss); and

- the financial measure most important to the company’s compensation determinations for all NEOs in that fiscal year (the “company selected measure”) that is not already required to be disclosed in the table (or, if the company’s “most important” measure is already included in the table, the company would then present its next-most important measure as its company selected measure).

An example of the tabular disclosure required by new Item 402(v) is set forth below (items marked with an asterisk are not required to be presented by smaller reporting companies):

Determination of Compensation “Actually Paid”

Under new Item 402(v), compensation “actually paid” derives from the total compensation currently reported in the Summary Compensation Table, adjusted to reflect certain pension benefit and equity award changes by:

- deducting the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans reported in the Summary Compensation Table;

- for defined benefit and actuarial pension plans, adding (i) the actuarially determined service cost for services rendered by the executive during the applicable year (the “service cost”), and (ii) the entire cost of benefits granted in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or initiation (the “prior service cost”), in each case, computed in accordance with FASB ASC Topic 715;

- deducting the fair value of stock and option awards at grant date (i.e., the amounts reported pursuant to Items 402(c)(2)(v) and (vi)); and

- adding (or subtracting, as appropriate):

- the year-end fair value of any equity awards granted in the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year;

- the amount of change as of the end of the covered fiscal year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the covered fiscal year;

- for awards that are granted and vest in the same covered fiscal year, the fair value as of the vesting date;

- for awards granted in prior years that vest in the covered fiscal year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value;

- for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during the covered fiscal year, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and

- the dollar value of any dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for the covered fiscal year.

A company will be required to include footnotes to the pay-for-performance table disclosing the amounts deducted from and added to the total compensation reported in the Summary Compensation Table pursuant to the adjustments described above, together with the valuation assumptions used by the company in valuing equity awards added in the determination of compensation actually paid (if those assumptions are materially different from the grant date assumptions otherwise disclosed).

Peer Group

The peer group used for purposes of the new Item 402(v) disclosure should be the same as either the peer group used in the company’s Form 10-K performance graph disclosure (Item 201(e)(1)(ii) of Regulation S-K) or the peer group described in the Compensation Discussion & Analysis (“CD&A”) of its proxy statement (Item 402(b)(2)(xiv) of Regulation S-K). If the peer group is not a published index, the company would be required to disclose the identity of the issuers. If the company has previously disclosed the composition of such peer issuers in prior filings, the company may comply with the disclosure requirement by incorporation by reference to those filings.

Time Period Covered

Companies will be required to provide disclosure for the five most recently completed fiscal years that it was a reporting company pursuant to Section 13(a) or Section 15(d) of the Exchange Act. The rules include a transition period, however, such that in the first applicable filing after the rules become effective, companies will be required to provide disclosure for only the three most recently completed fiscal years (smaller reporting companies for only the two most recently completed fiscal years), and then provide disclosure for an additional year in each of the two subsequent annual proxy or information statement filings where disclosure is required.

Comparative Disclosure

In addition to the foregoing tabular disclosure, the company will be required to provide a (i) description of the relationship between the executive compensation actually paid and the company’s TSR, (ii) comparison of the company and peer group TSR, in each case for the last five years, (iii) a description of the relationship between executive compensation actually paid and net income, and (iv) a description of the relationship between executive compensation actually paid and the company-selected measure. This disclosure could be made in narrative form, graphically (for example, by means of a graph providing executive compensation actually paid and change in TSR on parallel axes and plotting compensation and TSR over the required time period), or through a combination of both.

List of Most Important Financial Performance Measures

Companies will also be required to list (also in tabular form) at least three, and up to seven, of the most important financial performance measures they use to link executive compensation actually paid during the fiscal year to company performance. One of these must be the company-selected measure included in the tabular disclosure. Companies may include non-financial performance measures in the list if they are among their most important performance measures. The measures need not be ranked. Companies need not present the methodology for calculating the measure, though they may, if it would be helpful to investors or necessary to prevent the disclosure from being misleading. The determination of “most important” should be made with reference to the most recently completed fiscal year.

Companies may present one list for all NEOs, two lists (one for the PEO and one for the other NEOs), or a list for each NEO.

Additional Measures

Companies may choose to include additional measures of compensation or financial performance. These may be included in the table (in which case the company must also include a clear description of the relationship between executive compensation actually paid to the registrant’s PEO, and, on average, to the other NEOs, and that measure) or in other disclosure.

Any such measures or concepts must not be misleading, be clearly identified as supplemental (for example, by labeling any column as supplemental information), and not presented with greater prominence than the required disclosure.

Non-GAAP Measures

If any company selected measure or additional measures are non-GAAP measures, the company will be required to disclose how it calculates such measure from its audited financial statements (but will not need to otherwise comply with non-GAAP measure disclosure requirements).

Multiple PEOs

If a company has had more than one PEO during the period covered by the table, it will be required to include separate total compensation and actually paid columns for each PEO.

Other Provisions

The SEC did not specify a location for the new disclosure items. Some companies may wish to include these items in the CD&A, but the SEC noted that including this information in this manner would suggest that the company considered the pay‑for‑performance relationship (as disclosed) in its compensation decisions, which may or may not be the case.

The new Item 402(v) disclosures will not be required in any filings under the Securities Act or Exchange Act other than a proxy or information statement, and will not be deemed to be incorporated by reference into any other SEC filing, unless the company specifically states otherwise.

Finally, the SEC will require the new disclosure to be tagged using XBRL formats.

* * *