Paul, Weiss is an acknowledged leader among U.S. law firms representing Canadian public and private companies and their underwriters. With almost 50 years of history in Canada and an office in Toronto, our vibrant Canada practice is the largest among U.S. law firms and reflects our long-standing commitment to our clients in their Canadian–U.S. cross-border matters.

Client News

Equinox Gold Completes Secondary Offering

Paul, Weiss advised Equinox Gold Corp. in a secondary offering of approximately 24.8 million common shares, representing gross proceeds to the selling shareholder of approximately $140 million.

» moreClient News

SilverCrest to Be Acquired by Coeur in $1.7 Billion Transaction

Paul, Weiss is advising SilverCrest Metals Inc. in its sale to Coeur Mining, Inc. for $1.7 billion.

» moreAwards & Recognition

Ian Hazlett to Receive The M&A Advisor’s 2024 “Emerging Leaders Award”

The M&A Advisor will recognize corporate partner Ian Hazlett as a 2024 recipient of its “Emerging Leaders Award,” which celebrates professionals under the age of 40 whose significant achievements have established them as emerging leaders in the M&A, financing and restructuring industries.

» moreClient News

Columbia Pipelines Completes $800 Million Offering of Senior Notes

Paul, Weiss advised the initial purchasers of Columbia Pipelines Operating Company LLC’s offering of $400 million aggregate principal amount of notes, and the initial purchasers of Columbia Pipelines Holding Company LLC’s concurrent offering of $400 million aggregate principal amount of notes.

» moreClient News

Fortuna Closes Convertible Notes Offering

Paul, Weiss advised Fortuna Silver Mines Inc. in its $172.5 million private offering of 3.75% convertible senior notes due 2029.

» moreClient News

Homesteaders Life and Birch Hill to Acquire Park Lawn in C$1.2 Billion Take-Private Deal

Paul, Weiss is advising Homesteaders Life Company in its joint acquisition of Park Lawn Corporation with Birch Hill Equity Partners.

» moreClient News

J.P. Morgan and RBC Capital Underwrite South Bow’s C$7.9 Billion Dual-Currency Notes Offering

Paul, Weiss advised J.P. Morgan and RBC Capital Markets as initial purchasers and agents in an inaugural dual-currency offering by critical energy infrastructure company South Bow Corporation.

» moreClient News

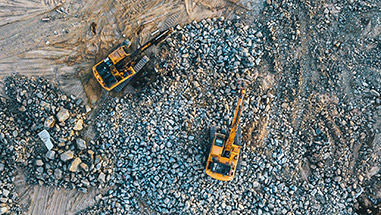

IAMGOLD Completes $300 Million Public Offering

Paul, Weiss advised IAMGOLD Corporation, a Canada-based intermediate gold producer and developer, in a $300 million underwritten public offering of common shares to help fund the repurchase of a 9.7% interest in the Côté Gold Mine in order to return IAMGOLD to its full 70% interest in Côté.

» moreClient News

New Gold Completes $173 Million Public Offering and Increases Exposure in New Afton Mine

Paul, Weiss advised New Gold Inc. in its $173 million public offering of common shares to help fund an agreement to increase its effective free cash flow interest in the New Afton mine to 80.1%.

» moreClient News

Equinox Gold Completes $299 Million Public Offering and Consolidates Ownership of Greenstone Mine

Paul, Weiss advised Equinox Gold Corp. in its $299 million public offering of common shares to help fund its acquisition of the remaining 40% stake in the Greenstone mine, and for general working capital and corporate purposes.

» moreClient News

Algoma Steel Completes $350 Million Senior Secured Second Lien Notes Offering

Paul, Weiss advised Algoma Steel Inc., a leading Canadian steel producer, in its private offering of $350 million aggregate principal amount of 9.125% senior secured second lien notes due 2029.

» moreClient News

ATS Completes Secondary Offering

Paul, Weiss advised ATS Corporation in a secondary offering of 3.5 million common shares, representing gross proceeds to the selling shareholder of approximately C$163 million.

» moreClient News

Colliers International Closes $300 Million Public Offering

Paul, Weiss represented the underwriters in Colliers International Group Inc.’s public offering of 2,479,500 subordinate voting shares at a price of $121 per share for gross proceeds of approximately $300 million.

» moreClient News

Constellation Software Closes $1 Billion Inaugural U.S. Notes Offering

Paul, Weiss advised Constellation Software Inc., a Canadian technology company focused on acquiring, managing and building vertical market software businesses, on its inaugural U.S. offering of $500 million aggregate principal amount of 5.158% senior notes due 2029 and $500 million aggregate principal amount of 5.461% senior notes due 2034.

» moreClient News

Pembina Pipeline Completes Public Offering of Subscription Receipts

Paul, Weiss advised Pembina Pipeline Corporation in its public offering in the United States and Canada of 29,900,000 subscription receipts, representing gross proceeds of approximately C$1.28 billion.

» more