Lawyers

- H. Christopher Boehning

- Walter Brown

- Jessica S. Carey

- John P. Carlin

- Roberto Finzi

- Harris Fischman

- Roberto J. Gonzalez

- Melinda Haag

- Elizabeth Hanft

- Joshua Hill Jr.

- Donna Ioffredo

- Brad S. Karp

- David K. Kessler

- Loretta E. Lynch

- Mark F. Mendelsohn

- Lorin L. Reisner

- Ian C. Richardson

- Richard C. Tarlowe

- Theodore V. Wells, Jr.

- Benjamin Klein

- Justin D. Lerer

- Sarah Calderone

- Neil Chitrao

- Genevieve F. Fried

- Claire Lisker

- Kevin P. Madden

- Liliana Ramirez

- Margaret "Maggie" E. Riley

- Ethan C. Stern

- Alexandra Tipton

- Amanda Valerio-Esene

- Phalguni "Phal" Vetrichelvan

- Miguel Zamora

- Hongjia "Jane" Zhang

Table of Contents

DOJ White Collar Priorities Memo and Corporate Enforcement Policy Revisions

Staffing at DOJ FCPA Unit, Disbanding of SEC FCPA Unit

Foreign Extortion Prevention Act

California State AG Announces Increased Role Amid Perceived Federal FCPA Enforcement Vacuum

Corporate Enforcement Overview

Resolved Corporate Enforcement Actions

Closeout of Ongoing FCPA Investigations

Early Termination of FCPA DPAs, NPAs, and Monitorships

Expansion of DOJ's Corporate Whistleblower Awards Pilot Program

SEC Whistleblower Awards Slow as Commission Scrutinizes Claims More Closely

Cross-Border Anti-Corruption Efforts

Corruption Charges Against U.S. Officials Involving Foreign Entities

Executive Summary

The past year marked an “America-first” recalibration of U.S. anti‑corruption enforcement with the White House and Department of Justice (“DOJ”) re‑centering Foreign Corrupt Practices Act (“FCPA”) enforcement around cases involving the Administration’s interpretation of U.S. economic and national security interests. The year began with a February 5, 2025 memorandum from the Attorney General directing the DOJ to focus its enforcement activities on ties to cartels and transnational criminal organizations (“TCOs”) and a February 10, 2025 executive order declaring a 180‑day FCPA enforcement pause, directing the DOJ to review all existing FCPA matters within 180 days, and instructing the Attorney General to issue new enforcement guidelines consistent with the President’s articulated views and priorities. That review led to the early termination of at least four deferred prosecution agreements (“DPAs”), a non-prosecution agreement (“NPA”), and a corporate monitorship; the discontinuance of approximately half of the DOJ’s open FCPA investigations; and the eve-of-trial dismissal of an indictment against two individuals.

In June 2025, the DOJ released its Guidelines for Investigations and Enforcement of the Foreign Corrupt Practices Act (“Guidelines”),[1] which address how FCPA cases should be evaluated and prioritized going forward. The Guidelines instruct prosecutors to focus their resources on cases involving U.S. economic and national security interests as well as more serious misconduct. The Guidelines also direct prosecutors to limit undue burdens on U.S. companies operating in the global market, including by expediting investigation timelines and accounting for potential business disruptions.

These enforcement policy changes were accompanied by structural shifts. The DOJ’s FCPA Unit lost approximately a third of its prosecutors since the start of 2025, while the Securities and Exchange Commission’s (“SEC”) FCPA Unit experienced a thinning of its ranks, including the departure of its chief and deputy chief, and then was quietly disbanded. Consistent with these changes and with the redirection of resources to immigration enforcement and combating drug trafficking, in 2025, the FBI disbanded its Foreign Influence Task Force and a public corruption investigation squad in the Washington field office—prominent teams focused on combating disinformation campaigns by foreign actors in the U.S. and corrupt acts by Congressional and federal officials, respectively.[2] However, at the time of this report, there are no public reports of changes to the FBI’s International Corruption squads in its Washington, New York, Los Angeles, and Miami field offices that investigate corrupt acts abroad with a U.S. nexus.[3]

While the DOJ notched only two corporate resolutions in 2025, one of which was a declination with disgorgement, and also a corporate indictment, legacy individual prosecutions mostly continued apace. A total of three defendants were tried and convicted in 2025; the only indicted FCPA case against individuals that was dropped was the long-running prosecution of two former Cognizant Technology Solutions Corporation (“Cognizant”) executives. [4] An additional five individuals were criminally charged in 2025, and the DOJ has signaled a continued commitment to holding individuals accountable for FCPA misconduct.

In response to the perceived federal enforcement gap, the California Attorney General has signaled an intent to address international corruption by leveraging unfair or deceptive acts or practices statutes, state securities laws, and other statutes to press FCPA‑adjacent theories against conduct affecting state markets and entities.

The whistleblower environment also shifted in 2025. The DOJ expanded its Corporate Whistleblower Awards Pilot Program to emphasize cartel/TCO‑related corporate crime, sanctions, trade and customs, procurement fraud, immigration violations, and material support of terrorism—in alignment with the new enforcement lens. By contrast, SEC awards slowed markedly as the Commission appeared to scrutinize whistleblower claims more closely.

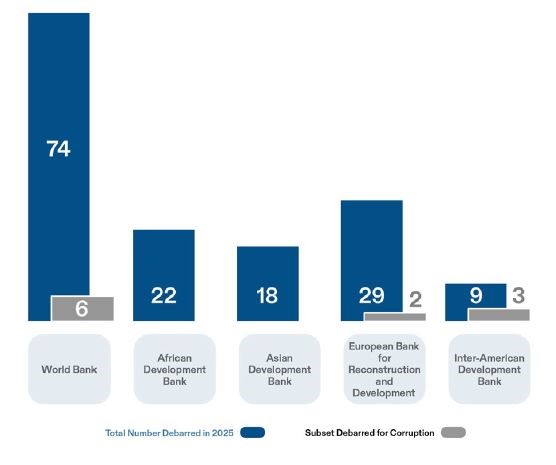

On the global stage, key European law enforcement agencies from the U.K., France, and Switzerland entered into a new cooperation arrangement—the International Anti‑Corruption Prosecutorial Taskforce—to coordinate complex cases.[5] Meanwhile, authorities across Latin America took steps to strengthen anti-corruption enforcement, including, at the national level, inter-institution cooperation, such as the information sharing and corporate resolution coordination agreement between the Attorney General’s Office, the Federal Auditor, and the Solicitor General in Brazil, and regional efforts like the Argentina-Ecuador memoranda of understanding (MOU) on combating money laundering. And the multilateral development banks (“MDBs”) witnessed a downturn in debarments, but with debarments linked in part to corrupt practices comparable to last year. However, regional MDBs saw a modest uptick in debarment activity and, across the World Bank Group, the MDBs continued to deploy cross‑debarments.

Our 2025 Year in Review Report covers all of these developments and more. Section I discusses Policy Developments and a changing enforcement landscape—including the FCPA pause, the post‑pause DOJ guidelines, the Criminal Division’s white‑collar priorities, leadership and staffing changes, monitorship policy, and the potential role of state attorneys general. Section II turns to Corporate Enforcement—resolutions, investigation closeouts, and the early terminations of DPAs, NPAs, and monitorships. Section III provides a review of Individual Enforcement activity, spanning dismissals, trials, sentencings, and new charges. Section IV addresses Whistleblower trends at the DOJ and the SEC. Section V surveys Foreign Enforcement and Multilateral Bank Activity. And Section VI examines Corrupt Foreign Influence in the United States. Together, these sections map a year that shifted federal focus regarding cross-border corruption, outline new opportunities for corporate actors to address exposure, and consider where the new enforcement policies may lead.

Policy Developments

FCPA Pause

Within the opening weeks of President Trump’s second term, the Administration made two FCPA-related pronouncements. First, on February 5, 2025, U.S. Attorney General Pamela Bondi issued the Memorandum on the Total Elimination of Cartels and Transnational Criminal Organizations,[6] instructing the DOJ’s FCPA Unit to “prioritize investigations related to foreign bribery that facilitates the criminal operations of Cartels and TCOs, and shift focus away from investigations and cases that do not involve such a connection.”[7]

Second, on February 10, 2025, President Trump issued the Executive Order Pausing Foreign Corrupt Practices Act Enforcement to Further American Economic and National Security (“FCPA Pause Order”).[8] The FCPA Pause Order imposed a 180-day pause on FCPA enforcement to allow the Attorney General to “review in detail” and “take appropriate action with respect to” “all existing FCPA investigations or enforcement actions,” and to issue new guidance on FCPA enforcement.[9] The Order called for the development of FCPA guidelines that “prioritize American interests, American economic competitiveness with respect to other nations, and the efficient use of Federal law enforcement resources.”[10] It explained that “[t]he President’s foreign policy authority is inextricably linked with the global economic competitiveness of American companies” and that FCPA enforcement should be reined in to “advance American economic and national security by eliminating excessive barriers to American commerce abroad.”[11]

FCPA Guidelines

On June 9, 2025, 119 days into the FCPA enforcement pause, the DOJ issued its Guidelines for Investigations and Enforcement of the Foreign Corrupt Practices Act,[12] ending the pause and presenting the DOJ’s new evaluation criteria for FCPA actions. The overarching theme of the Guidelines is that FCPA investigations and enforcement actions must serve U.S. interests, as measured by four key criteria: (1) safeguarding fair opportunities for U.S. companies, (2) protecting U.S. national security interests, (3) addressing serious misconduct, and (4) prioritizing combating corruption with a link to cartels or TCOs.[13] The Guidelines broadly align with the Administration’s February 2025 FCPA pronouncements and suggest a more business-friendly approach to FCPA enforcement. They are intended to “limit[] undue burdens on American companies that operate abroad” by directing prosecutors to accelerate investigative timelines and “consider collateral consequences,” including “the potential disruption to lawful business and the impact on a company’s employees, throughout an investigation, not only at the resolution phase.”[14] The Guidelines also instruct prosecutors to focus on cases involving individual misconduct and to “not attribute nonspecific malfeasance to corporate structures.”[15]

As we covered in depth in this client memorandum, the Guidelines require prosecutors to take into account the following non-exhaustive list of factors when determining whether to pursue FCPA investigations and enforcement actions: (1) “total elimination of cartels and [TCOs],” (2) “safeguarding fair opportunities for U.S. companies,” (3) “advancing U.S. national security,” and (4) “prioritizing investigations of serious misconduct.”[16] For the first factor, pursuing cartels and TCOs, the Guidelines call for the prosecution of “corrupt associates” of criminal organizations and the dismantling of their “financing mechanisms and shell companies.”[17] For the second factor, protecting competition for American companies operating abroad, prosecutors are instructed not to focus on “particular individuals or companies on the basis of their nationality” but rather to ask “[w]hether the alleged misconduct deprived specific and identifiable U.S. entities of fair access to compete and/or resulted in economic injury to specific and identifiable American companies or individuals.”[18] For the third factor, advancing U.S. national security interests, prosecutors are advised to “focus on the most urgent threats” stemming from “the bribery of corrupt foreign officials involving key infrastructure or assets,” because national security depends largely on “gaining strategic business advantages whether in critical minerals, deep-water ports, or other key infrastructure or assets.”[19] As for the fourth factor, prioritizing serious misconduct, the Guidelines call on prosecutors to focus on “alleged misconduct that bears strong indicia of corrupt intent tied to particular individuals, such as substantial bribe payments, proven and sophisticated efforts to conceal bribe payments, fraudulent conduct in furtherance of the bribery scheme, and efforts to obstruct justice.”[20] The Guidelines contrast such conduct with “routine business practices or the type of corporate conduct that involves de minimis or low-dollar, generally accepted business courtesies.”[21]

In the months that followed, the DOJ emphasized that it would “continue to enforce the FCPA firmly and fairly,” citing the Liberty Mutual declination in August 2025 and the Carl Zaglin conviction in September 2025, both of which we discuss below, as examples.[22] Most recently, at a major anti-corruption conference in December 2025, Deputy Attorney General (“DAG”) Todd Blanche reinforced that message in his keynote remarks, stating that the DOJ would enforce the FCPA firmly, fairly, and within the bounds of reason, tolerating no corruption whether by an individual or a corporation and regardless of nationality.[23] DAG Blanche cautioned, however, that de minimis courtesies and low-value customary business practices were not the priority and that the DOJ may decline bribery cases that lack a meaningful U.S. nexus and are better handled by foreign regulators.

The Guidelines do not appear to impact the DOJ/SEC “Resource Guide to the U.S. Foreign Corrupt Practices Act,” which was first published in 2012 and revised in 2020, and remains in effect.[24]

DOJ White Collar Priorities Memo and Corporate Enforcement Policy Revisions

On May 12, 2025, then-Acting Assistant Attorney General and Head of the Criminal Division Matthew Galeotti issued a memorandum entitled Focus, Fairness, and Efficiency in the Fight Against White-Collar Crime (“White-Collar Memorandum”), outlining “the Criminal Division’s enforcement priorities and policies for prosecuting corporate and white-collar crimes in the new Administration.”[25] It emphasizes the need for prosecutors to “avoid overreach that punishes risk-taking and hinders innovation,” and, as we discussed in this client memorandum, calls on prosecutors to abide by three core tenets: focus, fairness, and efficiency.[26] In public remarks made the same day, Acting AAG Galeotti explained that the Criminal Division was “turning a new page on white-collar and corporate enforcement” by “recognizing that law-abiding companies are key to a prosperous America” and prioritizing prosecution of “the most egregious white-collar crime.”[27]

Under the focus principle, the White-Collar Memorandum instructs prosecutors to prioritize investigations and prosecutions that protect taxpayers and U.S. interests, including fraud against government programs (e.g., Medicare, Medicaid, and defense spending), threats to American competitiveness and national security (e.g., trade and customs fraud, and sanctions evasion), and bribery and associated money laundering that undermine U.S. national interests. It also provides guidance regarding the prosecution of digital-asset crimes, consistent with DAG Blanche’s April 2025 memorandum on digital assets[28] and with the Administration’s focus on cartels and TCOs.

Under the fairness principle, the DOJ adopted more lenient declination guidelines in its updated Corporate Enforcement and Voluntary Self-Disclosure Policy (“CEP”), reflecting the view that not all “corporate misconduct warrants federal criminal prosecution” and emphasizing the importance of “policies that acknowledge law-abiding companies and companies that are willing to learn from their mistakes.”[29] The revised CEP provides that the Criminal Division will decline to prosecute companies for criminal conduct when they voluntarily self-disclose, fully cooperate, timely remediate, and have no aggravating circumstances.[30] Prosecutors also maintain discretion to recommend a declination even where aggravating circumstances exist, depending on their severity and the company’s cooperation and remediation.[31] Under a CEP declination, the company must pay all disgorgement, forfeiture, and victim restitution arising from the misconduct.[32] As with the prior CEP, all declinations will be made public.[33] In “near miss” cases—where a company fully cooperated and remediated but is ineligible for a declination solely because (i) its self-report did not qualify as a voluntary self-disclosure or (ii) it had aggravating factors that warrant a criminal resolution—the Criminal Division is to provide an NPA with a term of fewer than three years, no independent compliance monitor, and a 75% reduction off the low end of the U.S. Sentencing Guidelines fine range.[34]

In recent months, the DOJ has promoted these new incentives for companies to self-report and cooperate with law enforcement. According to Acting AAG Galeotti, “the benefits to companies that voluntarily self-report, cooperate, and remediate have never been clearer and more certain: those companies will receive a declination, not just a ‘presumption.’”[35] He encouraged business and compliance leaders, as well as their counsel, to take action, noting that “significant benefits” are available for those who cooperate and that, absent cooperation, the DOJ “will move swiftly and aggressively to bring cases” and will “use all [its] tools and seek strong sentences.”[36] Moreover, the DOJ has sought to ensure companies that they may obtain benefits even if they do not qualify for a declination: “The Criminal Division takes very seriously corporations’ efforts to cooperate and remediate wrongdoing, even outside of the parameters of the voluntary self-disclosure program, and will take such efforts into consideration when resolving a case.”[37] The revised CEP sets forth eligibility requirements for alternative resolutions such as NPAs.[38]

Finally, under the efficiency principle, the White-Collar Memorandum directs prosecutors to move expeditiously when conducting investigations to minimize collateral impacts on businesses.[39] As explained by Acting AAG Galeotti, “[l]engthy and sprawling investigations do not serve the Department, our prosecutors, the American public, or those under investigation.”[40] The White-Collar Memorandum also calls for the narrowly tailored use of monitors, instructing that they “only be imposed when they are necessary,” such as when “a company cannot be expected to implement an effective compliance program or prevent recurrence of the underlying misconduct” without “heavy-handed intervention.”[41] And in cases where they are imposed, monitorships should be tailored in a manner that minimizes cost, burden, and business interference. The DOJ’s May 2025 Memorandum on Selection of Monitors in Criminal Division Matters (the “Monitorship Memorandum”), further discussed below, initiated an “individualized review of all existing monitorships to make case specific determinations of whether each monitor is still necessary.”[42]

On December 4, 2025, DAG Blanche announced that the DOJ will release a new, single corporate enforcement policy in early 2026 to apply to all criminal cases across the DOJ. DAG Blanche said the single policy will “help provide certainty and transparency regardless of the specific prosecutors involved in the investigation” and “help ensure that every case is even-handed while accounting for the particular challenges posed by the breadth of our cases that our prosecutors tackle every day.”[43]

Leadership Changes

On December 18, 2025, the U.S. Senate confirmed Andrew Tysen Duva as the new Assistant Attorney General of the Criminal Division.[44] AAG Duva, who was confirmed by a 53-43 vote, replaced Acting AAG Galeotti. AAG Duva previously served as an Assistant United States Attorney in the Middle District of Florida for more than 18 years and reported having “substantial public corruption prosecution experience.”[45]

In response to a written questionnaire from the Senate Judiciary Committee ahead of his confirmation hearing, AAG Duva echoed President Trump’s recent proclamations about the FCPA, stating: “FCPA enforcement [h]as extended beyond its original intent, burdening American companies and harming our national interest. However, terrorists and criminals thrive where governments are weak and corruption is rampant, and foreign bribery prevents honest American companies from competing on a level playing field.”[46] When asked for his stance on FCPA enforcement at his nomination hearing in October 2025, Duva answered in step with the DOJ’s new priorities, noting that the “focus will be on transnational criminal organizations, where bribes are involved, and also market manipulation scams” and stating that he “look[s] forward to abiding by [the Guidelines] and progressing the good work of the men and women in that section.”[47]

Staffing at DOJ FCPA Unit, Disbanding of SEC FCPA Unit

According to the DOJ, the FCPA Unit’s headcount shrunk from 32 prosecutors in 2024 to 22 prosecutors in 2025.[48] While some FCPA Unit prosecutors have departed for roles outside the DOJ, others have moved to different DOJ components, including the Bank Integrity Unit, Market, Government, and Consumer Fraud Unit, and Healthcare Fraud Unit.[49]

While the DOJ’s FCPA Unit appears to be at its leanest point in more than a decade,[50] the impact of its downsizing remains unclear, particularly since FCPA enforcement was paused between February 2025 and June 2025 and the investigative docket was reportedly cut in half during the FCPA pause, a point we discuss in more detail in Section II below. The DOJ FCPA Unit’s productivity will likely hinge in part on external resources, including from law enforcement partners which have also undergone recent changes. Notably, there have not been public reports on specific policies affecting the FBI’s International Corruption Squads. However, the Attorney General’s February 5, 2025, memorandum on General Policy Regarding Charging, Plea Negotiations, and Sentencing disbanded and reassigned agents from the FBI’s Foreign Influence Taskforce, a unit charged with investigating corruption and espionage by foreign actors on U.S. soil.[51] Similarly, the FBI is disbanding a field office dedicated to public corruption issues, which has handled major corruption probes, including investigations into the Clinton Foundation and former Virginia governor Terry McAuliffe. [52] The DOJ’s Public Integrity Section has been reduced from roughly two dozen prosecutors to four to six,[53] and the DOJ has reportedly considered cuts to the Office of International Affairs, which handles extraditions and mutual legal assistance (“MLAT”) requests.[54] Further, the SEC’s total workforce is reportedly down about 15% from the previous Administration,[55] and, in April 2025, the SEC told staff that it was implementing a targeted reorganization of the Division of Enforcement, whose FCPA Unit has engaged in anti-corruption enforcement since the early 2000s but which did not bring any FCPA actions in 2025.[56] That same month, the media reported that Charles Cain, the SEC’s FCPA Unit Chief since 2017, and Tracy Price, its Deputy Chief since 2018, were “among hundreds of SEC officials leaving the agency.”[57] The SEC appears to have quietly disbanded its FCPA Unit following these leadership departures, with any FCPA cases being handled by staff attorneys across the Division of Enforcement.[58]

Still, the DOJ’s FCPA Unit retains seasoned, highly accomplished prosecutors, including its leader, David Fuhr, who arrived in the FCPA Unit in 2013 and has served as its Chief since 2023.

Monitorships

As mentioned above, in April 2025, the DOJ informally paused new monitorships and launched a review of existing arrangements.[59] Critics of corporate monitorships, which involve appointing independent third parties to oversee a company’s compliance with a DOJ settlement agreement and laws, criticize the practice’s cost, efficiency, and effectiveness.[60] As a move toward more judicious and cost-conscious corporate monitoring,[61] the DOJ ended the FCPA monitorship for Glencore plc early in March 2025, over a year prior to the expiration of its term in June 2026.[62]

The DOJ formalized its revised stance on monitorships in May 2025 with the Monitorship Memorandum,[63] which superseded prior monitorship guidance.[64] The Monitorship Memorandum emphasizes that monitorships “should never be imposed for punitive purposes” and must be narrowly tailored to address specific risks of recurrence.[65] Prosecutors are directed to consider factors such as the risk of recurrence of criminal conduct that significantly impacts U.S. interests, the availability and efficacy of other independent government oversight, the strength of the company’s compliance program and culture of compliance at the time of the resolution, and the maturity of the company’s controls and its ability to test and update its compliance program independently.[66] The Memorandum also introduced structural safeguards, including fee caps, budget approvals, and regular tri-party meetings to ensure monitorships remain efficient and proportionate.[67]

Throughout mid-2025, DOJ officials reinforced the new policy in public remarks. Acting AAG Galeotti indicated that monitorships “are meant to be a temporary bridge and accountability measure to move a company quickly and efficiently to full compliance” and that the DOJ would increasingly rely on self-reporting and compliance certifications, terminating monitorships where companies could demonstrate effective self-governance.[68] He further stated that the DOJ’s internal oversight mechanisms could often more efficiently transition companies to compliance, reducing the need for external monitors.[69] These comments reflected a broader effort to streamline enforcement and reduce the burdens associated with monitorships.

DAG Blanche confirmed the DOJ’s recalibrated approach in December 2025 during an annual FCPA conference. He announced that the DOJ would limit monitorships to cases where benefits clearly outweigh costs and would require fee caps that cannot be exceeded without prior approval.[70] Collectively, these developments signal that monitorships will be the exception rather than the rule, with the DOJ favoring self-governance and internal oversight in most corporate resolutions.

Individual Prosecutions

The DOJ did not dismiss all ongoing individual FCPA prosecutions in connection with its review of FCPA matters.[71] At least five FCPA trials involving individual defendants were scheduled for 2025 when the FCPA Pause Order took effect, and, with one exception, the DOJ proceeded with these trials, although one slipped into early 2026.[72] While several defendants sought to delay or terminate their trials in response to the FCPA Pause Order and the new FCPA Guidelines, most prosecutions continued.

The one exception was the dismissal of charges against former Cognizant executives Gordon Coburn and Steven Schwartz.[73] On April 2, 2025, federal prosecutors moved to dismiss the long-running case, citing the FCPA Pause Order and stating that “further prosecution is not in the interests of the United States at this time.”[74] The court granted the motion the following day, dismissing the case with prejudice.

Ultimately, the enforcement pause had limited impact on the DOJ’s individual FCPA prosecutions. Defense efforts to leverage the pause for dismissals were largely unsuccessful, and the DOJ continued to bring FCPA actions against individuals shortly after the pause was lifted.

Foreign Extortion Prevention Act

As we previously reported in 2023 and 2024,[75] on December 14, 2023, Congress passed the Foreign Extortion Prevention Act (“FEPA”) to hold criminally liable foreign officials who “corruptly demand, seek, receive, accept, or agree to receive or accept, directly or indirectly, anything of value” from (a) any person while in the territory of the United States, (b) a U.S. issuer, or (c) a domestic concern, in exchange for an improper business advantage.[76] Two years after the enactment of FEPA, the DOJ has yet to announce any charges under the statute or release any statutorily mandated reports on its FEPA enforcement efforts.[77]

California State AG Announces Increased Role Amid Perceived Federal FCPA Enforcement Vacuum

In April 2025, California Attorney General Rob Bonta issued a legal advisory clarifying that “the FCPA remains binding federal law and violations are actionable under California’s Unfair Competition Law” and “emphasiz[ing] the need for all businesses and individuals to continue complying with all applicable laws, including the FCPA, regardless of the federal administration’s pronouncements.”[78] In particular, Bonta cautioned that his office “may bring enforcement actions against businesses and individuals for violations of the [Unfair Competition Law], including actions predicated on FCPA violations.”[79] AG Bonta’s alert listed state law on unfair, deceptive, or abusive acts, as well as state or federal tax or securities law, as bases for enforcement and advised that “businesses should continue to maintain rigorous internal accounting controls and to ensure that they and their agents do not offer or pay anything of value to foreign officials to obtain or retain business.”[80]

Corporate Enforcement Overview

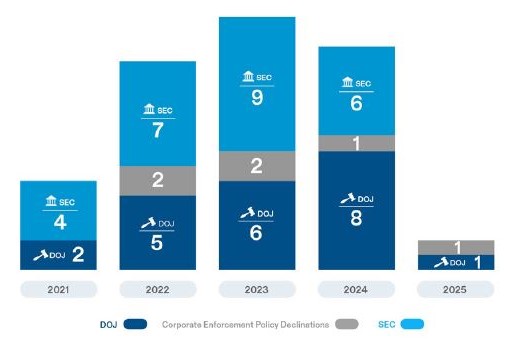

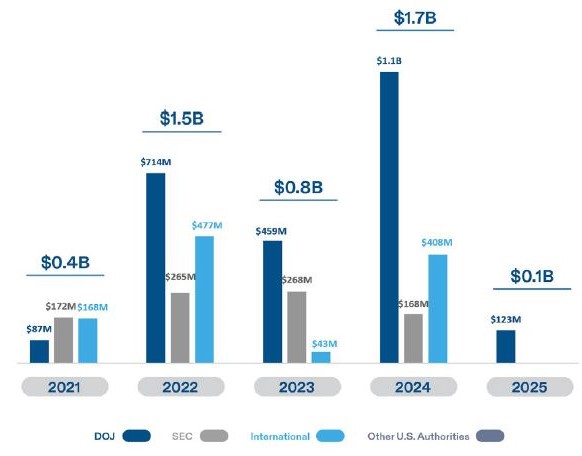

In 2025, the DOJ resolved two FCPA corporate enforcement actions—a declination with disgorgement for Liberty Mutual Insurance Company (“Liberty Mutual”) and a DPA for Comunicaciones Celulares S.A., d/b/a TIGO Guatemala (“TIGO Guatemala”) —for a combined total of nearly $123 million in penalties and disgorgement. As displayed below, this marks a significant reduction from 2024, which saw nine DOJ corporate resolutions and a combined penalty amount of $1.1 billion, and 2023, which had eight DOJ corporate resolutions with a combined penalty amount of approximately $459 million. As explained below, the DOJ also closed out several ongoing FCPA investigations and ended several DPAs, NPAs, and monitorships prior to their terms. And finally, as discussed in detail below, DOJ brought one indictment against a corporation, SGO Corporation Limited (“Smartmatic”).

|

FCPA AND ANTI-CORRUPTION ENFORCEMENT ACTION RESOLUTIONS, 2021-2025[81]

|

FCPA CORPORATE ENFORCEMENT ACTION PENALTIES, 2021-2025[82]

With fewer enforcement actions in 2025, the diversity of industries and regions impacted by enforcement was correspondingly less. However, as the DOJ reorients its enforcement work, we expect new trends to emerge in industries and regions particularly affected by cartels and TCOs. Similarly, regions and industries of strategic importance to U.S. national security and competition may also come under sharper scrutiny in future actions. None of these changes have come to fruition yet, however.

|

2025 FCPA CORPORATE ENFORCEMENT BY SECTOR[83]

|

2025 FCPA Corporate Enforcement Action by Location[84]

Resolved Corporate Enforcement Actions

Liberty Mutual Declination

On August 7, 2025, the DOJ Fraud Section and the U.S. Attorney’s Office for the District of Massachusetts announced a declination of prosecution for U.S.-based insurance company Liberty Mutual for FCPA violations arising from bribery by its Indian subsidiary, Liberty General Insurance (“LGI”), between 2017 and 2022.[85] The DOJ’s investigation found that LGI had paid bribes of approximately $1.47 million to officials at six state-owned banks in India to secure referrals of bank customers to LGI’s insurance products, concealing the payments as marketing expenses and using third-party intermediaries to pay the officials.[86] The scheme allegedly generated roughly $9.2 million in revenue and $4.7 million in profits.[87]

The DOJ based its decision on an assessment of the factors set forth in the CEP and the Principles of Federal Prosecution of Business Organizations.[88] The DOJ cited Liberty Mutual’s timely and voluntary self-disclosure (made in March 2024 while the internal investigation was ongoing), full and proactive cooperation (including provision of all relevant facts about individuals), and prompt, meaningful remediation, including separation from involved personnel and a thorough root-cause analysis.[89] The DOJ also credited significant compliance enhancements: strengthened vetting, monitoring, and oversight of third-party payments across global markets; structural reorganization and increased legal and compliance resources; and updated policies governing the use of social media and ephemeral messaging for business purposes.[90] The DOJ further cited the absence of aggravating circumstances and Liberty Mutual’s agreement to disgorge $4.7 million in profits.[91] While the DOJ reserved the right to pursue individuals responsible for the misconduct, no such actions have been disclosed to date. Notably, the Liberty Mutual declination had no link to any enforcement priorities identified in the Guidelines, including cartels/TCOs, U.S. competitiveness, national security, or especially serious misconduct.[92] The DOJ’s decision to issue the declination suggests that, although such links may be an aggravating factor in deciding whether to pursue an investigation or bring a prosecution, their import in the resolution phase remains to be assessed as more data becomes available.[93]

TIGO Guatemala DPA

On November 12, 2025, TIGO, a Guatemalan telecommunications service provider, entered into a two-year DPA with DOJ’s Fraud Section and the U.S. Attorney’s Office for the Southern District of Florida to resolve a long-running investigation into violations of the FCPA.[94] According to the DPA, TIGO engaged in a “pervasive bribery scheme” from at least 2012 through June 2018 involving regular cash payments to Guatemalan legislators to garner “support for legislation that benefitted TIGO” and to “secure improper business advantages.”[95] According to the DOJ, in 2015 TIGO’s parent company, Millicom, filed an initial and voluntary self-disclosure regarding the activities by TIGO and this investigation was closed in 2018. However, in 2020 DOJ “obtained and proactively developed new evidence from sources” and reopened the investigation. According to DOJ, the renewed investigation revealed “the scope of [TIGO’s] conduct, including that the criminal conduct continued during and after the [Department’s] closure of the first phase of the investigation and involved narcotrafficking proceeds that were used to generate cash for some of the bribe payments.”[96]

Under the DPA, TIGO is required to pay a $60 million criminal penalty and more than $58 million in forfeiture. TIGO is also subject to ongoing reporting and compliance obligations for the two-year period in which the agreement is effective, though no monitor was imposed.[97] In determining the appropriate resolution, DOJ credited Millicom’s 2015 self-disclosure and cooperation, granting it “the maximum reduction for cooperation and remediation” under the CEP, but found the case did not qualify for a declination or “near miss” NPA under the CEP because the conduct continued after the initial investigation and the bribery funds were derived, in part, from narcotics trafficking.[98]

ZTE Corporation’s Potential Settlement

Looking ahead to 2026, the DOJ appears to be nearing the conclusion of a long-running investigation into whether China-based telecom company ZTE Corporation made improper payments to secure telecommunications contracts in South America and other regions. Media reports from December 2025 suggest that the DOJ and ZTE are negotiating a potential resolution that could exceed $1 billion. [99]

The potential resolution would require navigation of several complexities, including the risk that the U.S. Commerce Department could reinstate a prior export ban if ZTE were found to have breached a 2018 Settlement Agreement, a step that had previously crippled ZTE’s operations by cutting off critical U.S. technology and components. Any eventual settlement will almost certainly require Chinese government approval, reflecting geopolitical sensitivities and possible supply-chain implications for U.S. technology vendors and operators in developing markets if restrictions were renewed. As of the end of 2025, the timing of the resolution remained uncertain.[100]

New Corporate Indictment

In October 2025, a federal grand jury in the Southern District of Florida returned a superseding indictment charging electronic voting machine maker SGO Corporation Limited (“Smartmatic”), alongside three previously charged Smartmatic executives—Roger Alejandro Pinate Martinez, Jorge Miguel Vasquez, and Juan Andres Donato Bautista—with conspiracy to violate the FCPA, conspiracy to commit money laundering, and international laundering of monetary instruments.[101] The DOJ has alleged that the defendants paid at least $1 million in bribes between 2015 and 2018 to obtain and retain election‑related business in the Philippines, including securing favorable VAT reimbursements and contractual payments tied to the 2016 national elections.[102]

According to the indictment, defendants organized a scheme to finance bribes by siphoning and laundering funds from inflated sales. First, defendants allegedly over-invoiced costs for voting machines to create a slush fund. They then concealed the alleged corrupt payments through sham contracts and “loan” agreements. Funds were layered through accounts in Asia, Europe, and the United States, including transactions routed through New York intermediaries and activity within the Southern District of Florida. Some funds allegedly reached a Singapore account for which one of the individual defendants was a beneficial owner. Those funds were later used to purchase San Francisco real estate.[103]

While there is no clear link to cartels or transnational criminal organizations, this case could be perceived as involving a national security interest due to the nature of Smartmatic’s business. The DOJ may also have determined that the case involves serious misconduct as set forth in the Guidelines.

Closeout of Ongoing FCPA Investigations

By June 10, 2025, the DOJ announced that it had closed approximately half of its open investigations.[104] DAG Blanche explained that, by closing these investigations, DOJ aims to “shift[] prosecutorial resources toward cases that clearly implicate U.S. national security and economic competitiveness.”[105] The SEC also closed a number of investigations in 2025. Below are some examples obtained from public filings and media reports.

PetroNor

In April 2025, Norwegian energy company PetroNor E&P ASA (“PetroNor”) disclosed that the DOJ had closed its FCPA inquiry—which appears to have dated back to at least April 2022—“based on the information that the DOJ has learned to date” and “in the light of a recent executive order.”[106] According to PetroNor, a parallel investigation by Norway’s National Authority for Investigation and Prosecution of Economic and Environmental Crime (“Økokrim”) remains ongoing.[107] Økokrim opened its investigation in December 2021 and is reportedly focusing on alleged corruption by the company’s former CEO and others in connection with projects in Africa.[108]

Digicel

Media reports from April 2025 indicate that the DOJ closed its FCPA investigation into Caribbean telecom company Digicel following a voluntary disclosure by the company in November 2024.[109] According to reports, the DOJ closed its investigation into Digicel in light of the FCPA Pause Order as well as information the DOJ learned from Digicel during the course of its investigation.[110] Digicel’s spokesperson stated to the media that the company “cooperated extensively and informed the Fraud Section that it had taken significant steps to assess and enhance its compliance program to ensure it is appropriately designed, resourced, tested and empowered to promote a culture of compliance.”[111]

Bombardier

In May 2025, Canadian aerospace company Bombardier Inc. reported that the DOJ had closed its investigations into the company’s business dealings in Azerbaijan and Indonesia.[112] The disclosure was less clear, however, regarding the status of the DOJ’s investigation into Bombardier’s business in South Africa. The DOJ’s investigations into Bombardier appear to date back to at least 2020, when the DOJ requested records related to the company’s business dealings with Azerbaijan Railways ADY.[113] The South Africa investigation concerns alleged irregularities in Bombardier’s dealings with South African rail company Transnet SOC Ltd. prior to Bombardier’s divestment of certain assets to French rail company Alstom SA in 2021.[114]

Stryker

In May 2025, medical technology company Stryker Corporation disclosed that the DOJ had closed its FCPA inquiry without further action.[115] In the same filing, Stryker indicated that it continues to cooperate with the SEC and “other regulatory authorities” while conducting an internal investigation into “certain business activities in certain foreign countries.”[116] The disclosure did not address the underlying conduct, the relevant geographies, or the DOJ’s rationale for closing the probe.[117] A December 2025 public filing by Stryker further suggests that investigations by the SEC and other authorities remain ongoing.[118]

The SEC previously brought two enforcement actions against Stryker: a 2018 SEC resolution with an $7.8 million penalty to resolve allegations of books and records violations in India and internal accounting controls violations in India, China, and Kuwait,[119] and a 2013 SEC resolution with a $13.2 million penalty to resolve improper payment allegations involving officials in five countries across Latin America and Europe.[120]

Inotiv

In June 2025, Indiana-based pharmaceutical company Inotiv Inc. disclosed that the SEC had concluded its FCPA investigation and did not intend to recommend an enforcement action.[121] The SEC’s closure notice followed requests for information in May 2023 and April 2024 related to the importation of primates from Asia.[122]

Toyota

Also in June 2025, global automaker Toyota disclosed that the DOJ had closed its investigation into possible anti‑bribery violations by a Thai subsidiary.[123] Toyota first disclosed potential FCPA violations to both the DOJ and SEC back in April 2020.[124] It is not clear whether the SEC also investigated Toyota and, if so, whether that investigation remains open.[125]

Reports suggest that the investigation involved allegations that Toyota’s subsidiary or its agents bribed senior Thai judges in connection with a high‑stakes import‑duty dispute over Prius parts.[126] In September 2022, the Thai Supreme Court upheld roughly 10 billion baht (approximately $286 million) in assessments, while Thai authorities launched their own bribery probe in May 2021, the current status of which remains uncertain.[127]

GE Healthcare Technologies

In July 2025, global medical technology company GE Healthcare Technologies Inc. disclosed that in May 2025 both the DOJ and SEC closed their FCPA investigations into the company “without further action.”[128]

Calavo Growers

In September 2025, California-based produce distributor Calavo Growers, Inc. disclosed that the DOJ had closed its FCPA inquiry related to the company’s operations in Mexico.[129] In December 2025, Calavo Growers reported that the SEC had similarly closed its FCPA investigation and that the regulator “does not intend to recommend an enforcement action.”[130] Calavo Growers made a voluntary disclosure to both the DOJ and SEC in early 2024.[131]

Early Termination of FCPA DPAs, NPAs, and Monitorships

In its White-Collar Memorandum, the DOJ announced a review of all corporate resolutions with ongoing post-resolution reporting obligations “to determine if they should be terminated early.”[132] Relevant considerations include the “duration of the post-resolution period, substantial reduction in the company’s risk profile, extent of remediation and maturity of the compliance corporate program, and whether the company self-reported the misconduct.”[133]

Over the course of 2025, the DOJ agreed to the early termination of at least four FCPA DPAs (Stericycle, ABB, Honeywell, and GOL Linhas Aéreas Inteligentes) and at least one NPA (Albemarle). The DOJ also agreed to the early termination of at least one compliance monitorship for Glencore International A.G., which had pleaded guilty in 2022 to FCPA violations and was in the last year of its three-year monitorship.

The DOJ’s decision to end these matters early, which it supported by citing satisfaction of settlement agreement terms, including completion of company certifications of compliance and remediation, reflected a departure from historic practices, though the DOJ has long been permitted to terminate DPAs and NPAs early under the standard provisions of such agreements.

Stericycle

In April 2025, the DOJ agreed to the early termination of U.S.-based multinational waste company Stericycle Inc.’s three-year DPA, which the company entered into in April 2022 when it agreed to pay over $84 million to resolve an FCPA investigation concerning payments to officials in Brazil, Mexico, and Argentina in order to obtain and retain business and other advantages.[134] The DPA included a compliance monitorship that was to last a “period of not less than 24 months.”[135] The monitor was retained in November 2022.[136] It is unclear when the monitorship concluded, and there is no discussion of the monitorship in the motion to dismiss or court order.

ABB

In June 2025, the DOJ agreed to the early termination of Swedish-Swiss multinational technology company ABB Ltd.’s DPA, which the company entered into in December 2022 when it agreed to pay over $315 million to resolve an FCPA investigation concerning the bribery of a high-ranking official at South Africa’s state-owned energy company to obtain business advantages in connection with the award of multiple contracts.[137] The DOJ had charged the company with substantive violations of the anti-bribery and books and records provisions as well as conspiracy violations of both provisions. The DPA ended nearly half a year before its three-year term.

Honeywell Universal Oil Products

In July 2025, the DOJ agreed to the early termination of U.S.-based multinational conglomerate Honeywell Universal Oil Products’ DPA, which the company entered into in December 2022 when it agreed to pay over $160 million to resolve parallel bribery investigations by criminal and civil authorities in the U.S. and Brazil stemming from alleged bribe payments offered to a high-ranking official at Brazil’s state-owned oil company.[138] Similar to ABB, this DPA ended nearly half a year before its three-year term.

GOL Linhas Aéreas Inteligentes

In August 2025, the DOJ agreed to the early termination of Brazilian airlines company GOL Linhas Aéreas Inteligentes’ DPA, which the company entered into in September 2022 when it agreed to pay over $41 million to resolve allegations that the company paid millions of dollars in bribes to foreign officials in Brazil in exchange for the passage of legislation that was beneficial to the airline.[139] The DPA ended approximately a month before its three-year term.[140]

Albemarle

In April 2025, the DOJ agreed to the early termination of Albemarle Corporation’s three-year NPA, which the company entered into in September 2023 when it agreed to pay over $218 million to the DOJ and SEC to resolve FCPA investigations into corrupt schemes to pay bribes to government officials in multiple countries.[141] The NPA had a scheduled expiration in September 2026 and was a little over halfway through its term when it was terminated.[142] According to an Albemarle securities filing, the early termination of the NPA was based on the DOJ’s “recognition that the terms of the agreement had been satisfied.”[143] Since NPAs are typically not filed with a court, no motion was needed.

Glencore

In March 2025, the DOJ agreed to terminate the compliance monitorship of Switzerland-based multinational commodity trading and mining company Glencore International A.G. 15 months ahead of schedule.[144] Glencore pleaded guilty in May 2022 to resolve the DOJ’s investigation into FCPA and commodity price manipulation violations, agreed to pay over $1.1 billion globally in fines and forfeiture, and agreed to engage an independent compliance monitor for three years.[145] According to the plea agreement, Glencore used third-party intermediaries to facilitate bribes to officials in Nigeria, Cameroon, Ivory Coast, Equatorial Guinea, Brazil, Venezuela, and the Democratic Republic of the Congo to obtain certain benefits, including oil contracts and avoidance of government audits.[146]

In its consent motion, the DOJ stated that the prosecutors had “assessed the facts and circumstances of the case” and would invoke their “sole discretion” to end the monitorship early without further explanation of its rationale.[147] The early termination is consistent with the 2025 enforcement posture favoring streamlined oversight where continuing monitorship is deemed unnecessary to mitigate residual risk, and it underscores DOJ’s willingness to tailor remedial obligations as circumstances evolve.

Individual Enforcement

As previewed above, the FCPA Pause Order notwithstanding, individual enforcement continued in 2025. Three individuals were tried and convicted in 2025 for FCPA or related violations. Additionally, other individuals who were convicted in 2024 were sentenced during 2025. This activity demonstrates the continued prioritization of individual prosecution under the current Guidelines and other DOJ policies.

Cognizant Dismissal

Perhaps the most notable development of 2025 in the individual enforcement context was the dismissal of the indictment against Gordon Coburn and Steven Schwartz, former senior executives at Cognizant.[148] As we have written about several times before, Coburn (Cognizant’s former President) and Schwartz (Cognizant’s former Chief Legal Officer) had been indicted on FCPA and other charges. Their trial was scheduled to begin in March 2025.[149]

On February 11, 2025, the day after Executive Order 14209 was issued, Judge Michael Farbiarz of the District of New Jersey issued a sua sponte text order, directing the DOJ to state its position regarding the upcoming trial.[150] After considerable back and forth, on April 2, 2025, the DOJ moved to dismiss its FCPA case with a filing that expressly invoked “the recent assessment of the Executive Order’s application to this matter.”[151] The district court dismissed the charges against Coburn and Schwartz with prejudice on April 3, 2025.[152]

Coburn and Schwartz also faced parallel civil FCPA charges in an action brought by the SEC. On July 15, 2025, the SEC announced that it had filed a joint stipulation with Coburn and Schwartz to dismiss the case with prejudice.[153] This brought to a close, in stunning fashion and without any criminal convictions, the odyssey of FCPA charges related to Cognizant, which became public when Cognizant received a declination from the DOJ and resolved an SEC action—and Coburn and Schwartz were indicted—all in February 2019.

Completed Trials

Despite the Executive Order-mandated review process and the dismissal of the Coburn and Schwartz indictment, several FCPA cases against individual defendants proceeded to trial in 2025.

In September 2025, a federal jury in Miami convicted Georgia businessman Carl Alan Zaglin of one count of conspiracy to violate the FCPA, one count of violating the FCPA, and one count of conspiracy to commit money laundering.[154] On December 2, 2025, Zaglin was sentenced to eight years’ imprisonment for these offenses.

Zaglin served as owner and CEO of Georgia-based manufacturer Atlanco LLC.[155] Between March 2015 and November 2019, Zaglin allegedly paid hundreds of thousands of dollars to bribe officials at the Comité Técnico del Fideicomiso para la Administración del Fondo de Protección y Seguridad Poblacional (“TASA”), a Honduran governmental agency that procures goods for the National Police, to win and maintain contracts.[156] The bribes were allegedly funneled through a third-party intermediary, Aldo Nestor Marchena of Boca Raton, Florida, via sham invoices approved by Zaglin.[157] In return, TASA officials, including former Executive Director Francisco Roberto Cosenza Centeno and former Titular Director Juan Ramon Molina, were alleged to have helped steer contracts worth more than $10 million to Atlanco.[158]

Zaglin’s codefendants in this prosecution—Marchena, Cosenza, and Molina—all pleaded guilty to conspiracy to commit money laundering.[159] Marchena was sentenced to 84 months’ imprisonment in November 2025; Cosenza and Molina await sentencing.[160]

Ramon Alexandro Rovirosa Martinez

On December 5, 2025, a federal jury in Houston found Ramon Alexandro Rovirosa Martinez guilty of orchestrating a scheme to bribe officials at Mexico’s state-owned oil company, Petróleos Mexicanos (“PEMEX”), and its exploration and production subsidiary, PEMEX Exploración y Producción (“PEP”), to benefit companies associated with him.[161]

Rovirosa, a Mexican citizen and U.S. lawful permanent resident living in Texas, allegedly paid more than $150,000 in bribes to PEP officials to retain contracts and payments from PEMEX and PEP and to secure additional “improper” advantages.[162] From approximately 2019 through 2021, Rovirosa and co-conspirators, including Mario Alberto Avila Lizarraga, were alleged to have provided cash, luxury goods, and other items of value to at least three PEMEX and PEP officials in exchange for favorable official actions.[163] These advantages helped companies linked to Rovirosa obtain contracts with PEMEX and PEP worth at least $2.5 million.[164] The jury convicted Rovirosa of one count of conspiracy to violate the FCPA and two counts of violating the FCPA; he was acquitted on a fourth count of violating the FCPA.[165]

Of note, in the DOJ’s initial press release announcing the indictment, Rovirosa was described as having “ties to Mexican cartel members.”[166] The DOJ’s press release was subsequently updated to remove references to Rovirosa’s cartel ties because of “safety concerns.”[167] Similarly, in its motion to oppose Rovirosa’s pre-trial release, DOJ cited close business relations of Rovirosa as having ties to Mexican cartel members previously involved in violent conduct.[168] During litigation over Rovirosa’s motion to dismiss the indictment, however, the DOJ stated that it had “not alleged any facts that would require evidence of Rovirosa’s alleged cartel ties (or absence thereof) [and] [t]he Government has no intention of raising this issue or introducing related evidence in its case-in-chief.”[169] There is no indication that any such evidence was raised at trial.

Rovirosa faces a maximum penalty of 15 years’ imprisonment and awaits sentencing.[170] In the interim, he has since filed a motion for a judgment of acquittal, which is pending.[171] Rovirosa’s alleged co-conspirator, Avila, remains a fugitive.[172]

Finally, while not an FCPA or FEPA prosecution, on August 28, 2025, after a four-day jury trial in the Central District of California, a Los Angeles-area attorney, Paulinus Iheanacho “Pollie” Okoronkwo, was convicted of three counts of money laundering, one count of tax evasion, and one count of obstruction of justice arising from a $2.1 million bribe he received while serving as an officer of the Nigerian National Petroleum Corp. (“NNPC”), Nigeria’s state-owned oil company.[173]

Okoronkwo, a dual U.S.-Nigerian citizen who practiced law in Los Angeles, also served as general manager of the upstream division of NNPC.[174] Evidence at trial showed that, in October 2015, Addax Petroleum, a Switzerland-based subsidiary of Sinopec (a Chinese state-owned petroleum conglomerate),[175] wired over $2 million to Okoronkwo’s law firm’s Interest on Lawyers’ Trust Account.[176] Although the payment was facially for legal consulting to negotiate a settlement agreement with NNPC to secure drilling rights in Nigeria, the engagement letter, bearing a fake Lagos address, was a sham to disguise a bribe intended to leverage Okoronkwo’s official influence to obtain favorable financial terms for Addax’s crude oil operations.[177] Addax falsely recorded the payment as legal fees, deceived an auditor regarding its nature, and terminated executives who questioned the payment’s propriety.[178]

The jury found that Okoronkwo failed to report the bribe on his 2015 federal income tax return and later obstructed justice in June 2022 by falsely telling federal investigators that he had not used the funds to purchase a home and that the money represented client funds rather than income to his law practice.[179]

While Okoronkwo’s sentencing is set for February 2026 and he potentially faces decades behind bars, the DOJ has recommended a sentence of a little over 10 years.[180] The court has already ordered the forfeiture of the proceeds from the sale of his house in California.[181]

Upcoming Trials

Charles Hunter Hobson

In March 2022, the DOJ charged Charles Hunter Hobson, a former vice president of Pennsylvania coal company Corsa Coal,[182] with facilitating bribes to government officials in Egypt in connection with contracts from Al Nasr Company for Coke and Chemicals, an Egyptian state-owned and -controlled coal company.[183] The indictment alleged that Hobson paid bribes to Al Nasr officials in Egypt to obtain approximately $143 million in coal contracts via an intermediary, transferred the payments through a U.S. bank account, and received kickbacks himself.[184] The trial had been set for April 2025.

Following the Executive Order, Hobson requested a 180-day continuance, arguing that the review might alter the status of his case, and the DOJ acknowledged that it was performing a prioritized review of his case.[185] While the court granted Hobson a temporary stay and vacated the April 2025 trial date,[186] the DOJ subsequently informed the court of its intent to proceed.[187] In January 2026, the DOJ filed multiple motions seeking to block Hobson from presenting various evidence at trial, including evidence regarding the prevalence of corruption in Egypt as well as evidence suggesting that bribes were justified to secure American business.[188] The trial is scheduled for February 2026.

Asante Berko

Asante Berko, a former investment banker at Goldman Sachs in the U.K., was arrested in 2022 and subsequently extradited to the United States in 2024, where he had been indicted for violations of the FCPA and money laundering based on allegations that he paid hundreds of thousands of dollars to assist a Turkish energy company in securing approvals to build a power plant in Ghana. In August 2025, an April 30, 2025 letter from Berko’s counsel to the DOJ was attached to a motion on the public docket, in which Berko attempted to get his case dismissed in light of the Executive Order.[189] The DOJ’s response is not publicly available, but it has clearly decided to proceed with the case. In November 2025, the DOJ opposed a motion to dismiss the indictment filed by Berko and the court denied that motion in December 2025.[190] Trial is currently scheduled for July 2026.[191]

Sentencings

The DOJ also defended an FCPA conviction won in 2024 and wrapped up sentencing in that case. As we reported last year, Glenn Oztemel was convicted in September 2024 of conspiracy to violate the FCPA, conspiracy to commit money laundering, three counts of violating the FCPA, and two counts of money laundering.[192] Oztemel was found to have paid over $1 million in bribes to officials at Petróleo Brasileiro S.A. (“Petrobras”). On December 9, 2025, he was sentenced to 15 months in prison following the denial of his motion for a judgment of acquittal in August 2025.[193]

New Charges Filed in 2025

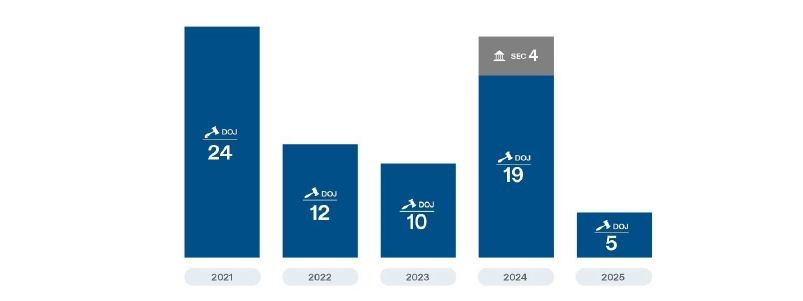

In 2025, the DOJ brought criminal FCPA or anti-corruption charges against five individuals, a marked decrease from 2024 and the fewest individual prosecutions in any calendar year since 2012. There were no civil charges brought against individuals for FCPA violations by the SEC.

|

FCPA AND ANTI-CORRUPTION ENFORCEMENT ACTIONS AGAINST INDIVIDUALS, 2021-2025[194]

Two of the five individuals indicted in new FCPA cases this year were Rovirosa and Avila, as discussed above. Two others were indicted in United States v. Nazar Mohamed and Azruddin Mohamed, where the defendants were charged with mail fraud, wire fraud, and money laundering charges in the Southern District of Florida for allegedly paying bribes to Guyanese government officials, including customs officials, to avoid paying Guyanese taxes and royalties.[195] The indictment alleges that at least 10,000 kilograms of gold were exported without required tax payments, causing approximately $50 million in losses to Guyanese authorities. It further alleges a separate mail-fraud scheme involving a Lamborghini falsely invoiced at less than $100,000 when the actual cost was nearly $700,000 to avoid over $1,000,000 in Guyanese import taxes. Neither defendant has appeared, and the case remains pending.[196]

The final individual was indicted in United States. v. Carlos Leopoldo Alvelais, where the defendant pleaded guilty to conspiring to violate the FCPA after waiving indictment. All key documents remain sealed, suggesting a wider case. Media reports note that Alvelais may have been a customs broker at the Mexican border.[197]

Other Case Updates

Ng Chong Hwa, also known as Roger Ng, who was convicted in 2022 and sentenced to ten years in prison in 2023 for conspiring to violate the FCPA and to launder money by misappropriating billions of dollars from the Malaysian sovereign wealth fund, 1Malaysia Development Berhad, had his appeal denied by the Second Circuit in December 2025.[198] Ng contended on appeal that “the district court erred in excluding from evidence a recording that was material to his defense, that the government breached an agreement pursuant to which he had waived extradition from Malaysia; that venue in the Eastern District of New York was improper; and that the forfeiture order constituted an excessive fine, violating the Eighth Amendment to the Constitution.”[199] The Second Circuit found all of Ng’s arguments without merit and affirmed the district court’s judgment and order of forfeiture.[200]

Hernan Lopez and Full Play Group

In March 2023, Hernan Lopez, a former executive at Twenty-First Century Fox, and Full Play Group, S.A. (“Full Play”), a South American sports media company, were convicted by jury verdict in connection with the long-running FIFA corruption prosecutions conducted by the U.S. Attorney’s Office for the Eastern District of New York.[201] The government proved at trial that Lopez, Full Play, and others engaged in schemes to pay bribes to officials of regional soccer confederations (including CONCACAF and CONMEBOL) to secure broadcasting rights for international soccer tournaments and other matches, including qualifiers for the FIFA World Cup and international friendlies, in violation of the honest services wire fraud statute, 18 U.S.C. § 1346.[202] Prior to trial, Lopez and Full Play had unsuccessfully moved to dismiss the indictments against them, arguing that the theory of prosecution was based upon an improper extraterritorial application of section 1346.[203] Lopez and Full Play renewed their motion after trial, based upon intervening Supreme Court decisions on the scope of the honest services wire fraud statute.[204] On September 12, 2023, the district court granted Lopez’s and Full Play’s motions and vacated their convictions, reasoning that these intervening decisions signaled “limits on the scope of the honest wire fraud statute” and that the honest services wire fraud statute did not apply to foreign commercial bribery cases.[205]

On July 2, 2025, the Second Circuit reversed the district court and reinstated the convictions, finding that the intervening Supreme Court decisions did not control because neither case addressed foreign commercial activity similar to the conduct underlying the prosecutions of Lopez and Full Play.[206] The Second Circuit further determined “that the foreign identity of the officials and their employers does not remove the schemes from § 1346’s reach.”[207] In September 2025, Lopez and Full Play separately petitioned the United States Supreme Court for a writ of certiorari on the Second Circuit’s decision reinstating the convictions.[208] On December 9, 2025, the DOJ filed a response in the Supreme Court, stating that “the government has determined in its prosecutorial discretion that dismissal of this criminal case is in the interests of justice,” and notified the Court that, on that same date, it had filed a motion in the district court under Federal Rule of Criminal Procedure 48(a) to vacate the judgment and dismiss the indictment as to Lopez and Full Play with prejudice.[209] The DOJ requested that the Supreme Court grant the pending certiorari petitions, vacate, and remand the case to the district court to allow proceedings to proceed on the DOJ’s Rule 48 motion.[210] On January 14, 2026, the Supreme Court granted the petitions, vacated the judgments as to both Lopez and Full Play, and remanded the cases to the Second Circuit “for further consideration” in light of the pending motion to dismiss the indictment in the District Court.[211] On January 23, 2026, the Second Circuit remanded the cases to the District Court for further consideration.[212]

Whistleblower Developments

Expansion of DOJ's Corporate Whistleblower Awards Pilot Program

In 2025, the DOJ updated the subject areas covered by its Corporate Whistleblower Awards Pilot Program (the “Whistleblower Pilot Program”).[213] The three-year pilot program, launched in August 2024, seeks to uncover and prosecute corporate crime by rewarding whistleblowers who provide the Criminal Division with “original and truthful information about corporate misconduct that results in a successful forfeiture.”[214] As part of the Pilot Program, the DOJ stated that it “plans to regularly evaluate the initiative and determine whether any refinements are necessary,” as the program was developed “with an eye to potential legislation.”[215]

In May 2025, the DOJ revised the covered subject areas to align with Administration priorities. Whereas the Whistleblower Pilot Program previously covered four categories of criminal conduct—foreign corruption, domestic corruption, healthcare fraud, and certain crimes involving financial institutions—the revised program prioritizes six additional subject areas, all for corporate criminal offenses:

- Cartel/TCO-related violations, including money laundering and narcotics offenses;

- Federal immigration law violations;

- Material support of terrorism violations;

- Sanctions violations;

- Trade, tariff, and customs fraud; and

- Procurement fraud.[216]

While the DOJ has not issued any formal announcements on whistleblower reporting activity or rewards to date, Acting Chief Counselor for the Criminal Division Keith Edelman noted during his comments at the December 2025 ACI FCPA Conference that over 1,100 submissions have been made through the Whistleblower Pilot Program since its inception in 2024 and that, since the program was updated in May 2025 as described above, approximately 80% of the tips received have been referred to prosecutors for further investigation.[217]

SEC Whistleblower Awards Slow as Commission Scrutinizes Claims More Closely

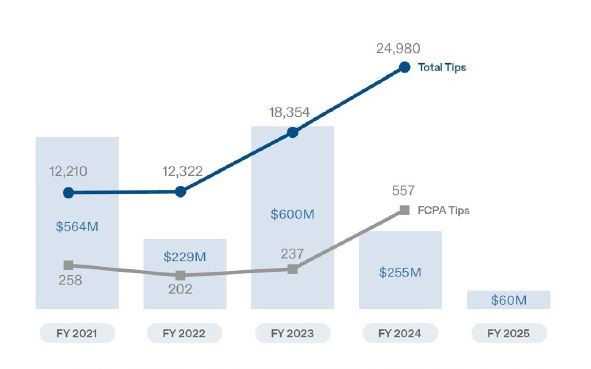

The SEC’s 2025 Annual Report to Congress on the Dodd-Frank Whistleblower Program has not been released as of the date of publication of this Year in Review. However, a review of the SEC’s Final Orders for Whistleblower Award Determinations indicates that, based on the award amounts that are publicly available, SEC awards in 2025 decreased significantly from prior years, with approximately $60 million awarded to 26 whistleblowers in 2025.[218]

|

SEC WHISTLEBLOWER TIPS & TOTAL AWARDS, 2021-2025[219]

Media reports analyzing these data have noted this slowdown in awards for the SEC’s whistleblower program and suggest the Commission may be looking for technical reasons to disqualify whistleblowers.[220] Regardless of its motivation, the SEC does appear to be scrutinizing cases more closely.

Cross-Border Anti-Corruption Efforts

In December 2025, the International Foreign Bribery Taskforce (“IFBT")—composed of the United Kingdom’s SFO and National Crime Agency, the Australian Federal Police, the Royal Canadian Mounted Police, the New Zealand Police and Serious Fraud Office, and the FBI—published their first set of foreign bribery indicators.[221] The indicators provide practical warning signs in six areas—conduct, government affiliations, country links, ownership, and other associations—designed to help businesses, compliance teams, and professionals working in high-risk sectors detect patterns that may indicate bribery risk before misconduct escalates.[222] The guidance emphasizes that no single indicator should be viewed in isolation, but rather risks emerge when multiple indicators appear together or combine to raise a company’s broader risk profile.[223] The guidance further acknowledges significant overlap with money laundering red flags, reinforcing the need for organizations to conduct integrated financial crime and bribery risk assessments.[224] While the guidance is not substantively novel, it does underscore the push for continued international coordination to address and mitigate corruption risk, including by U.S. authorities.

In 2025, cross‑border anti‑corruption enforcement efforts were further strengthened by two complementary European-based frameworks. First, the U.K.’s Serious Fraud Office, France’s Parquet National Financier (“PNF”), and Switzerland’s Office of the Attorney General announced the formation of the International Anti‑Corruption Prosecutorial Taskforce, which is composed of a Leaders’ Group for the regular exchange of strategy and a Working Group for enhanced cooperation.[225] Second, the U.K.’s National Crime Agency formed the operationally focused International Anti‑Corruption Coordination Centre, a multi‑agency hub that collates intelligence and supports anti-corruption investigations worldwide.[226] The creation of these two organizations may lead to even greater European‑led case coordination and intelligence pooling. Significantly, this European-based focus on multi‑jurisdictional teamwork, rather than ad hoc cooperation, to combat corruption is taking place amid evolving U.S. anti-corruption enforcement, as discussed above.

Likewise, Latin America saw some efforts to strengthen cross-border anti-corruption enforcement, including Argentina and Ecuador’s formalization of an MOU aimed at combatting money laundering, terrorist financing, and related crimes.[227] The MOU establishes direct channels for information-sharing, case coordination, and asset-tracing; provides for joint training and secondments to align investigative methodologies between the two countries’ respective prosecutorial and financial intelligence units; and creates designated liaison points to accelerate MLAT requests and parallel proceedings.[228] The MOU prioritizes uncovering complex schemes involving public procurement, state-owned entities, and politically exposed persons.[229]

International Developments

Africa and Middle East

In its Phase 4 Report on South Africa, the Organization for Economic Co-operation and Development (“OECD”) reported that South Africa has “enhanced its fight against foreign bribery” and that “its law enforcement authorities are more concertedly detecting and investigating foreign bribery.”[230] The OECD report highlighted that in recent years South Africa has provided “significant support” to other members of OECD’s Working Group on Bribery, whose foreign bribery cases implicated South African public officials, resulting in corporate resolutions.[231]

Morocco took a step to increase its anti-corruption efforts in 2025 when its National Authority for Integrity, Prevention and Combating of Bribery signed an MOU with the UAE Accountability Authority.[232] The MOU helps facilitate the exchange of expertise, knowledge, and best practices in combating corruption, preventing financial malfeasance, and safeguarding public funds.[233]

In Saudi Arabia, 112 government officials were arrested on charges of bribery, abuse of power, and exploitation of official positions.[234] The individuals arrested included employees from the Ministries of Defense, Interior, Municipal and Rural Affairs and Housing, Education, and Health.[235]

Asia

In China, anti-corruption crackdowns continued as a priority. On December 9, 2025, China executed a former general manager of China Huarong International Holdings Limited, Bai Tianhui, after he was convicted of bribery.[236] According to the Chinese government, Bai exploited senior positions between 2014 and 2018 to accept money and assets totaling about U.S. $157 million (1.108 billion yuan) in exchange for favorable treatment for certain entities in project acquisitions and corporate financing transactions in the state-linked financial sector.[237] Bai was sentenced to death on May 28, 2024 by Tianjin No. 2 Intermediate People’s Court. He appealed the verdict, but, on February 24, 2025, the Tianjin High People’s Court upheld the original ruling, which the Supreme People’s Court of China (“SPC”) later also affirmed. The SPC concluded that the gravity of Bai’s offenses warranted no leniency because he had accepted an “especially huge” amount of bribes, because of “extremely severe” circumstances, and because the offense had a “particularly harmful” social impact, warranting the most severe punishment under Chinese law. Prior to his execution, Bai was permanently deprived of political rights and had all personal assets confiscated, with illegal gains ordered to be recovered to the state.

The Bai case was part of China’s larger anti-graft campaign, a priority for China’s leadership in 2025, with a focus on the finance, energy, and healthcare sectors. Bai is one of the highest‑profile financial‑sector defendants to be executed for corruption since his former superior, Lai Xiaomin, the ex‑chairman of China Huarong, was executed in 2021 for his role in a bribery scheme totaling approximately 1.78–1.79 billion yuan (U.S. $260-$280 million). Bai’s case underscores the continued intensity of President Xi Jinping’s anti‑corruption campaign in the financial industry, where authorities have targeted numerous regulators, bank chairs, and executives.

In 2025, Vietnam took a different tack, removing the death penalty for eight offenses—embezzlement, accepting bribes, espionage, illegal drug transport, production and sale of counterfeit medicine, jeopardizing peace, waging war, and vandalizing state property—effective July 1, 2025. These crimes are now punishable by life imprisonment.[238] This policy change prevented the execution of Truong My Lan, who was sentenced to death on December 3, 2024 for embezzling $12.5 billion in Vietnam’s largest fraud case.[239] Lan appealed the death sentence in 2024 and lost; however, because of Vietnam’s 2025 policy changes, her sentence has been reduced to life in prison.[240] The bank Lan formerly ran has now been placed under the control of the state.

In South Korea, an anti-corruption action continued against now-ex-President Yoon Suk Yeol. In 2024, Yoon was faced with widespread protest and ultimately impeachment by the National Assembly after he declared martial law. On April 4, 2025, the Constitutional Court upheld Yoon’s impeachment in a unanimous 8-0 decision, which resulted in his immediate removal from office.[241] The Constitutional Court explained its reasoning for its decision, which included that Yoon “declared the martial law in question with the intent of overcoming a standoff with the National Assembly, then deployed military and police forces to obstruct the Assembly’s exercise of its constitutional authority, thereby denying the principles of popular sovereignty and democracy.” The Court also emphasized that removing Yoon from office “far outweighs the national costs associated with dismissing a sitting president.”[242]

Europe

In Ukraine, Andriy Yermak, Ukrainian President Volodymyr Zelensky’s chief of staff, resigned on November 28, 2025, following anti-corruption raids on Yermak’s home and office by the National Anti-Corruption Bureau in connection with a $100 million corruption scandal involving Energoatom, the state-owned nuclear operator.[243] Insiders allegedly received kickbacks of 10-15% from Energoatom’s commercial partners and, if the partners failed to pay, they were removed from a list of approved counterparties or not reimbursed for services already rendered.[244] Other officials allegedly involved include Zelensky’s close associate Timur Mindich, who is accused of being the main organizer of the corruption scheme; former Deputy Prime Minister Oleksiy Chernyshov; Justice Minister Herman Halushchenko, who previously served as Energy Minister; and Rustem Umerov, who was a former Defense Minister and is now Secretary of the National Security and Defense Council.[245] Participants allegedly took advantage of a regulation that bans contractors from claiming debts during martial law by blackmailing and pressuring contractors.[246]